Study Notes:

In this lesson, we’ll walk you through how to set up a Market order using TWS Mosaic.

- We’ll define the objective of the Market order type

- Show you how to create a Market order in TWS Mosaic

- Show you where you can locate Market orders within the Activity panel

Market order

When you want to sell or buy shares at the market bid or offer price, you are choosing to execute a Market order.

This type of order may not only increase the likelihood of a fill, but also the speed of execution.

Unlike the limit order, Market orders do not provide price protection. In fact, they may fill at a price worse than the displayed bid or ask price.

Set up of Market order in TWS

If you want to conduct a Market order, here’s how to set it up in IBKR’s Trader Workstation:

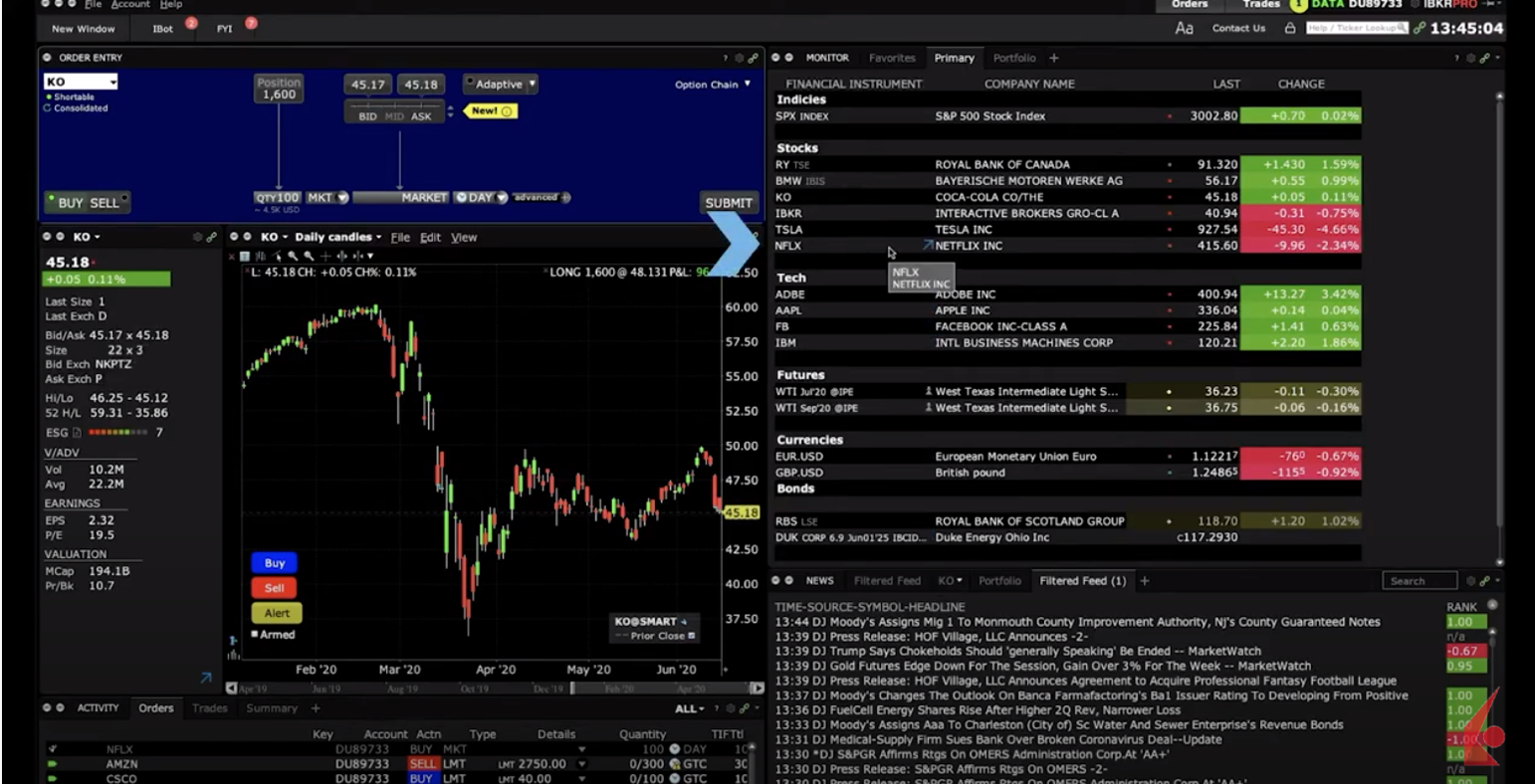

First, choose your ticker symbol from the Watchlist.

