DAL, the major airline company Delta Air lines, recently reported its earnings on October 12, 2023, before the market opening (BMO). DAL announced better-than-expected results, causing the stock to make a significant jump in the morning. It climbed as high as $37.30 in premarket trading from the previous day’s close of $35.98. However, as the trading day unfolded, DAL’s stock took a different path, eventually closing down at $35.15, marking a decline of -2.3% for the day.

As traders, we have a penchant for analyzing historical data to gauge its potential impact on our trading strategies and risk management. Curious about the recent earnings move, we decided to examine our historical data to discern how this behavior correlated with DAL’s past patterns, exploring whether historical insights could have enhanced our trading plan.

DAL Earnings Moves: A Historical Perspective

DAL Historical Earnings Patterns

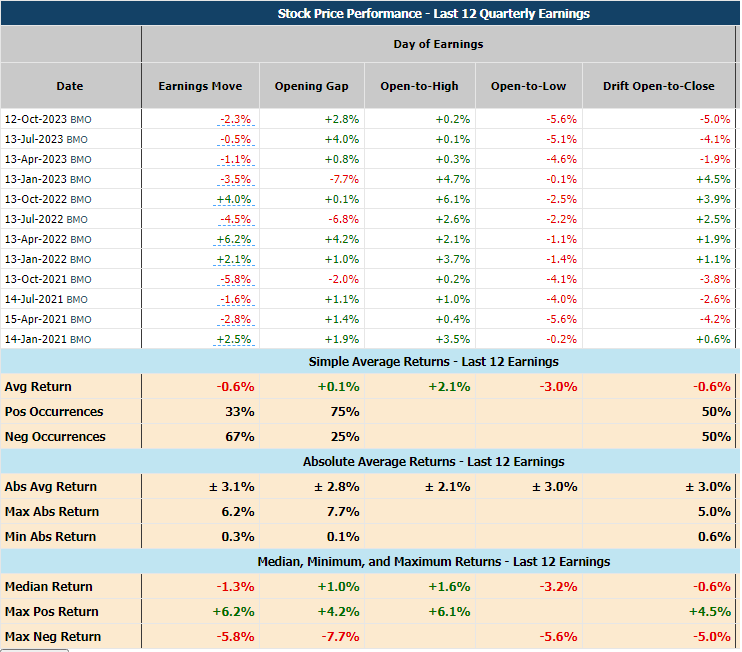

When we looked at the last 12 quarters of DAL’s earnings announcements, we noted some interesting patterns:

Gap Open Trends: DAL’s stock tended to gap open higher 75% of the time in these quarters. This means that more often than not, investors reacted positively to the earnings news, causing the stock to open higher than its previous closing price.

Average Price Movement: On average, DAL’s stock moved by approximately +/- 2.8% in either direction following an earnings announcement.

Drift from the Open: After the opening bell, DAL’s stock showed a 50-50 split in terms of moving up or down during the trading day. However, the down moves tended to outweigh the up moves, resulting in an average loss of approximately -0.6%.

How Did DAL’s Recent Earnings Move Compare to Its Historical Trends?

This time around, with the stock’s premarket climb and subsequent dip, it behaved quite in line with this historical norm. In contrast to the historical pattern, this time the day’s drift was notably down, marking a -5% decline. It’s worth noting that this drop coincided with a broader market sell-off, indicating external factors at play.

Using Historical Data for Guidance

While it’s impossible to know with certainty how a stock will react to any given earnings announcement, a historical look can provide valuable insights and general guidance for potential outcomes when strategizing trades and managing risk.

DAL’s recent earnings move, while initially positive, eventually saw a decline. Understanding historical trends and patterns can help traders and investors make informed decisions when approaching earnings announcements.

In the end, the key takeaway is that historical data can be a valuable tool in a trader’s toolkit, offering a lens into how a stock has typically responded to similar events in the past. However, it’s crucial to factor in the ever-changing market dynamics and external influences when making investment decisions.

—

Originally Posted October 12, 2023 – How Did DAL Earnings Moves Compare to Its Historical Tendencies?

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Investing in stocks involves risks, and past performance is not indicative of future results. Always conduct thorough research and consider your risk tolerance before making investment decisions. Past results and performance do not guarantee future results.

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.