With negotiations underway, a US default remains a low but distinct possibility. When might the default “x-date” fall – and how will markets respond?

The US risks default in a matter of weeks unless Congress can reach a deal to raise the country’s borrowing limit.

While negotiations are underway, if the “x-date” (see below) passes without the debt ceiling being raised, coupon payments and redemptions of Treasury securities will stop.

While technical lapses have occurred – such as the 1979 check-processing glitch that delayed some redemption requests – a true default would be an unprecedented event with far-reaching ramifications.

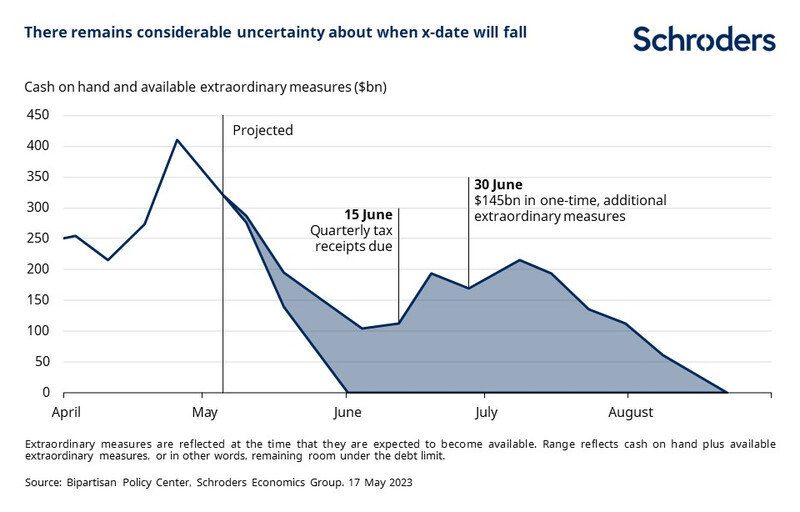

Why the precise x-date deadline is uncertain

The x-date would mark the point at which the Treasury runs out of funds. After disappointing tax receipts for 2022, much now hinges on how revenue shapes up through May. If this can sustain the government into mid-June, when quarterly tax payments are due, the Treasury is likely to be able to make it through much of July and perhaps even to August.

What needs to happen to avoid default?

After much internal wrangling, Republicans have unified behind one position and begun negotiations with the White House. Even if the two sides eventually strike a deal, as we expect, it would still need to clear Congress. Beyond the limited legislative timeframe, the main obstacle will be ultraconservative Republicans who could obstruct it by unseating the speaker to prevent bills from being brought to the floor.

However, some centrist Democrats are reported to have privately assured the speaker that they would come to his aid under such circumstances. President Joe Biden has also openly explored using section four of the 14th amendment, which states that the validity of US public debt “shall not be questioned”. But this unprecedented unilateral action could end up being struck down by the Supreme Court.

So although a default is unlikely, it should not be ruled out. As always, context is important. Investors would probably perceive any default to be a consequence of the fractious political environment rather than a fundamental inability of the US to meet its debt obligations. That being said, we still expect risk-off sentiment to grip markets over the coming weeks, which could be magnified by persistent concerns about the soundness of the banking system.

Investors’ portfolio response

Our message for investors therefore remains the same: hope for success, but plan for failure. Where possible, portfolios ought to be liquid and diversified to ensure capital can be redeployed quickly given the volatility seen during prior episodes of debt ceiling brinkmanship. However, it would be a mistake to assume that assets will perform as they did before. For instance, the rally in Treasuries during the 2011 standoff coincided with concerns about the eurozone debt crisis.

Outlook for Treasuries

While it is conceivable that Treasuries could perform well over the coming weeks, this is by no means guaranteed. Our strongest conviction is to have an overweight allocation to gold, even in spite of the recent rally, as well as towards AAA-rated sovereign issuance such as German Bunds. Alongside this, we would also expect safe haven currencies such as the Japanese yen and the Swiss franc to perform well against the US dollar.

Outlook for equities

On the other hand, equities will probably find themselves under the most pressure. But there is likely to be a wide divergence beyond the headline indices. Companies that have a heavy reliance towards US government spending or subsidies are likely to come under the most pressure. Whereas value stocks could hold up better, as should defensive and non-cyclical sectors such as pharmaceuticals

Strategic opportunities

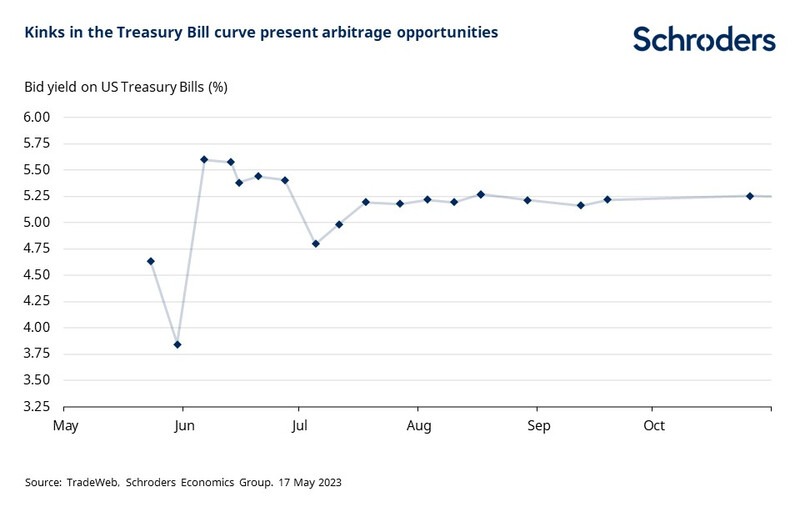

Finally, for those willing to bet that Congress will manage to raise the debt ceiling in time, some investors may look to arbitrage the yield gap between T-Bills maturing before and after early June. Key to this will be timing, with the opportune moment being when concerns over the debt ceiling peak.

We are not yet at that stage, but it ought not to be far away.

—

Originally Posted May 18, 2023 – US debt ceiling deadline: understanding x-date

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.