Despite what the calendar and thermometer say, this week is considered the unofficial last hurrah of summer. Equity volumes were below average all last week and yesterday. But the government is open (at least for now) and a number of meaningful economic statistics will have the markets’ focus this week. This morning, we had a reminder of what can happen when an unexpected pair of economic reports hit thin markets.

To be frank, many of us were looking past today’s reports on Consumer Confidence and JOLTS Job Openings toward the GDP, PCE Core Deflator, and Nonfarm Payrolls reports due later this week. But today’s reports proved to be quite surprising, and hence market-moving, on their own.

The Conference Board’s report on Consumer Confidence was much weaker than expected, coming in at 106.1 when 116 was anticipated. Furthermore, the prior number was reduced to 114 from 117. Concurrently, the JOLTS data showed that job openings fell dramatically to 8.827 million, well below the 9.5 million expectation, and well below last month’s 9.165 million (itself revised down from 9.582 million).

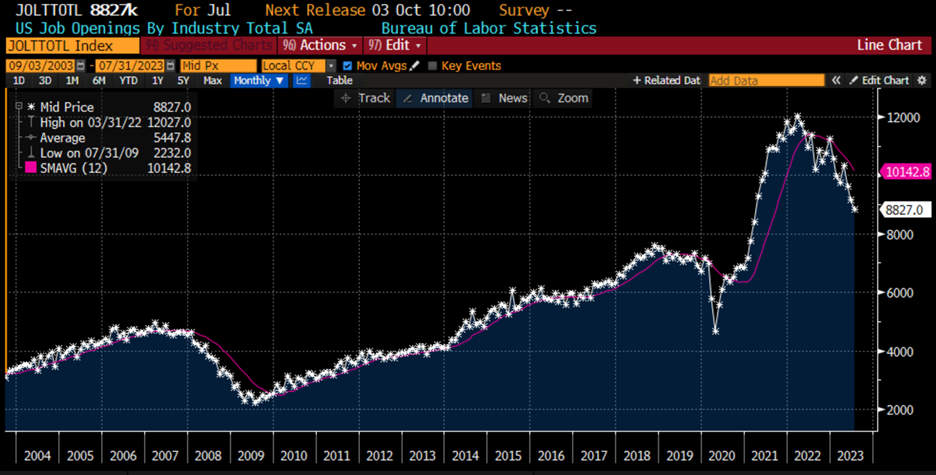

The confidence report fits with what we’ve heard from a variety of retailers, that consumers are becoming more cautious about discretionary spending. But hearing about it anecdotally and seeing a hard(-ish) data point have different effects on traders’ psyches. And the JOLTS report certainly lived up to its acronym, jolting the markets’ opinions about the health of the job market. This weaker than expected report affirms the idea that we are more rapidly approaching a more typical equilibrium between the supply and demand for labor. We have been seeing job openings fall steadily since their peak in early 2022, though they remain quite elevated on a historic basis:

JOLTS Job Openings, 20-Years Monthly Data (white), with 12-Month Moving Average (magenta)

Source: Bloomberg

A weaker labor picture is considered a key to the Federal Reserve halting, and ultimately reversing, its path of rate hikes. Bonds reacted accordingly, with 2-Year Treasury yields dropping from 3 basis points higher before the reports to 10 basis points lower within minutes. Fed Funds futures’ expectations for rate hikes dropped from 22% in September and 69% in November to 14% and 51% respectively. Rates are now expected to be marginally lower by March, up from yesterday’s anticipated May.

Stocks followed bond prices higher. They had already been creeping higher before the data after two days of gains on light volume and are now near session highs with the S&P 500 (SPX) up 0.75% and the NASDAQ 100 up more than 1.5%.

Today’s jump is another reminder that liquidity considerations are more important to stock traders than the health of the economy. The market is reacting positively to reports that point to economic weakness. In theory, economic health is a key element for positive stock prices. In reality, traders are willing to sacrifice economic growth if it brings them another hit of the monetary accommodation that they truly crave.

The takeaway for the rest of this week is that markets can respond very aggressively to economic reports. But of course, we don’t know if the plethora of upcoming reports will be market-friendly or not. Volatility markets seem to believe that today’s numbers are the start of a trend, with VIX dropping to levels not seen since the start of August. Remember, volatility is non-directional – upward moves count exactly the same as downward moves – but volatility indices tend to reflect the market’s mood. The mood has brightened today, even if the economic picture hasn’t.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Exactly! I learned this with cash decades ago and it remains true today. Your column is a valuable asset, Thank You so much.

Thank you for commenting and following Traders’ Insight, David!

Very well done report!

Thank you, Steven! We hope you’ll continue to read Traders’ Insight.

jobs, jobs, people getting raises long term very positive, with this slightly short term slowdown to change the feds outlook!

Thank you much for a clear and precise explanation of the market move yesterday. Well said!

Thanks, Ken!