Meta Earnings: Straddle Pricing Expectations and Historical Analysis

Meta is scheduled to report earnings on October 25, 2023, after the market close. As traders approach this date, they may be wondering how the option straddle will be priced. By analyzing historical data, we can gain valuable insights into the potential pricing of the options straddle before the earnings announcement. This information serves as a reference point and guide for market expectations, aiding traders and investors in making informed decisions as the earnings release date approaches.

What to Expect for the Earnings Options Straddle

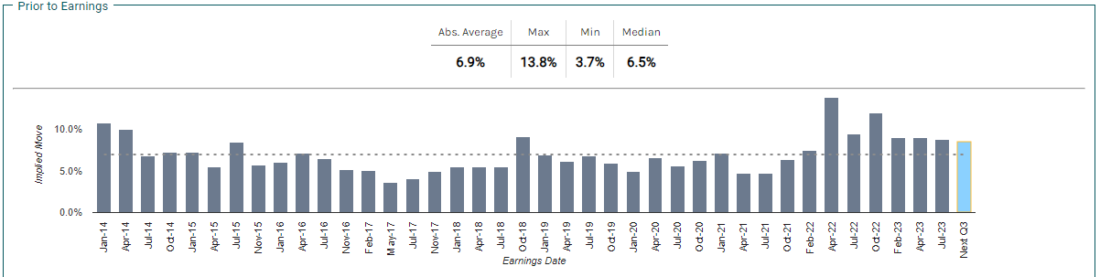

Meta Earnings Option Straddle Prices Over Time Chart

Source: Market Chameleon

Historically, the Meta options straddle has priced in a +/- 6.9% move on average going back to 2014. The median price of a straddle was 6.5%. This can establish a baseline for where the straddle may be priced in the upcoming announcement.

However, it is important to note that the straddle has a wide range of potential prices. The largest option premium priced in a 13.8% move while the lowest priced straddle was 3.7%.

Additionally, the straddle has a tendency to overestimate the actual move. Historically, the straddle overestimated the actual move 59% of the time.

What About Q3 Straddles?

Turning our attention to third-quarter earnings, we observe a slight uptick in the average straddle pricing. Historically, the Q3 straddle averaged ±7%, suggesting slightly higher expectations for this specific quarter. This variance may be attributed to seasonal factors or unique market dynamics during this period.

Conclusion: Preparing for Meta’s Earnings

In conclusion, while the final straddle pricing remains uncertain, historical data provides us with essential guidance. Traders can use this historical baseline as an early indicator to anticipate where the straddle may fall as the earnings announcement approaches. By understanding the patterns and tendencies surrounding Meta’s options straddle, traders can refine their strategies, manage risk effectively, and navigate the market with confidence.

As always, please exercise due diligence and conduct thorough research before making any trading decisions.

—

Originally Posted October 24, 2023 – Meta Earnings and the Options Straddle: What Traders Should Know

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial advice or a recommendation to buy or sell any securities. Trading options involves risks, and historical data may not guarantee future results. It’s important to conduct your own research and consult with a qualified financial advisor before making any investment decisions. expectations and strategize ahead of earnings.

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.