- Movie stocks have performed well in 2023 despite mixed consumer spending trends

- While ticket sales are up from a year ago, data show that nothing tops at-home Netflix-and-chill

- We spotlight key entertainment dates as the summer season heats up

Ditching the dual monitors to take in a big-screen flick is not a bad way to unwind after a long day and busy earnings season. But volatility could be on the way in the space amid a Hollywood writers strike, dismal results from Paramount Global (PARA), and cost cuts at Netflix (NFLX).

Get Your Popcorn Ready

Wall Street Horizon is known for monitoring market-moving earnings event dates, corporate conferences, and dozens of other event types, but one of our personal favorites is the movie release category. Ahead of the summer box office period and before the unofficial kickoff to the season (Memorial Day weekend), let’s run through the state of the film industry. You might just find catalysts to add some glitz and glamour to your portfolio.

Box Office Sales Continue to Improve

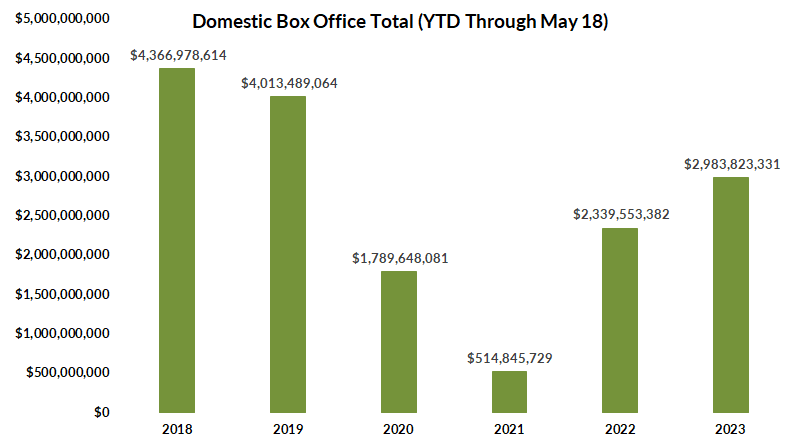

To get the opening credits going, data from IMDb show that this year’s running total of box office receipts continues to build off the pandemic lows. As 2020 got off to a usual start in the States, the industry grounded to a halt in mid-March that year and did not recover until mid-2021. Over the last two years – despite the omicron variant disruption early last year – more folks have been taking in a cinema night. Compared to year-ago levels, 2023 year-to-date box office receipts are higher by 28%. Of course, inflation has been a bit hot over that time, but that’s still a lofty total. Compared to 2019’s pre-COVID amount, however, the spending sum is still down 26% (not adjusted for inflation).

Better Box Office Numbers In 2023, Still Lagging Pre-Pandemic Totals

Source: IMDb

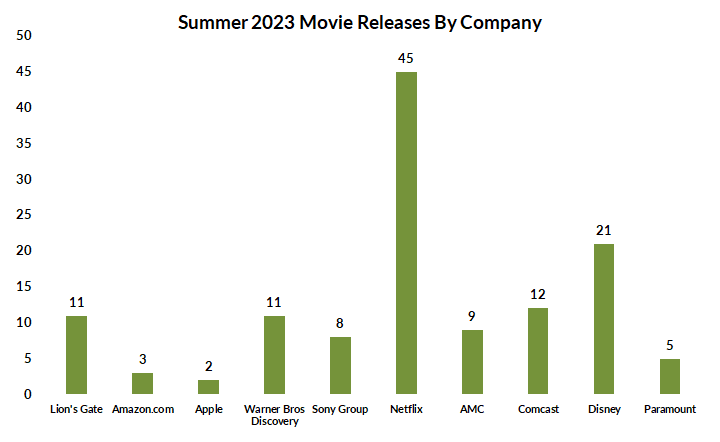

So, what movie producer steals the show? As you might have guessed, Netflix is in the limelight with 45 releases slated from late May through Labor Day weekend. NFLX has rallied in recent days following the announcement of its new ad tier to augment revenue. Disney (DIS) and Comcast (CMCSA) are distant second and third-place finishers in the movie count.

