As well as the seasonality of the year, there are other calendrical cycles such as the week or the month. Today, we are going to consider the performance of the S&P 500, analysed by looking at the days of the week from the year 2000. Believe it or not, there are individual days of the week that perform significantly better than others!

Tuesday especially firm

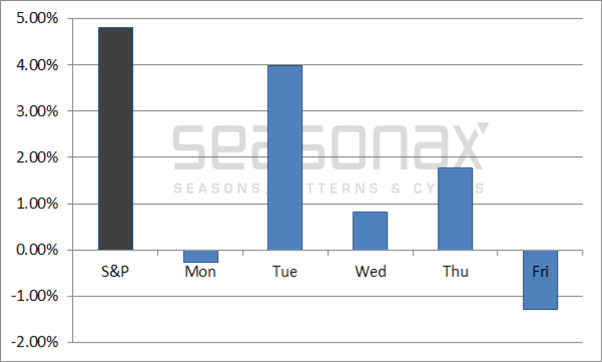

This first chart shows you in black the annualized performance of the S&P 500 since the turn of the millennium, as well as each day of the week in blue.

I always measure from close to close; the performance of Tuesday, for example, is the performance from Monday’s close to Tuesday’s close.

S&P 500, performance by weekdays, 2000 to 6/2023

Tuesday is almost as good as the overall period. Source: Seasonax

As you can see, one day stood out positively: Tuesday. Tuesday alone has a better stock market performance than all five trading days combined! Tuesdays rose an annualized 3.98%, compared to 4.81% for the S&P 500.

Monday and Friday, on the other hand, were weak on average.

The difference, measured over no less than 5,933 trading days, is already very clear. This indicates that it is not a matter of coincidence.

But what does this look like in the individual stock market phases – bear markets and bull markets?

The days of the week under the magnifying glass

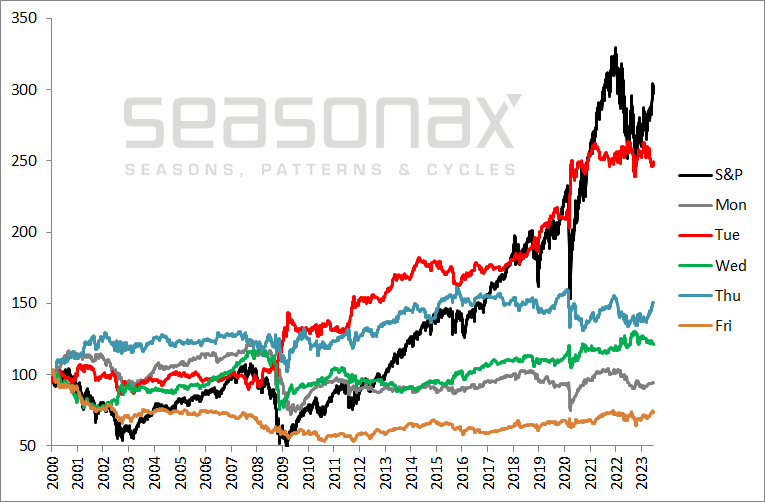

The next chart shows in black the development of the returns of the S&P 500 since the turn of the millennium, as well as those on individual weekdays in other colors.

S&P 500, performance trend per weekday, 2000 to 06/2023

Tuesday went up even in bear markets! Source: Seasonax

The red line confirms that Tuesday (red) alone performed almost as well as the S&P overall – and with less volatility.

Now take a closer look at performance in the bear markets after 2000, during the 2008 financial crisis and the 2020 Corona Crash.

Even during these difficult stock market times, Tuesdays were quite decent.

In the 2008 and 2020 crashes, Tuesdays actually rose significantly, bucking the market trend.

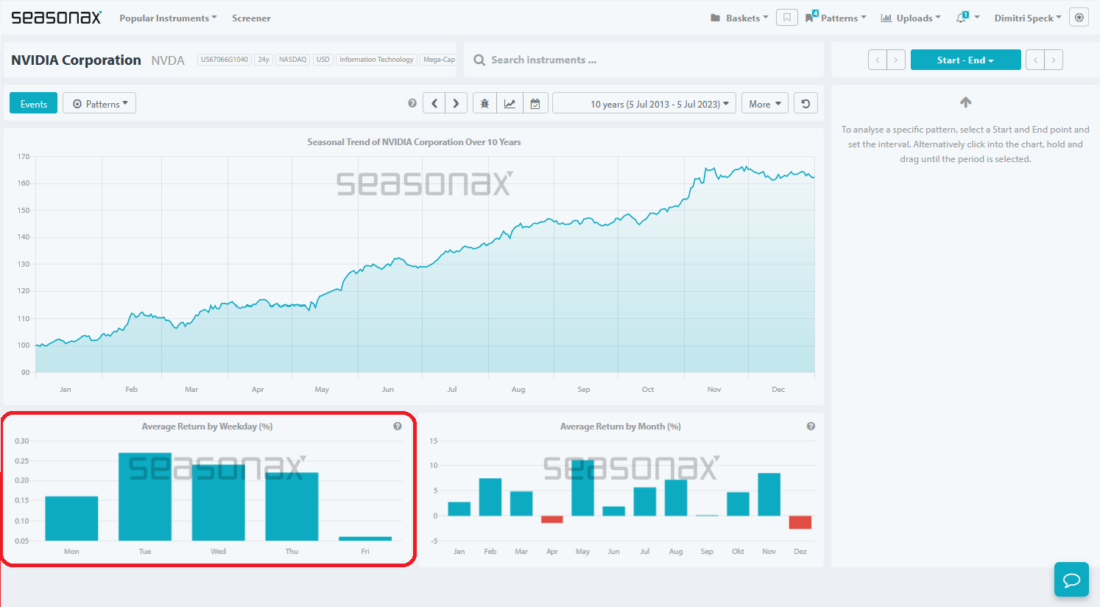

The days of the week in Seasonax

You too can display the days of the week for all instruments in Seasonax. All you have to do is call up a value. The weekday history appears immediately below the seasonal chart.

Seasonax screen, with weekday history

The history by days of the week appears immediately. Source: Seasonax

It is that easy to find out how your favorite instrument performs over the course of a week.

Why not try it out right now at www.seasonax.com

—

Originally Posted July 6, 2023 – S&P 500: Which is the best day of the week?

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Seasonax

Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. Seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. Seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by Seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. Seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Seasonax and is being posted with its permission. The views expressed in this material are solely those of the author and/or Seasonax and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

thank you

Thank you for reading, Alan!

So as far as buying into a low cost S&P 500 index fund goes:

– FXAIX (Fidelity S&P500 index fund) 0.015% fee

– SWPPX (Charles Schwab S&P 500 index fund) 0.020% fee

– VFIAX (Vanguard S&P 500 index fund) 0.040% fee

The best day to buy on a weekly basis would be when the market closes on Monday evening (index funds only transact once per day M-F).

I set up my Fidelity account to automatically transfer cash to my brokerage account on Fridays and have the investment into the S&P 500 fund on Monday evenings close price.