AAPL Earnings: Option Straddle Insights from Market Chameleon

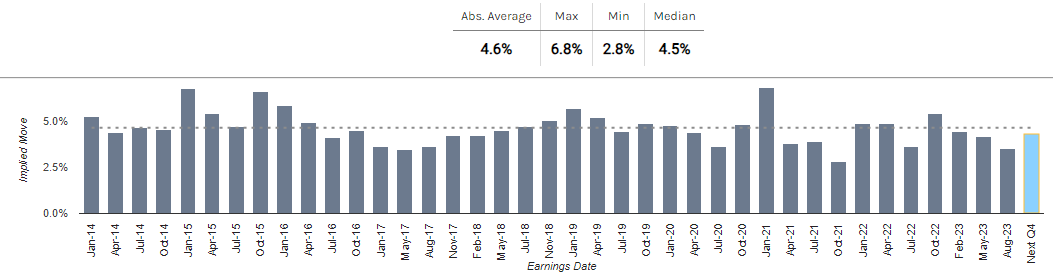

Market Chameleon Chart Showing APPL Historical Options Straddle Premiums Pre-Earnings

AAPL is scheduled to release earnings on November 2, 2023 after the market closes. As we get closer to the announcement, there are a number of key metrics that traders pay attention to help inform their trading strategies. One of these key metrics is the option straddle, or the market’s implied move of the stock post earnings announcement.

What Does the Historical AAPL Earnings Straddle Data Tell Us?

Our analysis spans back to 2014, examining how the option straddle typically closes just before earnings. The option straddle premium represents the implied move of the stock post-earnings announcement.

On average, the option straddle premium for AAPL has been approximately 4.6% of the spot price, with a median value of 4.5%. The range has fluctuated from a high of 6.85% to a low of 2.8%. These figures provide a historical baseline, offering insights into how the market has priced the pre-earnings straddle.

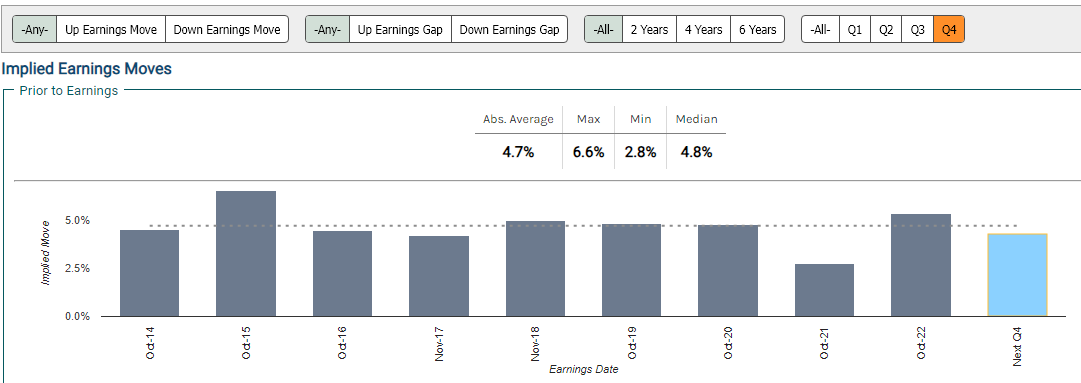

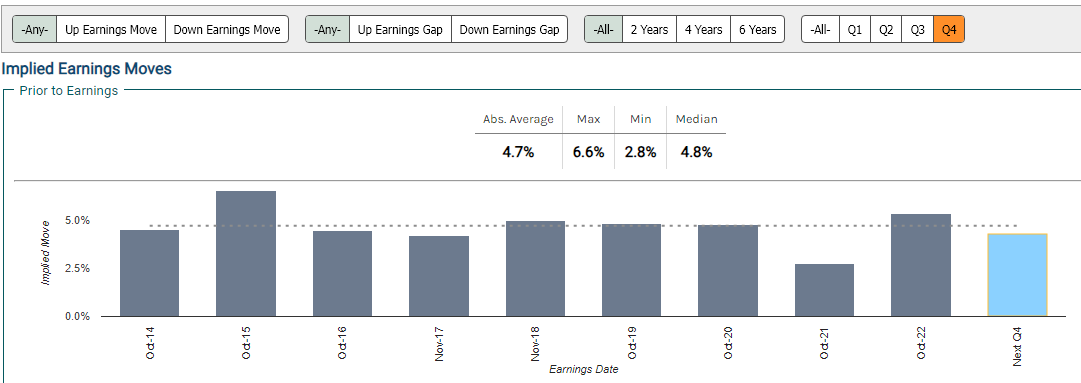

Insights for Q4 Earnings

If we focus specifically on AAPL’s Q4 earnings, the data suggests the straddle has tended to close at slightly higher valuations. On average, it’s been around 4.7%, with a median of 4.8%.

What Does This Mean for the Upcoming Earnings Announcement?

Now, let’s consider the current scenario. The current straddle sits at a 4.3% premium, which is close to the historical averages. However, it suggests there’s still potential for appreciation if the straddle were to move closer to its historical average.

It’s essential to remember that these metrics reflect how the market typically prices pre-earnings straddles and do not account for actual earnings results. Nonetheless, this data can provide valuable insights into potential market behavior leading up to the earnings announcement.

Conclusion

As AAPL’s earnings date approaches, keeping an eye on these metrics can help you make more informed decisions, identify opportunities, and fine-tune your trading strategies. While past performance is not indicative of future results, historical insights can be a valuable resource in your trading toolkit.

—

Originally Posted October 30, 2023 – AAPL Earnings Coming Up: What Does the Option Straddle Tell Us?

Disclaimer:

The information contained in this article is for informational purposes only and should not be construed as financial advice. Market Chameleon does not provide investment advice and does not endorse or recommend any specific investment strategies or securities. Investors should always do their own research and consult with a financial advisor before making any investment decisions.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

EXcellent Presentation!!!!!!!