Have you been keeping a watchful eye on Netflix (NFLX)? Lately, it’s been making some major down moves in the market, and historical benchmarks hint at the potential for further correction. If you’re looking for a way to hedge your bets or offset some downside risk, our scan has identified an interesting option spread that piqued our interest, and we’re excited to share it with you. In this article we will analyze a NFLX Put Calendar Spread.

What Has NFLX Stock Been Doing Recently?

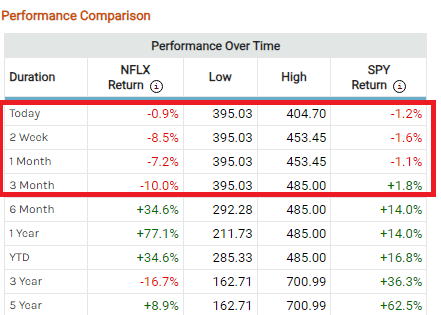

First, let’s take a look at NFLX’s recent performance. While the stock has been a market darling over the past year, with an impressive return of +77%, recent trends have raised some eyebrows. The stock has exhibited relative weakness compared to the broader market over shorter timeframes:

NFLX Relative Performance

This dip in performance indicates that NFLX may be experiencing some headwinds, making it an intriguing candidate for bearish strategies.

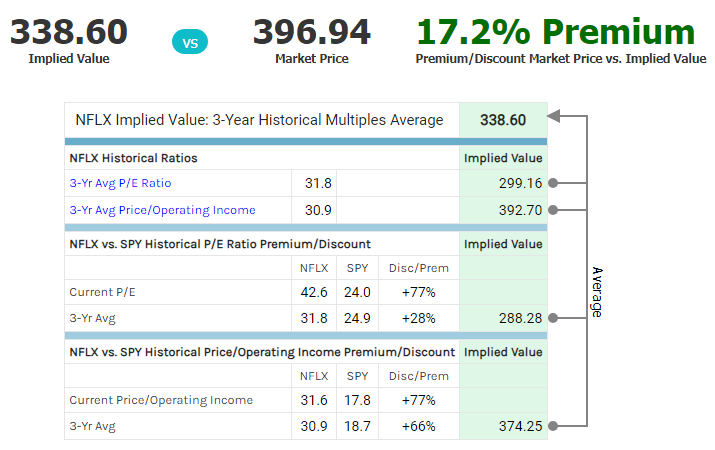

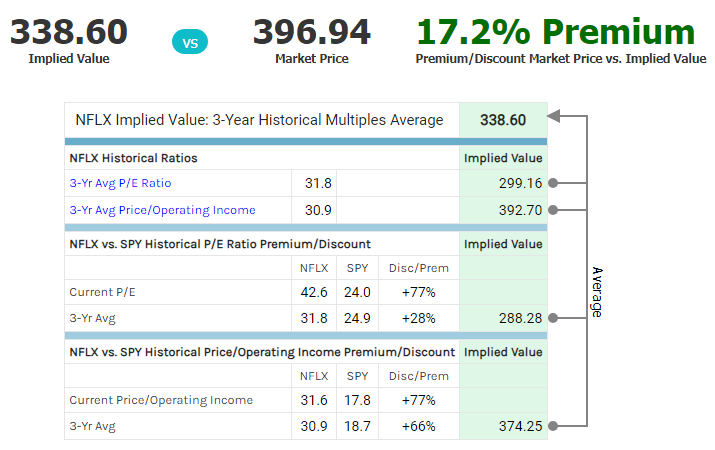

NFLX Historical Valuation Benchmarks Hint At A Possible Correction

NFLX Historical Valuation Benchmark

Adding to our interest is the valuation aspect. Our fair value model suggests that NFLX could be overvalued by a significant margin, potentially by as much as 17% when compared to its historical 3-year average valuation ratios. This overvaluation could be an indication that NFLX’s price might be due for a correction.

Implied Volatility at a Low

NFLX’s implied volatility is another factor that caught our attention. It currently sits at the 15th percentile rank, indicating that it’s on the lower end of its historical range. In simpler terms, this means that NFLX options are relatively cheap in terms of implied volatility.

Given these observations, we set out to find a strategy that could capitalize on a potential further decline in NFLX’s share price and the possibility of implied volatility reverting closer to its historical norms.

Enter the NFLX Put Calendar Spread

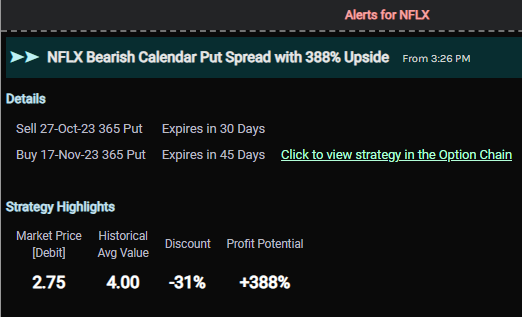

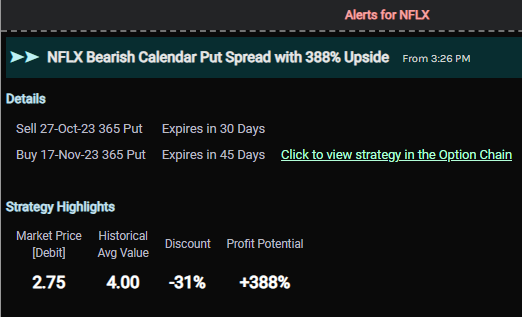

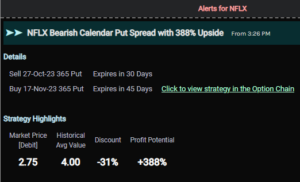

Our scan of the options landscape unearthed an interesting candidate: the NFLX Put Calendar Spread. Here’s how it works: you sell the 27-Oct-23 365 Put and simultaneously buy the 17-Nov-23 365 Put.

Why We Like This Spread

There are several reasons:

Stock Price Drift: This spread benefits if NFLX’s stock price drifts lower to the 365 strike. If this happens, implied volatility is likely to start ticking back up, creating an ideal scenario for this strategy.

Discounted Value: Our historical data analysis suggests that the theoretical value of this spread is much higher, at $4. This means that the spread is currently trading at a substantial -31% discount, providing a cushion in case our analysis is off the mark.

Reward to Risk Opportunity: Should the stock move in our favor and implied volatility revert to its median level, the potential gain on this spread could be as high as +388%. This represents a significant reward-to-risk opportunity for savvy traders.

Note on Execution

It’s important to be aware that the bid-ask spread on calendar spreads can be wide. To maximize your potential profit, consider trying to execute the trade at a price between the bid and ask.

In Conclusion

The NFLX Calendar Spread is an appealing strategy that takes advantage of the recent bearish trend in NFLX stock and the potential for implied volatility to bounce back. What sweetens the deal is that it’s currently trading at a discount to its historical average value, providing a cushion in case things don’t go as planned. With the potential for a substantial reward-to-risk ratio, this spread is a compelling choice for traders with a bearish outlook on the stock.

Remember that options trading involves risk and isn’t suitable for all investors. It’s essential to thoroughly understand the strategy, conduct your own research, and consider your risk tolerance before executing any trade. Happy trading!

—

Originally Posted September 15, 2023 – Here’s Why We Like This NFLX Calendar Spread

Disclaimer: This blog post is for informational purposes only and should not be considered as financial or investment advice. Trading options carries inherent risks, and you should consult with a qualified financial advisor before making any trading decisions.

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.