GE’s Performance and Upcoming Earnings

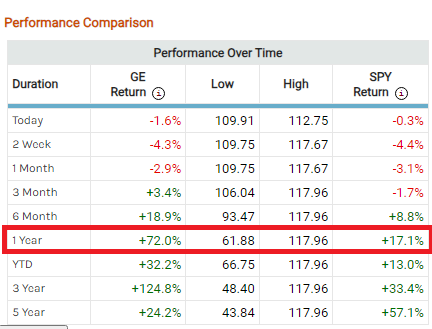

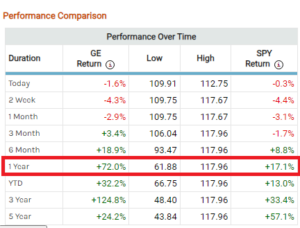

As the earnings season approaches, many eyes are on General Electric (GE), with the company set to release its results on October 24, 2023. GE has had an impressive run over the past year, recording a surge of 72.4% in its stock price, starkly outperforming the broader market’s gain of just 17.1%. However, since its last earnings announcement on July 25, 2023, when the stock jumped 6.3% to close at $117.08, it has somewhat retreated, hovering around the $110.77 mark.

GE Relative Performance

Given this backdrop, the impending earnings release provides an interesting opportunity for option traders. Especially when considering strategies that capitalize on potential stock price movements and the characteristic surge in implied volatility (IV) leading up to earnings.

Capitalizing on IV: The Calendar Spread Strategy

A popular tactic among seasoned traders in such scenarios is the calendar spread. The essence of this strategy involves playing two options against each other: one that expires before the earnings release and another that expires afterward. The anticipated rise in IV usually leading up to the earnings is the main catalyst this strategy seeks to benefit from.

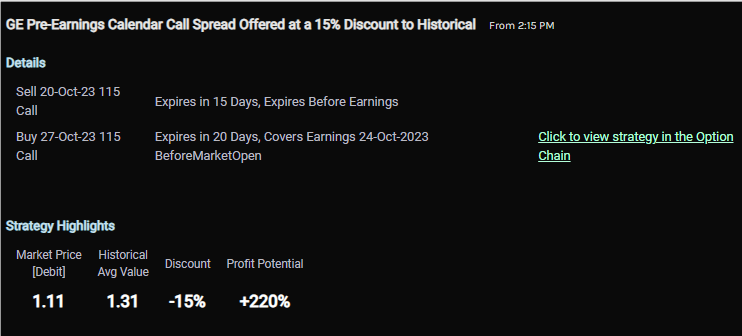

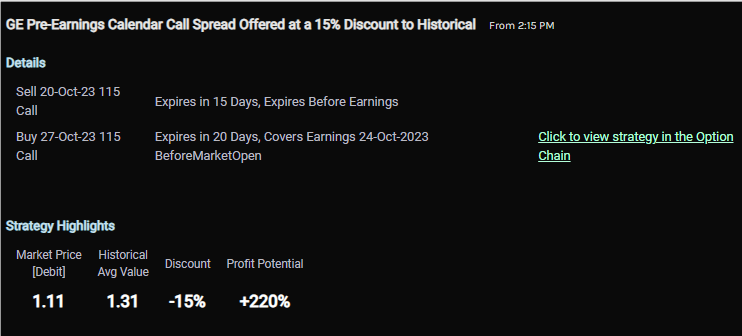

For GE, we’ve pinpointed an appealing calendar spread:

Sell: 20-Oct-23 115 Call

Buy: 27-Oct-23 115 Call

Currently, the market quotes this spread at $1.11. The longer-dated option encompasses the earnings release, while the shorter-dated option will expire before GE’s earnings announcement. By executing this time spread, the sale of the shorter-dated option can help offset part of the purchase price of the longer-dated option. The ideal scenario? The shorter-dated option expires worthless, and the remaining option appreciates due to the increased implied volatility as earnings approach.

Why This Spread Looks Attractive

Our analysis dug deeper into the historical performance of this specific option setup. Findings suggest a historical mean value of $1.31 for the spread. This places the current market price at a theoretical discount of around 15% compared to its historical average.

Moreover, potential profit simulations reveal encouraging outcomes. If GE’s stock drifts to the strike price before the shorter-dated option’s expiration and the implied volatility returns to its historical average, we estimate a potential profit surge of up to 220%.

A major advantage of buying a calendar spread is the limited risk. The maximum loss an investor can incur is confined to the spread’s purchase price. However, traders should be aware of the assignment risk, especially if the option remains in-the-money by its expiration date.

In Summary

As GE’s earnings day nears, traders looking to exploit the expected IV surge have an opportunity in the form of a calendar spread. Not only is the spread currently trading at an attractive discount relative to its historical pricing, but it also offers a high potential return, and limited risk. As always, while strategies like these offer potential rewards, it’s essential to approach them with a comprehensive understanding and stay vigilant to market movements.

—

Originally Posted September 29, 2023 – We Examine GE’s Pre-Earnings Options Calendar Spread for October

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as investment advice, endorsement, or an offer or solicitation to buy or sell securities. The views expressed in this article represent the author’s opinions and should not be considered as financial advice. Investing involves risks, including the potential loss of capital. Before making any investment decisions, readers should conduct their own research and seek advice from a qualified financial advisor.

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.