For those of you who were not afficionados of late 20th Century radio, Lake Wobegon was a fictional town that featured in Garrison Keillor’s “A Prairie Home Companion.” I confess that I know little about the program except that its segments ended with tag line that ended with “all the children are above average.”

The same can be said, to some degree, about US company earnings.

It is well known that a significant majority of the companies in the S&P 500 routinely report earnings that are above their consensus estimates. According to John Butters at FactSet:

To date [August 7th, 2023], 84% of the companies in the S&P 500 have reported earnings for the second quarter. Of these companies, 79% have reported actual EPS above the mean EPS estimate, which is above the 5-year average of 77% and above the 10-year average of 73%.

Obviously, for blue-chip US stocks, the norm is not simply meeting expectations, but beating them. That the 5-year average of beats is above the 10-year average implies that it is becoming more typical for companies to beat their estimates, not less.

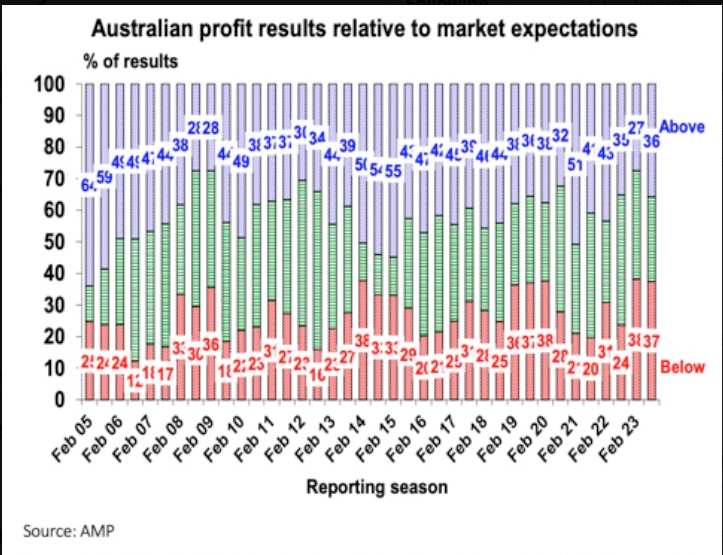

Quite frankly, I’d never given this too much thought. It simply became a given that US companies were expected to beat their estimate by at least a penny, and that simply meeting estimates was a bit of an underachievement. But this weekend, I came across the following chart on social media:

The above chart shows that in Australia it is quite normal for earnings reports to be centered (centred?) around the median analyst estimates. Over the past 18 years, roughly a third of companies beat, a third miss, and a third meet estimates. This certainly seems like a more normal distribution, at least in a qualitative sense.

Other than proving that two grown-ups can actually have an intelligent and respectful conversation on social media, my question about why two countries with similar societies have such disparate approaches to earnings reports remains unresolved. The original poster, Danielle Ecuyer of Ausbiz, posited that the US emphasizes buybacks and share prices over dividends, which have greater priority in Australia. I acknowledge that while that explanation is indeed truthful and offers a valid incentive for managers whose compensation is full of stock-based incentives, it doesn’t explain why US analysts haven’t adapted their estimates to enable a more normal distribution of results around the mean estimates.

I have often asserted that US CEO’s need to be as skilled at managing expectations as they are at managing their actual businesses. Woe be it for the corporate chieftain who fails to meet, let alone beat expectations.

It is not clear when the trend started, but it would appear that Jack Welch, the late, former head of General Electric (GE), had something to do with it. GE was a darling of corporate America and stock markets, partly because of its remarkable ability to offer both consistent earnings and growth. It always appeared that under Welch’s reign, GE could always beat expectations by a penny or two. Much of that was because of the company’s GE Capital division, which I used to refer to as “Welch’s couch cushion.” Thanks to the nature of financial accounting, a finance division could choose to realize profits from selling profitable investments in a timely manner or keep those gains unrealized if not needed. Eventually that cozy relationship unraveled, but not until after it became de rigueur for growth companies to regularly beat expectations.

As for why analysts haven’t adapted, it may be that they don’t want to risk being on the outs with a key company’s management. Almost everyone who listens to an earnings call has recognized that an analyst’s question often begins with flattery (“Great quarter, Bob…”). No analyst wants to lose his or her access, so they avoid getting on management’s bad side. If they get calls from a CFO or investor relations heads that tell them that maybe their $0.50 estimate looks a penny or two too high, it is likely that they may get into line with the rest of the street at $0.48-0.49, only to have the company report $0.50.

Finally, it seems that investors are getting hip to the game. The above-cited FactSet report goes on to say:

Companies that have reported positive earnings surprises for Q2 2023 have seen an average price decrease of 0.5% two days before the earnings release through two days after the earnings release. This percentage decrease is well below the 5-year average price increase of 1.0% during this same window for companies reporting positive earnings surprises. In fact, if this is the final percentage for the quarter, it will mark the largest average negative price reaction to positive EPS surprises reported by S&P 500 companies for a quarter since Q2 2011 (-2.1%).

We have noted that this quarter we have seen several companies decline even after beating their EPS estimates. Microsoft (MSFT), Apple (AAPL), Tesla (TSLA) and Netflix (NFLX) are among the high-profile companies that beat their consensus earnings estimates but fell after another key metric missed expectations. Investors started looking past EPS as the sole key to a report some time ago when they began putting nearly equal weight on revenue estimates, but for the largest companies, the list of other important metrics has expanded to a wide range of company-specific metrics.

For this quarter, at least, investors decided that simply beating consensus EPS was insufficient. They took a more holistic view of a given company’s business. It is too early to know whether this marks a turning point in how investors respond to earnings reports overall – it could simply be that after a quarter when prices rose much faster than than earnings expectations, the bar was raised. But it behooves traders and investors alike to take a much more nuanced view of a company’s earnings report, and not simply acknowledge whether the company beat estimates or not.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.