~ Tip: You can select ticker in the order entry panel

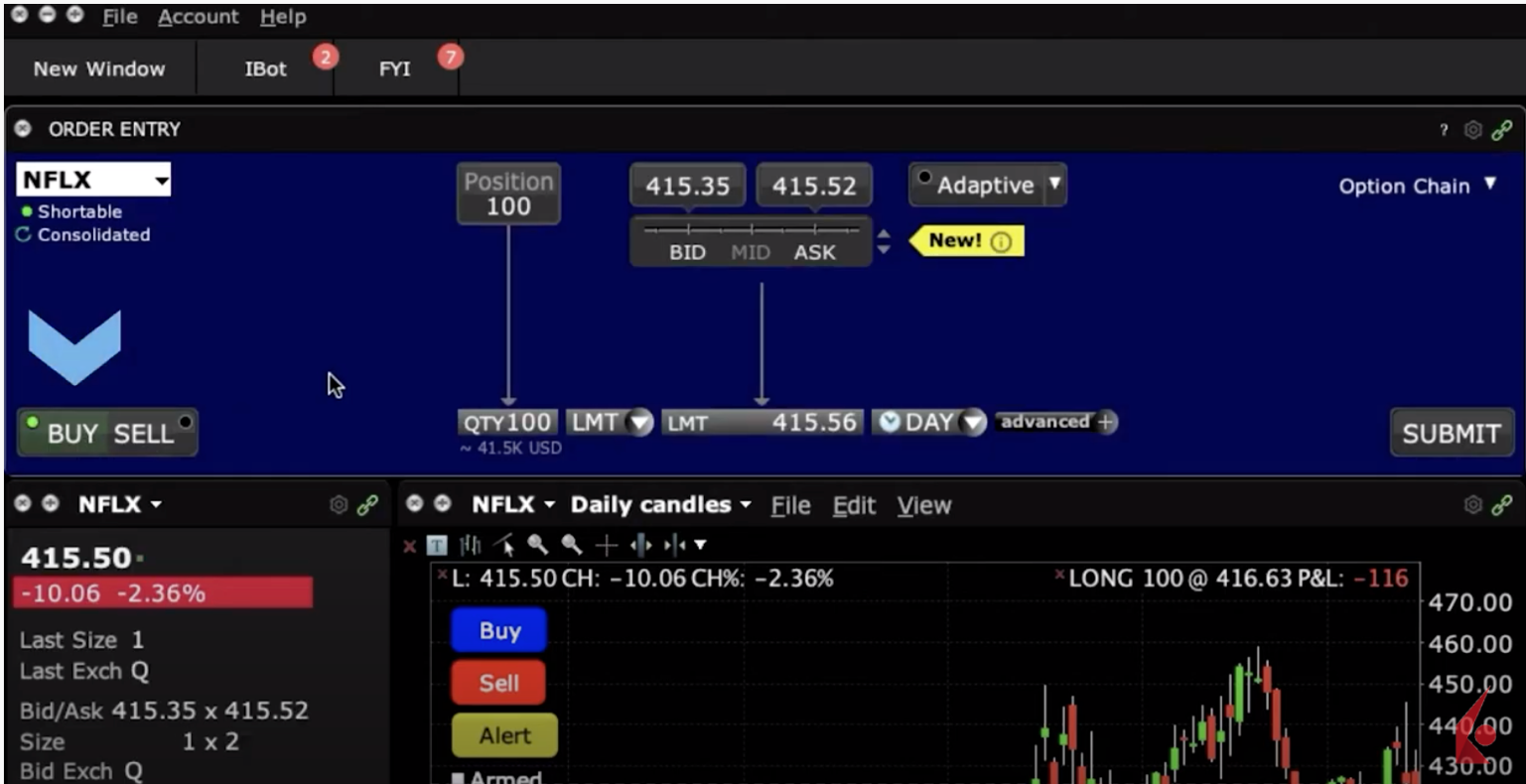

For example, let’s select NFLX – the ticker for Netflix.

Do we want to buy or sell shares of Netflix?

Do we want to buy or sell shares of Netflix?

For illustration purposes, let’s buy. To do this, I’ll start off by clicking on the buy button – but now I also need to know how many shares I want to buy.

