In a significant turnaround for its aviation sector, Mexico’s air safety rating was upgraded from Category 2 back to Category 1 by the Federal Aviation Administration (FAA), the agency announced last week.

The reinstatement comes after a costly two-year downgrade that restricted Mexico’s airline growth and led to losses exceeding $1 billion for the industry.

For investors watching the aviation space, this upgrade could be a game-changer, offering opportunities for both Mexican airlines and their U.S. joint venture partners. I believe the recent rise in oil prices, which has put pressure on airline stocks, has also created an attractive buying opportunity.

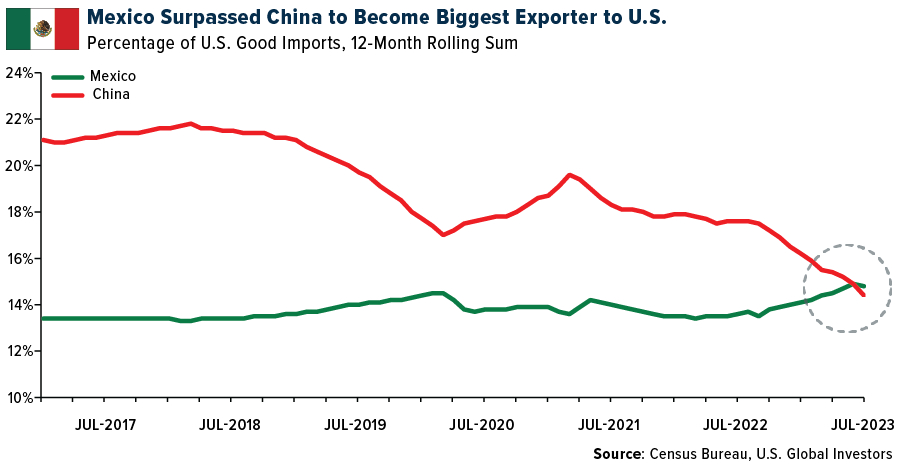

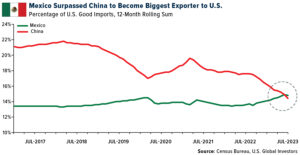

The upgrade to Category 1 is a watershed moment for the Mexican airline industry. This status allows Mexican carriers to add new routes to the U.S., a significant benefit given the Central American country’s status as the leading exporter to the U.S., displacing China.

Beyond opening up new routes, the upgrade is a green light for American airlines engaged in joint ventures with Mexican carriers. Volaris, which had been constrained by the Category 2 rating, can now expand its U.S. network, a development that should also make it more attractive to investors.

Delta Air Lines, with its joint venture with Mexican flagship carrier Aeroméxico, is another beneficiary, especially as Aeroméxico plans to go public in the U.S. after delisting from the Mexican stock exchange late last year. Ultra-low-cost carrier (ULCC) Allegiant Air also stands to gain, thanks to its proposed partnership with Viva Aerobus, currently being reviewed by the Department of Transportation (DOT).

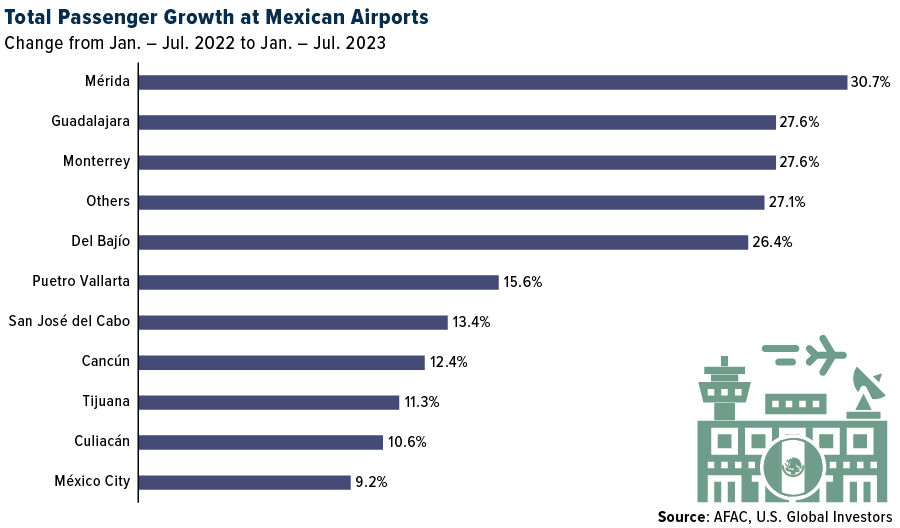

Despite an array of challenges ranging from safety issues to infrastructural vulnerabilities, Mexico’s top three airlines—Aeroméxico, Viva Aerobus and Volaris—registered a collective 16.5% increase in passenger numbers in the first half of 2023 compared to the same period last year.

This growth isn’t that surprising, considering that air travel is increasingly replacing long-distance bus, car and train journeys in Mexico, the number one overseas destination for Americans. Each airline has found its niche—Volaris caters to leisure routes, Aeroméxico targets business travelers and Viva focuses on converting bus passengers to airline customers.

Investment Opportunities In The Airline Sector

Investors have several compelling reasons to look closely at Mexican airlines. First, the reinstatement to Category 1 status makes these stocks an attractive proposition for market growth and increased revenue.

