Study Notes:

Interactive Brokers serves more than two million clients around the world, and when you join us – like them – you’ll be able to trade stocks, options, futures, forex, bonds, and more, from a single unified platform, at our low and transparent costs, as well as have access to the global markets with the use of our innovative platforms, tools, and services, including our award-winning Trader Workstation (TWS).

Through this guide, we’ll help you find those resources best suited for your trading and investing needs – whether you’re an individual making an occasional investment, a professional and frequent trader, or an institutional investor – we’re here to help steer you in the right direction.

Open an Account

To become a client at Interactive Brokers, you’ll first need to open an account, fund it, and, once it’s approved, you can then begin to actively deposit and withdraw your funds. In this lesson, we’ll show you how to find the information you need to get started with these steps, as well as provide you with some tips that might help speed up your application review process.

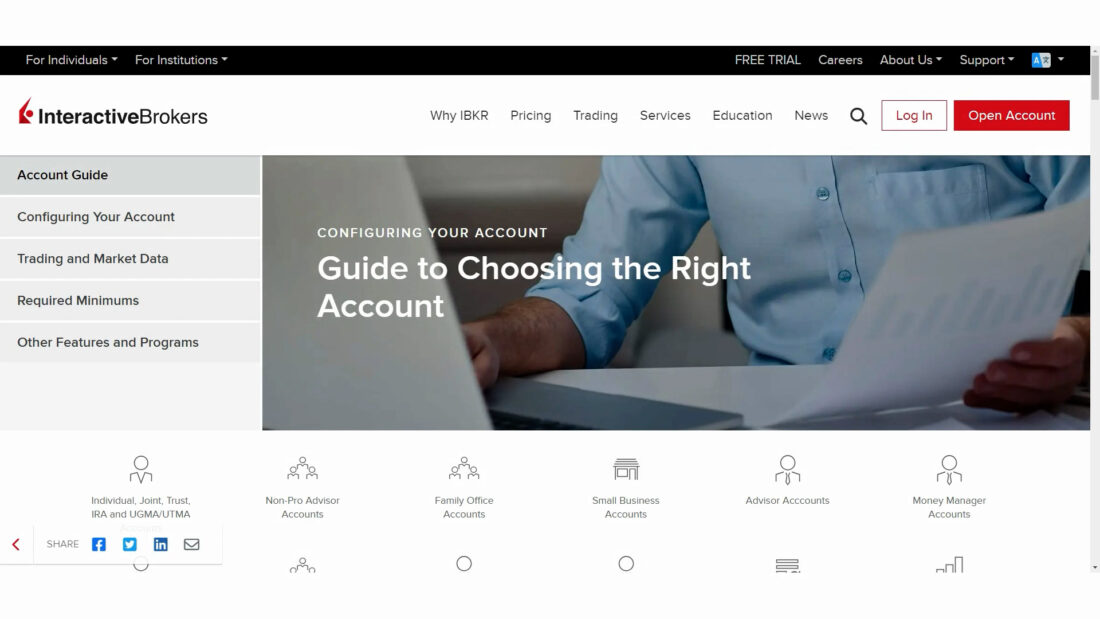

Our website offers a wealth of details about the specific account types that are available to you. To determine which one is right for you will ultimately depend on whether you are applying as an individual or as an institution.

The Open Account menu on our website offers a guide to choosing the appropriate account, with easy-to-read tables that break down and describe our various selections, including individual, joint, trust, and IRA accounts, professional and non-professional advisor accounts, family offices, small businesses, hedge funds, mutual funds, money managers, and much more.

To further help you prepare for the application process, you can also select ‘What You Need’ from the Open Account menu, and when you’re ready, simply start the application. By the way, if you’ve already started on an application, you can complete it by choosing the ‘Finish an Application’ option in the same menu.

