First, let’s review what the BX stock has been doing.

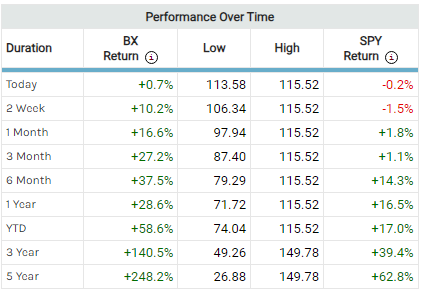

Blackstone Group Inc. (BX) has been making waves in the stock market, with its shares riding a remarkable uptrend, recently reaching a 52-week high at $115.22. Investors are taking notice of BX’s outstanding performance, which has outpaced the broader market in both the short and long term. Over the past year, BX has surged by an impressive 28.6%, compared to the market’s 16.5% gain, and in the past month alone, it has risen by 16.6%, while the market managed just 1.8%. With such a strong track record, let’s turn to an option strategy that can capitalize on this momentum while keeping risks in check.

In this blog post, we will explore the BX Sep 29 Call Spread and why it presents an intriguing opportunity

The Bull Call Spread Strategy

Source: Marketchameleon Alerts

The Bull Call Spread is a trading strategy that stands to benefit from a potential uptick in BX stock. Here’s how it’s structured:

Buy 29-Sep-23 113 Call

Sell 29-Sep-23 116 Call

The current market price for this spread is $1.84.

What Makes the BX Call Spread Attractive

Impressive ROI Potential: If BX’s stock price climbs above the $116 strike by the time of expiration, which represents a relatively modest increase from its current level of $115.12, this call spread could deliver an impressive 63% return on the amount at risk. To put this in perspective, this return exceeds the stock’s year-to-date performance of 58.6%. This illustrates the power of leveraging options to enhance returns in a short time frame.

Historical Data Support: We’ve conducted a historical data analysis on the spread and estimated its theoretical value to be $2.02. This suggests that the current market price of $1.84 implies a discount of -9.6% compared to its long-term average value. This discount serves as an additional cushion for investors, indicating that they are potentially getting a better deal than what historical returns would suggest.

Limited Downside Risk: In the event that BX’s stock price falls below the $113 strike, the spread’s risk is limited to the purchase price. This means that the potential losses are well-defined and controlled, providing a level of comfort for traders.

In Conclusion

The BX Sep 29 Call Spread offers an enticing opportunity for traders looking to capitalize on the strong upward momentum in BX stock. With the potential for a significant return in just a short holding period, along with a theoretical edge that suggests the market price is discounted relative to historical averages, this strategy combines the allure of high returns with a calculated approach to risk management. As always, it’s important to conduct your own due diligence and consult with a financial advisor before making any investment decisions.

—

Originally Posted September 19, 2023 – We Examine the BX Sep Call Spread and Profit Outlook

Disclaimer:

The information provided in this article is for educational and informational purposes only. It should not be considered as financial advice or a recommendation to buy or sell any securities or investment products.

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.