Many years ago, a very intelligent and experienced colleague made a classic mistake about annualization. We made a tweak to our trading model in the hope that this minor change would yield marginally better daily trading results. And on the first day, it worked even better than we’d hoped. I don’t remember the exact figures, so let’s say that we made an extra $10,000 on the first day. My colleague said, “this is amazing. If we make an extra $10k per day, that will be about $2.5 million per year.” I hated being “that guy”, but I reminded him that his new estimate was over-optimistic. We had no expectation that the daily improvement would be anywhere close to that profitable, and that if the change was indeed that meaningful, the rest of the market would adapt. Unfortunately, I was correct. The tweak was just that – a solid and necessary, but marginal improvement.

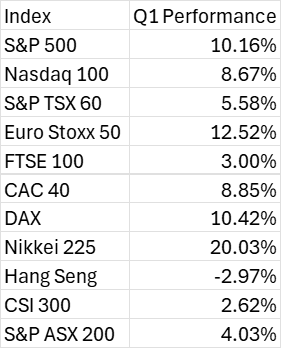

Today, on the final day of 2024’s stellar first quarter, I reminded myself about that discussion about annualization. We’re in the midst of a synchronized, global rally in risk assets with many key equity indexes at or near all-time highs. For reference, here is a table with year-to-date performances for several key indicators:

Even “uninvestable” Mainland China managed to eke out a gain, though the far more accessible Hong Kong benchmark was one of the few sporting a loss. There are days when it feels like we’re never going down again. The mysterious 0.5% rally in SPX during the last half-hour of yesterday’s session certainly added to that sense.

Heck, what’s not to like?

- The economy is humming along. The FOMC projects a 2.1% rise in real GDP for 2024, and this morning’s final read of 4Q real GDP was 3.4%

- The unemployment rate, despite a recent rise, remains an enviable 3.9%

- Inflation, despite being above the Fed’s 2% target, is under much better control

- Corporate earnings are solid

- Both consumers and investors feel exuberant, with speculation in vogue – including a return of meme stocks

One can of course question whether any rate cuts, let alone three, seem at all necessary or even desirable, but questioning that view would once again make me “that guy.” Thus we find ourselves in the quite enviable position of anticipating an expansionary monetary policy layered on top of an expanding economy. Again, what’s not to like? (The prospect of reigniting inflation, that’s what. But bringing up that idea would again make me “that guy.”

Late last year, as rate cut hopes far outpaced the three that the FOMC acknowledged, we questioned how investors could reasonably anticipate both a soft landing AND six or seven rate cuts. As the weeks went on, rate cut hopes faded as it became clear that the economy was on solid footing, allowing companies to show solid profitability. That what was we hoped when we wrote in January:

It is therefore quite difficult, if not impossible, to imagine that we can get double-digit earnings growth and mid-single-digit revenue growth without a decent, if not robust economy. While some of the revenue growth could be achieved if prices rise sufficiently, but that would of course imply that inflation is running above the Fed’s target, muting their ability and desire to cut rates. But if we assume that revenue growth roughly matches GDP growth plus inflation (a big, generalized assumption, to be fair), and inflation falls sufficiently to justify rate cuts, it implies GDP growth of about 2-3%. We’re not likely to get six or seven cuts if the economy grows at anything resembling that pace.

How then do we resolve this paradox? It will require data.

As it turned out, the data was good. And that is perhaps the best reason for stocks to rally. If given the choice between a solid economy or one that requires stimulation from rate cuts, I’ll take the former every time.

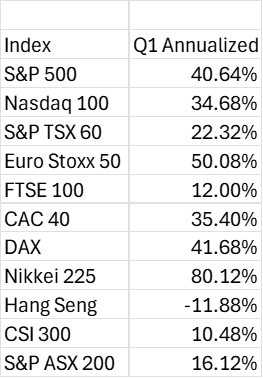

But let’s get back to our original point about annualization. Here are the Q1 market results annualized for a full year at the same pace:

Does that seem at all sustainable or reasonable? C’mon, be honest, bearing in mind the rallies that most of those markets experienced last year.

Therein lies the problem. It sometimes feels like we’re going to continue to rally steadily and uninterrupted. But common sense tells us that seems impossible. It implies that we will have either a sideways market or even a bit of a correction. But why, and when? The 13 level of VIX implies that the answer to “when” is “not anytime soon.”

Let’s celebrate the end of a highly successful quarter for most investors. But in the spirit of Warren Buffett’s famous admonition, “be fearful when others are greedy,” it behooves us to consider the “why and when” questions raised above. But in the meantime, feel free to dream about annualizing this quarter’s amazing performance.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

I watch way too much CNBC and BloombergTV, and I don’t think I hear enough about the ‘under the radar’ stimulus that is still flooding the economy. Take student loan forgiveness, for example. Hundreds of thousands of people got their loans forgiven since the middle of last year and through today, including very high paid professionals (e.g., doctors) with hundreds of thousands of dollars in loan balances. That, on top of the payment forbearance that lasted 3.5 years since the start of COVID and all the rest of the stimulus programs that usually get most of the airtime, it’s not hard to figure out what has turbocharged the consumer, i.e. the king and savior of the economy. For some reasons, people talked more about loan payments restart, which have been washed down and delayed again – that is the equivalent of using a bucket to clear a flood. Sure, that stimulus will dry up at some point, bringing inflation down… but is it not also likely to create an air pocket for this surprising strong economy? If it doesn’t, I need to accept that everything I studied in college and in my MBA was just nonsense. In that case, oh well… I will keep reading this column, though… thanks for writing it.

I realize the attraction of viewing possible trades in terms of “annualized returns” and for novice investors to be absorbed by annualized returns. For many, a year may seem to be a long, long time. However, anyone who has more than a passing experience in the market is aware that although the history is that markets tend to rise, they do at times fall. After more than forty years in the market, I think it is safe to conclude that one can expect that they will even experience years which have negative returns. The only important thing is what is your return over the long run.

Which is not to discount short term winners, only to say that many waste much effort extolling their winners and ruing their losers. Understanding how you got there is important, but you will do better to move on to the next thing than dwell on past results. BTW, anyone who thinks about it for moment has to realize that when Madoff reports a monthly gain of 1% month after month, year after year, is dealing with pure puffery.

Taking the first three months of the year and times it by 4, is delusional. Most often there will be a period of drawdown in the second quarter when the first has been hot. And yes, often the market will go back up in the fall, but to steal a phrase from politics, the important question is, “Are you better off today than you were four years ago?” That is, would you done better in T bills?, I dare say, “Not!”