Even before the status upgrade, Aeroméxico was experiencing strong demand in European markets, capitalizing on its unique position as Mexico’s only long-haul operator. According to data from the Centre for Aviation (CAPA) and the Official Airline Guide (OAG), 65% of the airline’s available seat kilometers (ASKs) are from international operations.

Speaking of Europe, passenger volumes at airports were 97% of pre-pandemic levels in July, according to the latest report by Airports Council International (ACI). London Heathrow was the month’s busiest airport, serving over 7.7 million passengers, followed by Istanbul Airport (7.4 million passengers) and Paris Charles de Gaulle Airport (6.6 million).

For those considering diversified options, American partners of Mexican carriers also present investment opportunities. With global air traffic nearly returning to pre-pandemic levels and Latin American airlines experiencing a more than 25% increase in traffic between July 2022 and July 2023, the industry looks set for an upswing.

The Double-Edged Sword Of Rising Oil Prices

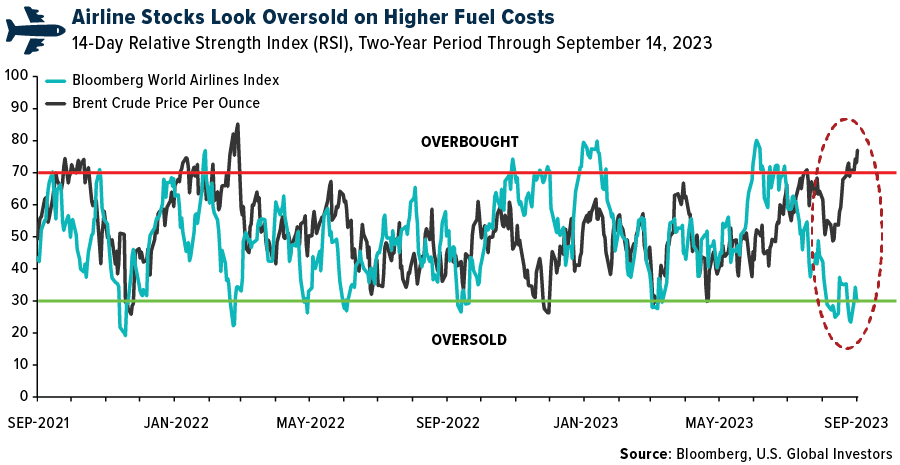

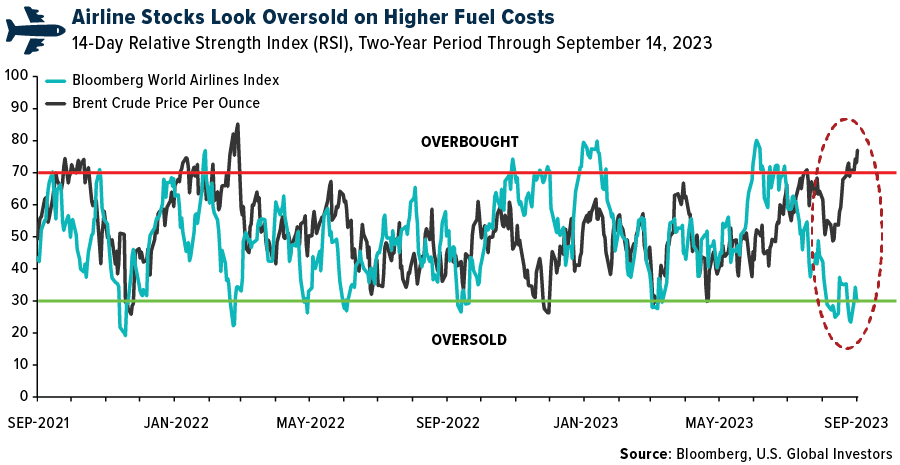

I would be remiss if I didn’t address rising oil prices in the context of airline stocks. Brent oil has climbed to over $94 per barrel for the first time since November 2022, with the rise attributed to supply cuts and rebounding demand.

In the past, the immediate market reaction to rising oil prices has included a selloff of aviation names. This could lead to overselling, providing an opportunity for investors to buy shares at a lower cost with the expectation that they will rebound—just as they did during the pandemic.

Indeed, global airline stocks look oversold right now, with the Bloomberg World Airlines Index below 30 on the 14-day relative strength index (RSI), compared to oil prices, which are safely in overbought territory. Now could be an attractive entry point for airlines as we await mean reversion to take place.

However, both the Organization of Petroleum Exporting Countries (OPEC), which turned 63 years old last week, and the International Energy Agency (IEA) predict continued supply shortages. Starting this month, “the loss of OPEC+ production, led by Saudi Arabia, will drive a significant supply shortfall through the fourth quarter,” the IEA writes, adding that a rollback to the cuts at the beginning of next year “would shift the balance to a surplus,” which would be good news for airlines.

—

Originally Posted September 18, 2023 – Mexico’s Airlines Safety Upgrade May Be The Lift Investors Have Been Waiting For

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Bloomberg World Airlines Index is a capitalization-weighted index of the leading airlines stocks in the World. The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions. Mean reversion is a financial term for the assumption that an asset’s price will tend to converge to the average price over time.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (06/30/2023): Allegiant Travel Co., Delta Air Lines Inc.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.