Study Notes:

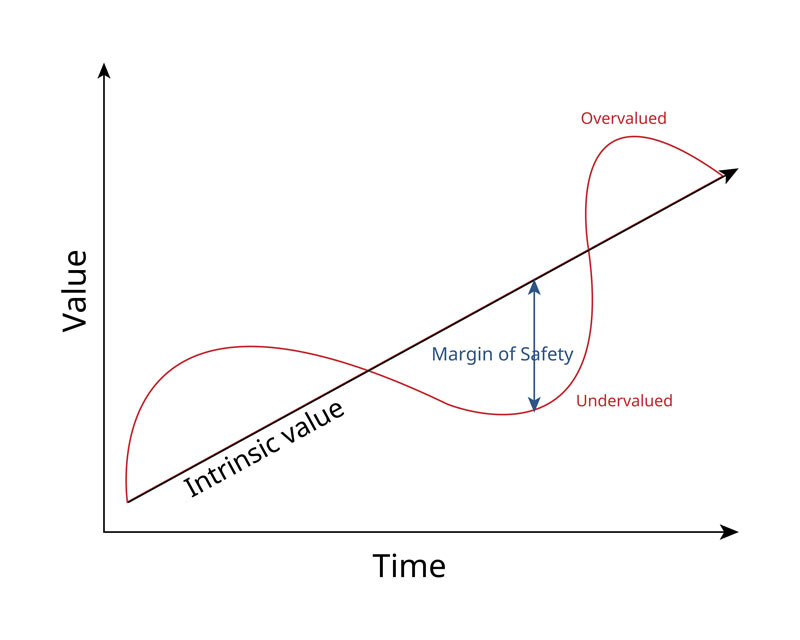

Margin of safety is a concept widely used by value investors to protect themselves from potential losses in their investments. It refers to the difference between the intrinsic value of a stock and its market price. By investing in companies with a significant margin of safety, investors aim to minimize the risk of capital loss and increase the likelihood of achieving a favorable return on their investment.

To better understand the concept of margin of safety, let’s take an example using a fictional company called Stuart’s Global Spices. Stuart’s Global Spices specializes in producing and distributing high-quality spice blends and seasonings for culinary enthusiasts worldwide.

As a value investor, assessing Stuart’s Global Spices would involve a comprehensive analysis of its financials, market position, growth prospects, and cash flows. Let’s assume that after conducting this analysis, the value investor determines that the intrinsic value of Stuart’s Global Spices is $100 per share.

However, the current market price of Stuart’s Global Spices stock is $70 per share. This creates a margin of safety of $30 per share ($100 – $70), representing the discount between the market price and the estimated intrinsic value. The margin of safety serves as a protective cushion for the investor against potential uncertainties and market fluctuations.

Let’s explore some factors that may contribute to the margin of safety in the case of Stuart’s Global Spices:

Competitive Advantage: Stuart’s Global Spices has a strong competitive advantage in the spice industry. This advantage could be derived from its unique blend recipes, well-established distribution network, or a loyal customer base. This competitive advantage may enable the company to generate sustainable profits, contributing to the margin of safety.

Market Expansion Opportunities: The value investor may have identified potential growth opportunities for Stuart’s Global Spices, such as entering new international markets or expanding product lines. These growth prospects can enhance the intrinsic value of the company and create a larger margin of safety for the investor.

Brand Reputation: Stuart’s Global Spices may have developed a reputation for delivering high-quality products, which resonates with consumers seeking premium spice blends. Plus, they have excellent customer support that leads to a solid reputation. Investors recognize the value of the brand and its ability to command higher prices, leading to increased profitability and a wider margin of safety.

By investing in Stuart’s Global Spices with a margin of safety, the value investor aims to minimize the risk of capital loss while maximizing the potential for returns. If the market price of the stock gradually approaches its intrinsic value over time, the investor can generate a profit. Furthermore, the margin of safety provides protection in case of unexpected challenges or fluctuations in the market.

It is important to emphasize that estimating the intrinsic value of a company, such as Stuart’s Global Spices, and determining an appropriate margin of safety requires thorough analysis and sound judgment. Value investors usually rely on various valuation models and techniques, such as discounted cash flow analysis, earnings multiples, and brand valuation methodologies, to arrive at their estimates.

So, margin of safety is a fundamental concept for value investors, helping them safeguard against investment risks.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.