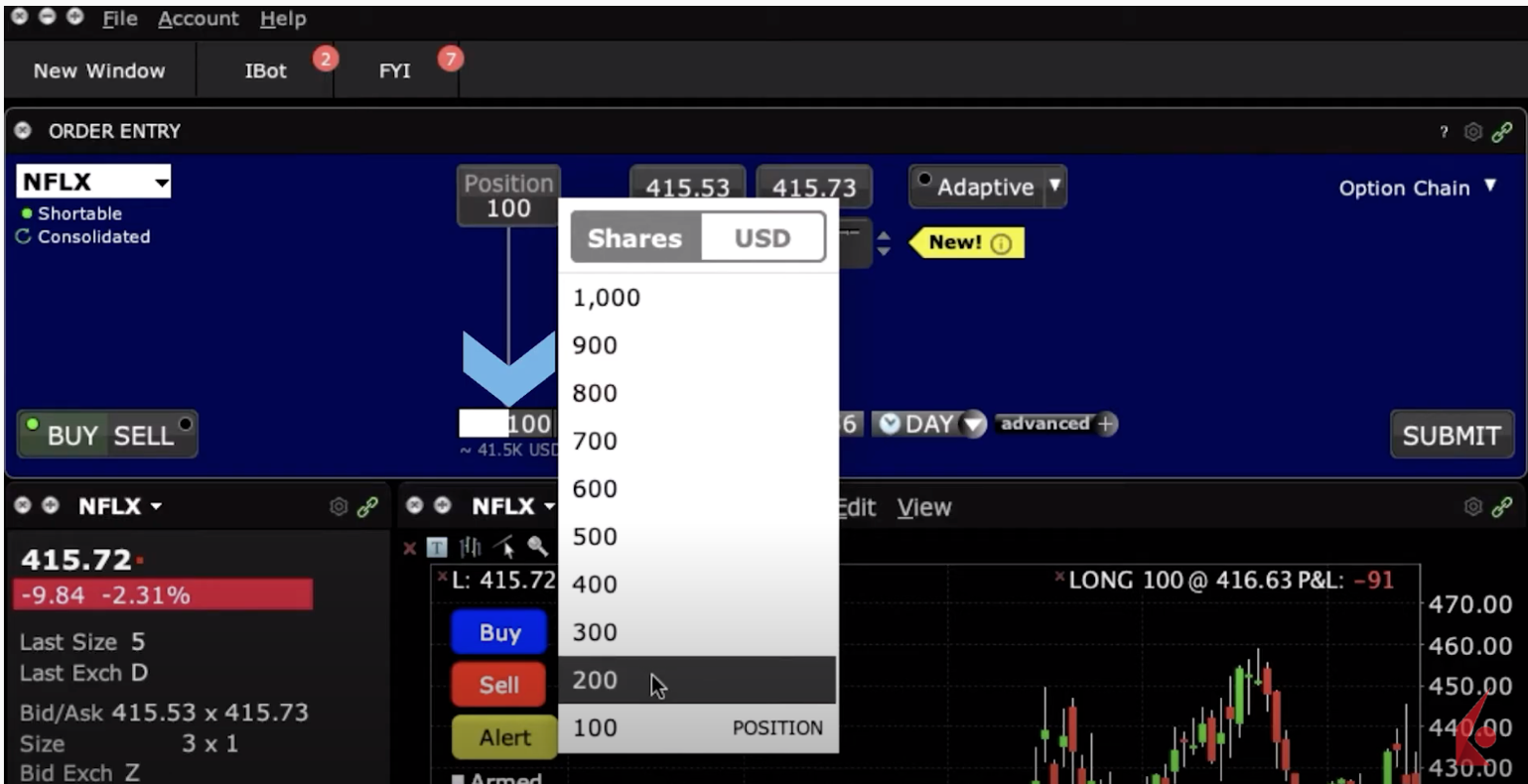

Ok, I’ve decided I want to buy 200 shares. I can select this number by clicking in the Quantity field.

I can also type this – 200 – as my number of shares, directly into the input field. Now, it looks like I already have 100 shares of Netflix.

I can also type this – 200 – as my number of shares, directly into the input field. Now, it looks like I already have 100 shares of Netflix.

That’s what this number tells me – that I already have a position in the company, and now I’m buying more.

This order type drop-down menu should look familiar – we used this for the Limit order in another lesson – but since this is a Market order, I’m going to select MKT for that.

Also, because this is a Market order, there’s no need to change the time in force field – we’ll just leave that as DAY.

Also, because this is a Market order, there’s no need to change the time in force field – we’ll just leave that as DAY.

Now, when I submit this order, it will use IBKR’s SmartRouting – this means that, by default, the order will be routed across all available exchanges to achieve the most favorable price.

For this to happen, just click on the Submit button.

And that’s it!

And that’s it!

