For veteran options pros, it seems strange to see VIX (Cboe Volatility Index) mired in the 12-13 range. Sure, investors are in a buoyant mood, which would reduce their desire to seek volatility protection, but there have been plenty of periods in recent years when investors have been sanguine while VIX traded at higher levels. At the risk of invoking the most dangerous phrase for investors, what might be different this time?

As we have noted on several occasions, VIX is not a fear gauge – it just plays one on TV. It is constructed to measure the market’s best estimate of volatility over the coming 30 days. Of course, nervous traders tend to anticipate higher volatility than calmer ones, so there is indeed a decent correlation between fear and VIX, but it is hardly the only explanatory factor. Recency bias plays a role. If markets are not particularly volatile, it is human nature to anticipate that those conditions are likely to persist in the coming days and weeks. But other specific factors have come into play.

It is also important that the VIX calculation utilizes all S&P 500 (SPX) options – puts and calls – with 23-37 days to expiration and bids of a penny or more. If the implied volatilities of calls are depressed, that has an effect on VIX. Recently, we have seen a rise in ETFs that employ strategies that involve selling volatility. Those include JEPI, XYLD, QYLD, PBP, and a host of others. While they tend to employ the relatively benign strategy of writing covered calls, those calls have to be bought by someone. And if enough of those calls persistently enter the market on a regular basis, the traders who buy those calls know to adjust their prices lower.

Another factor is whether correlations of the stocks within SPX are relatively high or low. If stocks are moving in synch, then index volatilities tend to rise. If not, the index movement is dampened. Think of it this way: suppose you have a two-stock index. If stock A goes up while stock B goes down by a similar amount, the overall index remains relatively unchanged – even if the individual stock moves are substantial. Yet if they move in the same direction — up or down – so will that index. By extension, if the components in SPX or any other index move in the same direction with a high correlation, then its volatility will be higher. The opposite is of course true if there is dispersion in the components’ returns.

It is important to remember that even though volatility calculations don’t consider the direction of the movement in the underlying stock or index, people do. We have raised the concept of “socially acceptable volatility” several times. In short, people like it when markets go up. That’s why they’re invested in the first place, and over time, stock markets have tended to go up. Investors don’t like it when markets go down. That causes nervous traders to seek volatility protection, which tends to boost VIX. We have all recognized the asymmetry of VIX’ response to up and down moves. This is the underlying reason.

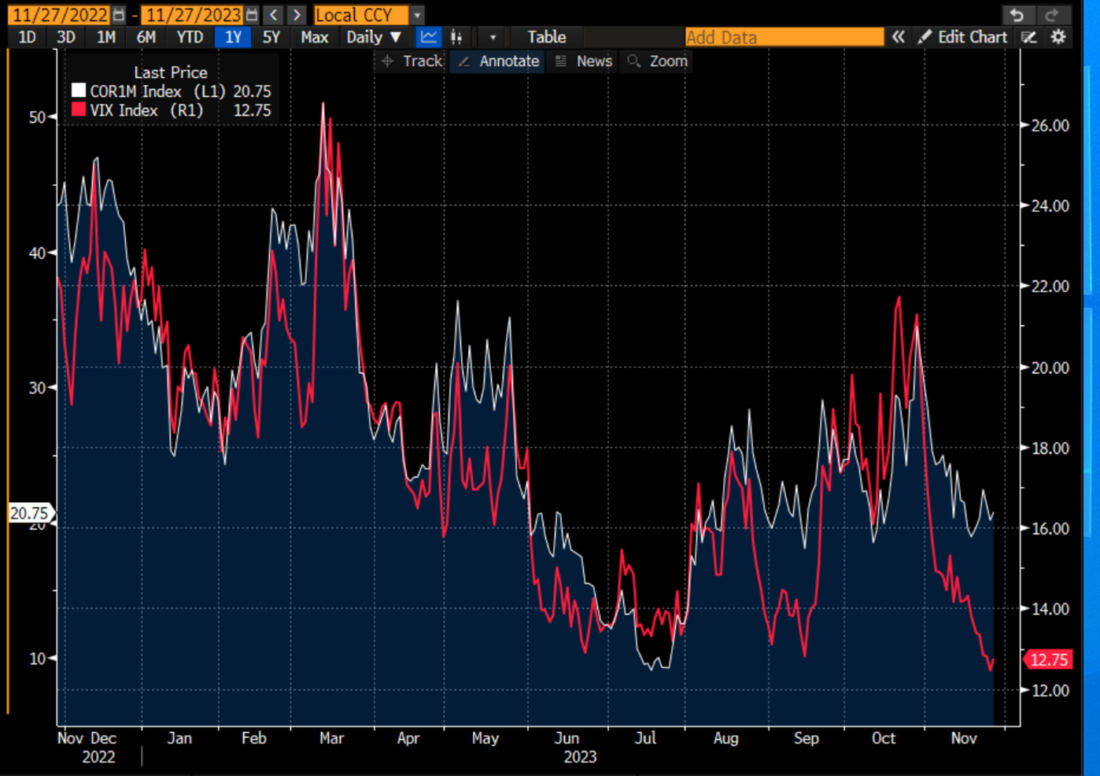

The correlation, or lack thereof, is an important consideration for VIX right now. In this case we have utilized the Cboe’s 1-Month Implied Correlation Index (COR1M) as we have done before. In September, we noted that VIX had sunk disproportionately to COR1M. A few days after writing that piece, VIX rose sharply to the high teens toward 20. We see a similar situation once again:

