Study Notes:

Relative or Pegged-to-Primary Order Type

In this lesson, we’ll walk you through how to set up a Relative or Pegged-to-Primary order using TWS Mosaic.

- We’ll define the objective of the Relative order type

- Show you how to create a Relative order in TWS Mosaic

- Show you where you can locate this order within the Activity panel

TWS Mosaic Relative or Pegged-to-Primary order

The Relative order type allows traders to seek a more aggressive price than the National Best Bid and Offer (the NBBO), without showing their hand to the market, by using an offset amount.

In doing so, this order type increases the odds of filling an order.

Entering a Relative order may help traders in higher priced stocks where the bid/ask spread is wider, or in less liquid markets, where bids and offers are thin, while quotes are automatically adjusted as the markets move, to remain aggressive.

Creating a Relative order in TWS Mosaic – Buy order

Let’s now look at how to set up a Relative order using Mosaic:

Select a ticker to populate the Order Entry panel, then click on Buy, which – as you can see – turns the background to blue.

Now use the Quantity field to select the number of shares you want to purchase.

Once you’ve completed this, select REL, which represents the Relative order type, from the Order Type dropdown menu – *notice that when you do this, an additional offset input field populates.

Before we enter a value there, let’s first set a limit price to an amount above which we do not want the order to execute.

Let’s take a look now at the current spread between the bid and ask prices and revisit that offset input field we mentioned earlier.

Let’s now enter a value of five-cents in this field.

This means that my order to buy will be pegged to the NBB as it moves plus the five-cent value of the offset, which makes it more aggressive than the market, so more likely to fill.

Should the market fall away, this order will remain pegged to the bid and may fall.

But should the market increase, so too will my bid price, but exceeding the value of competing bids by the five-cent offset.

However, the order will not execute above the chosen limit price should the share price rise above it.

Click Submit when you’re ready to generate an Order Confirmation.

*Note that the Relative order shown on the confirmation also indicates the value of your stated offset amount.

Locating orders within the Activity panel

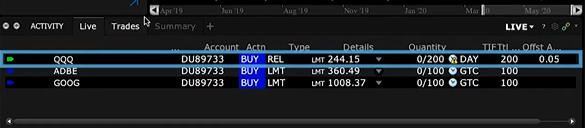

Now click Transmit to send the order to the exchange and check the Activity panel and Orders tab to see the live working order as it fills.

Relative order – Sell order

OK – let’s now repeat the process for a Sell order.

Populate the Order Entry panel with a ticker and select Sell, which will turn the background to red, then enter the number of shares you want to sell.

We’ll again select REL from the Order Type dropdown menu, and noting the current bid/ask prices above, we’ll decide on a limit price below the live quote so that the order will stop executing should the bid price fall beneath that level.

The sell order is pegged to the NBO. But in this case, I will enter an offset of 2-cents, meaning my order will be two cents more aggressive than the best available offer in the market.

If the market moves down, my offer goes with it.

If the market moves up, my offer will move, but appear more attractive than the NBBO by the value of the offset.

If the share price falls below my stated limit price, my order will stop executing until the price returns to the limit.

However, if prices remain below the limit, no more shares will execute.

Click Submit when you’re ready to generate an Order Confirmation.

*Note the Relative order shown on the confirmation also indicates the value of your stated offset amount.

Now click Transmit and check the Activity panel and Orders tab to see the live working order as it fills.

Now that you know how to create Relative orders in Mosaic, let’s turn our attention in the next lesson on order types in Traders’ Academy.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.