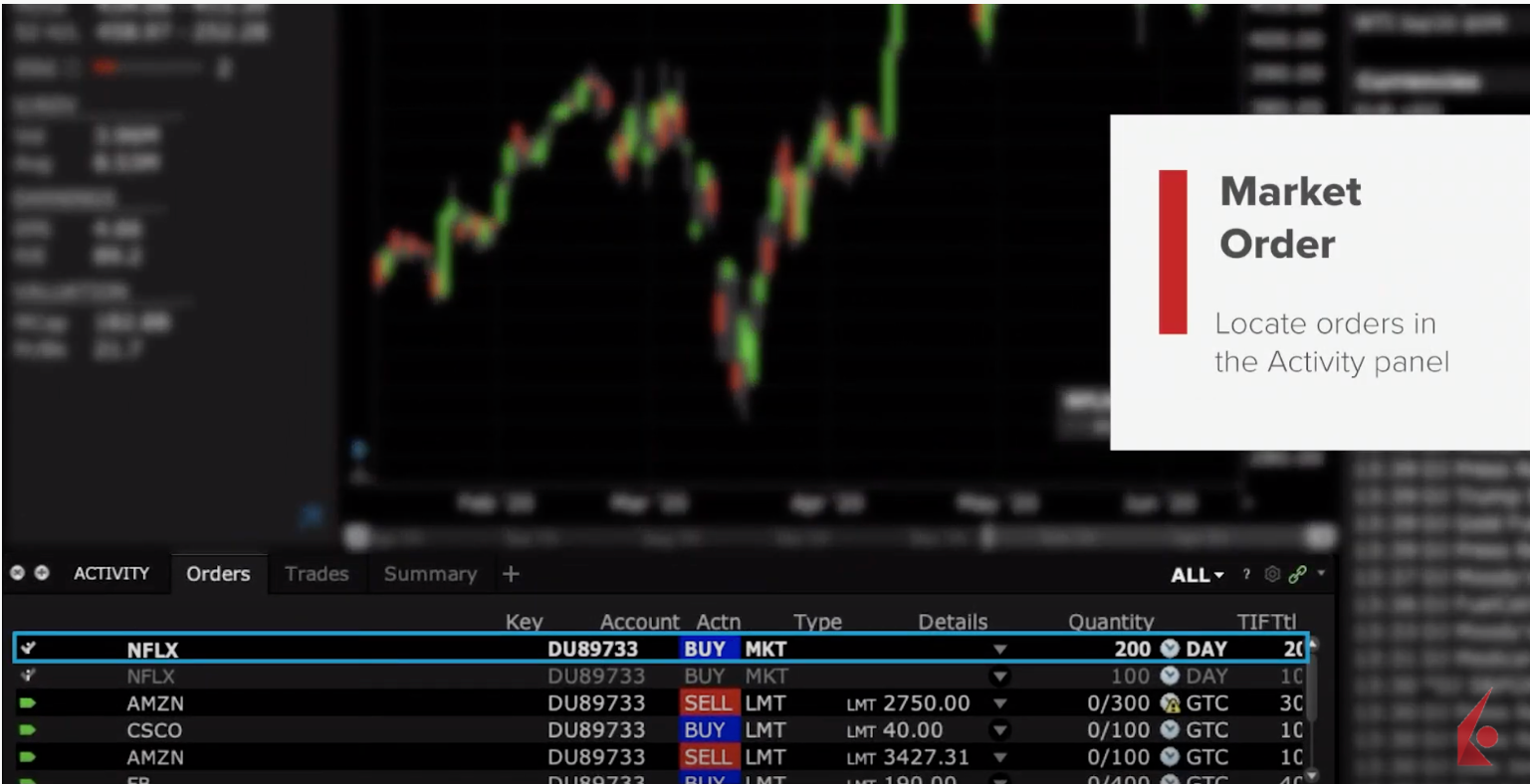

My market order to buy 200 shares of Netflix has been entered.

Locate orders in the Activity panel

I can see the details of my order in the Order Confirmation window.

Meanwhile, the Orders window in the Activity panel will provide you with an update on your open order, and details on filled orders will display on the Trades tab.

Meanwhile, the Orders window in the Activity panel will provide you with an update on your open order, and details on filled orders will display on the Trades tab.

TWS Mosaic Market order

Overall, Market orders may be useful to investors when markets are liquid, and their order size is unlikely to move the share price.

However, if markets are less liquid, this order type could move prices adversely, especially for larger orders.

It’s therefore important to consider both market conditions, as well as regular volume, for the specific stock you are trading.

Now that you know how to create a Market order in Mosaic, let’s turn our attention in the next lesson on order types in Traders’ Academy.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.