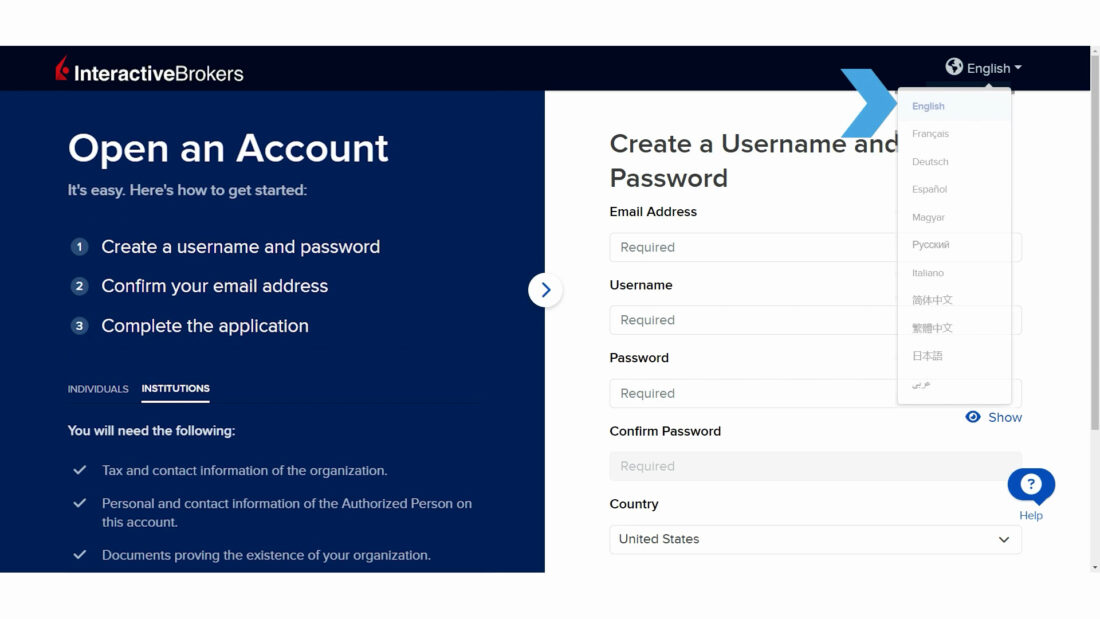

It’s quite simple to request opening an account with us. All you need to do to get started is:

- Create a username and password,

- Confirm your email address, and

- Complete the application.

You can find certain, general requirements on our website for individual and institutional applicants, including contact information, as well as bank account details, among other items specific to the type of account being requested. You can even select a different language to apply in, if needed. Additional support is also available through our Help services.

Once all documentation has been submitted and accepted, please allow us time to complete our due diligence checks and application review.

And, as mentioned earlier, there are steps you can take to accelerate, or prioritize, the application review process. For example, you may fund your application prior to approval, and If for any reason your account is not approved, the funds will promptly be returned. Please note, however, that while an ACAT (Automated Customer Account Transfer) can be entered as an initial funding method, the request will not begin processing until application approval is granted.

To further help ensure your application status is on track, you can log in, and once there, you can verify that all the necessary documentation has been submitted. You can also check the email you provided us for any correspondence from our Compliance team, which might be a request for additional documentation and / or clarification of existing information. This might help mitigate any undue delays during the review process.

Funding Your Account – Making Deposits & Withdrawals

To learn how to fund, and make subsequent deposits, to your account, refer to the ‘Fund Your Account’ option in the Support section of our website. Since our clients reside in diverse geographic locations globally, we offer a long list of ways to fund accounts across a host of different countries, as well as in several different currencies.

Select to Deposit Funds into your account, and input your region or country of residence, along with the currency type you’re using. For example, if you reside in the United States, you can elect to deposit funds via a direct, electronic transfer from your bank, or mail a check, among other methods. You can use U.S. dollars, or another currency, like Hong Kong dollars, or euros. But if you reside in say, Singapore, you’ll see different selections for methods to deposit funds, as well as available currencies.

We also offer several methods to withdraw funds, including ACH transfers for U.S.-based accounts, Canadian EFT transfers, among several others. Check out our online guides on entering withdrawals, limits, and withdrawing funds to a third party, along with a host of other related information.

Now that you’re more familiar and better prepared for the simple process of applying for an account, funding it, and ways in which you can deposit and withdraw funds, we’ll next take you on a brief tour of our website, where we’ll highlight some of the places you can go to get up-and-running quickly with our platforms, tools, and services.

LEARN MORE

Guide to Choosing the Right Account

What You Need for the Application

Not very helpful