1-Year Line Chart, VIX (red) vs. COR1M (white)

Source: Bloomberg

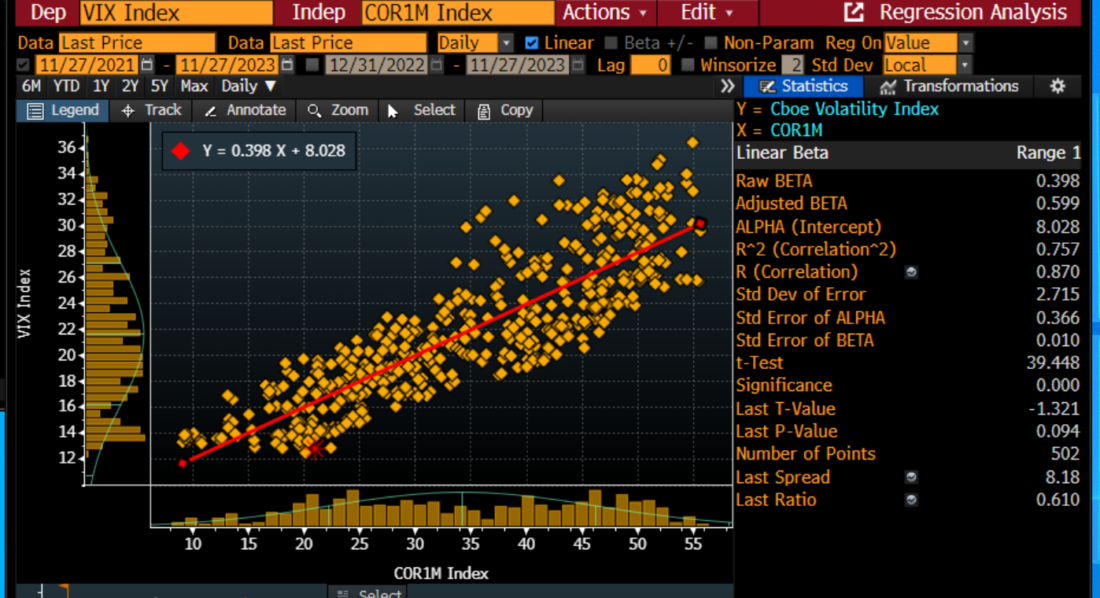

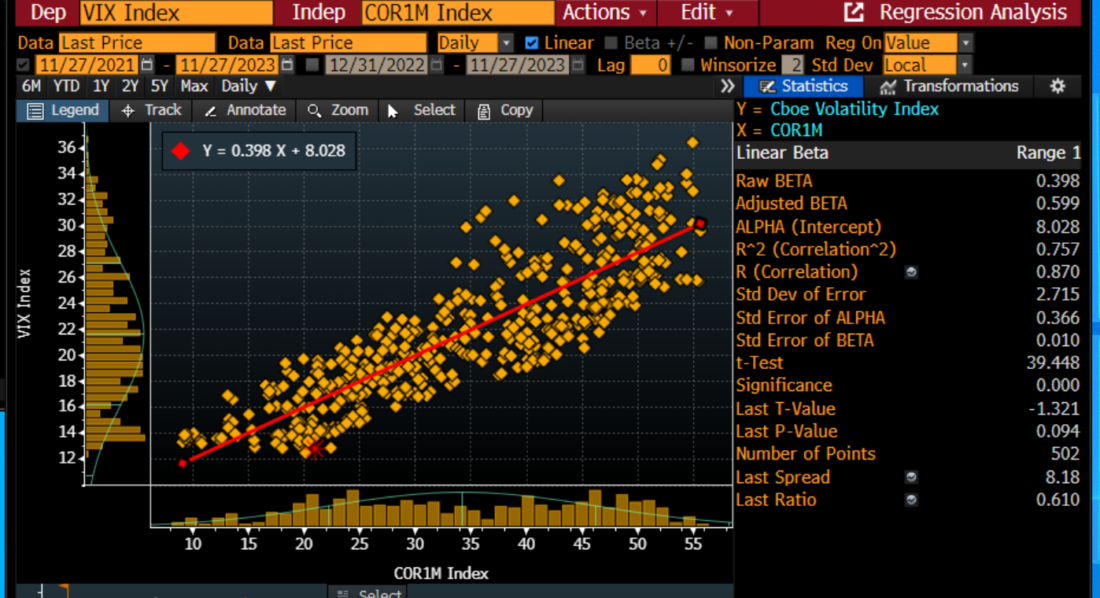

In the chart above, note how VIX has plunged even as COR1M has not. That was the situation in September as well. A scatterplot shows that there is a reasonably solid relationship between COR1M and VIX, yet the current data point is at near the lowest levels seen over the past two years:

Regression Analysis, 2 Years, with COR1M as the Independent Variable and VIX as the Dependent Variable

Source: Bloomberg

Bottom line: traders seem quite sanguine at present, and not actively seeking volatility protection at current levels. But it is quite possible that the current level of VIX is too depressed compared to the correlation of its components, with mechanical selling by ETFs as a contributing factor.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Wouldn’t another factor that should be considered is that there has been much greater volume in shorter dated options, which are not included in the VIX calculation?

I agree with your opinion

If options with approx.. 30-day expiration have become less relevant, then their trading volume should have decreased. I don’t know if that’s the case, but it would be interesting to know.

Q* is at least 5% of the volume these days