I have to admit, I was planning to title this piece “One Step Forward, Two Steps Back”, but then it occurred to me that is was the title of a 1904 book by V.I. Lenin. Yes that Lenin. While we could assert that his legacy has more than a little to do with the current stock market malaise, equities had already been in a bit of a funk before the Ukraine crisis took center stage. Not including today, which is shaping up to be another down day, there have been 45 trading days so far this year and 28 of them have seen the S&P 500 Index (SPX) close lower. For many investors, two out of three are bad (apologies to the late great Meat Loaf and Jim Steinman).

I wish I could say that this year’s general themes are unanticipated, but faithful readers will know that we have discussed several of them at length (ad nauseum?) over the course of the past few months. Prior to the start of the year, our outlook stressed the likelihood of a return to a more volatile environment. In mid-January we reminded readers that traders should not forget about the second half of the phrase “buy the dips, sell the rips.” Just over a month ago, after a sharp rally similar to the one we saw yesterday, we reminded readers that “bear market rallies are short, sharp and ferocious.” About two weeks ago we noted that even though the VIX futures curve was inverted, that is a necessary, but not sufficient condition to presage a market bounce.

I realize that no one likes to be told “I told you so,” but there we have it. It is important now to be looking for signals that the tide of negative sentiment has truly turned. As of today, that seems unlikely with war continuing to rage in Ukraine. There are still too many unanswerable questions about the effect that the conflict will have on key global commodity supplies, such as oil, gas, and wheat, though it has been encouraging to see them halt their parabolic advances over the past couple of days. Those who were looking for a hopeful sign in today’s CPI numbers were thwarted. The statistics were in line with expectations but still high enough for the negative headlines reminding us that it was a 40-year high and that today’s reading was taken prior to seeing the full effect of the hostilities.

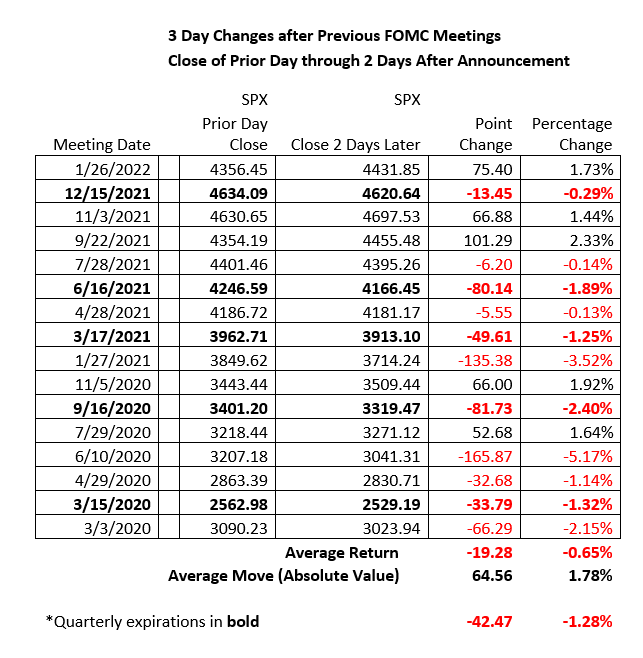

There is reason for bulls, or at least dip-buyers, to eye next week’s FOMC announcement. Since the Fed has moved from an easing to a tightening stance we have seen a change to the pattern of post-meeting moves. In the post-Covid era, 10 of the first 12 FOMC meetings saw a decline in the 3-day period that encompassed the announcement. Remember, this was during a relentless bull market and amidst record monetary accommodation. It was likely that traders priced in too much good news from the FOMC and Chair Powell. Since September, when the rhetoric moved away from accommodation, three out of those four meetings have seen higher markets. The table below tells the story:

Data Source: Interactive Brokers, Bloomberg

The exception to the moves higher after the past four sessions was the December meeting, which coincided with a quarterly expiration. All five of the last FOMC meetings that occurred in quarterly expiration weeks saw lower closes. Next week’s meeting on March 16th comes two days ahead of a quarterly expiration on March 18th. Although Chair Powell has signaled somewhat unequivocally that he will be recommending a 25 basis point hike next week, which appears dovish and well-discounted by traders, the volatile global environment could lead the statement and subsequent press conference in unpredictable directions.

Shifting gears, there was the big news after the close about Amazon (AMZN) announcing a 20:1 stock split. This comes on the heels of Alphabet (GOOG, GOOGL) making a similar decision early last month. At the time, we discussed the ramifications of the GOOG stock split, noting that:

… stock splits have no bearing on a corporation’s business or balance sheet. They are the equivalent of making change. You give me a $20 bill and I give you back 20 singles.

Yet we also noted that stock splits can have a positive impact on the liquidity of a stock’s trading and have profoundly positive benefits to the affordability and liquidity of its options. I urge those with questions about the AMZN split to read the linked report, with the added caveat that the AMZN split is not neatly tied to an expiration in the way that GOOG’s is.

Finally, while I avoided Lenin and gave side eye to Meat Loaf, be thankful that I didn’t need to reference Olivia Rodrigo’s “1 step forward, 3 steps back.” We’re not at that point.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