Netflix Leads the Movie Release Count for the Summer Stretch

Source: Wall Street Horizon

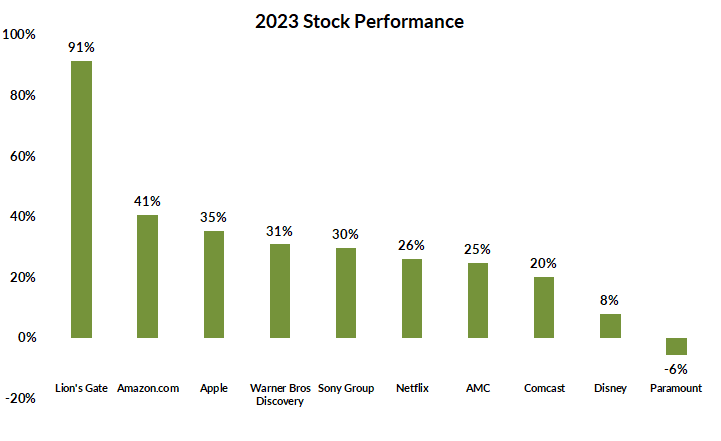

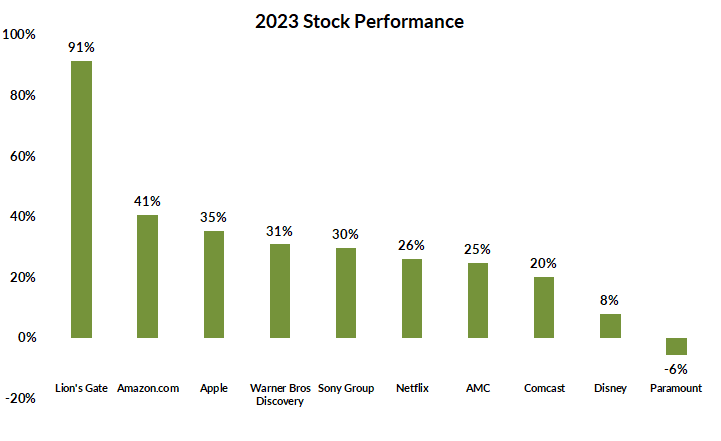

The Shift to Services Spending Helps Entertainment Companies

NFLX is no doubt the star of the show, but shares are higher by only 15% on the year. Lions Gate Entertainment (LGF.A) has been the ‘best actor in a leading role’ in 2023 (bear with us on these puns). LGF.A has returned 91% YTD. More broadly, the Communication Services sector – where most of these companies are within – has taken turns with the Information Technology sector as the best-performing slice of the S&P 500 on the year.

Consumer Discretionary (arguably where going to the movies might fall within) likewise has been a blockbuster of a sector – rising more than 16% through mid-May. It remains to be seen whether the summer season will be a comedy or a tragedy for the group, but sans Paramount Global, the group boasts strong momentum.

Broad-Based Gains for Filmmaker Stocks

Source: Stockcharts.com

Events on the Docket

Ahead of the unofficial kickoff to summer, JP Morgan hosts its 51st annual TMT Global Technology, Media, and Communications Conference this week from Monday through Wednesday. Disney, Comcast, and Warner Bros Discovery (WBD), among others, are expected to present. Investors should stay tuned for possible industry-moving news at the event.

After that, the next key event is Lions Gate’s Q4 2023 earnings report which is confirmed for Thursday, May 25 AMC. Before Netflix’s Q2 profit report on July 18 and a slew of EPS reports later that month and in early August, three moviemakers hold annual shareholder meetings: Netflix on June 1, Comcast, on June 7, and Sony (SONY) on June 20.

Coming Attraction: Spinoffs

Speaking of Sony, one broader trend we notice is another uptick in spinoffs – the Tokyo-based firm consumer electronics company is reportedly considering a spinoff of its financial services arm. Alibaba (BABA) is another consumer name in playing the spinoff game – stay tuned for more coverage of this trend from us.

Closing Credits

Will entertainment companies continue to reel in profits? As consumer spending trends ebb and flow, like a suspenseful thriller film for economic data watchers, uncertainty runs high in this group of stocks; be sure to monitor key events to see how the script plays out.

—

Originally Posted May 19, 2023 – The Box Office Bounce Back: Entertainment Stocks Produce Strong Returns

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.