The article “Does Investing in a More Concentrated Fund Result in Better Performance?” first appeared on Alpha Architect blog.

This study explores the degree to which fund concentration as measured by high tracking error or active share, affects the magnitude of excess returns and whether or not the likelihood of outperformance or underperformance are distributed similarly. Three methods of analysis were used to examine the relationship between dispersion of fund excess returns and the degree of portfolio concentration characterized for a sample of active US equity managers.

Fund Concentration: A Magnifier of Manager Skill

- Chris Tidmore

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

- Is fund concentration (number of names and weightings in the portfolio, N) positively correlated with higher excess returns?

- Does industry concentration matter?

What are the Academic Insights?

- YES. The relationship between concentration and excess returns is convex. Increasing concentration (measured by N) has an unmistakable positive impact on performance on the top tails of return distributions and an equally marked negative impact on the bottom tails of return performance distributions. It also appears that industry concentration plays a significant part in explaining the relationship between measures of concentration and dispersion of excess returns. A friendly reminder as to the meaning of “convexity” in the context of equity returns:

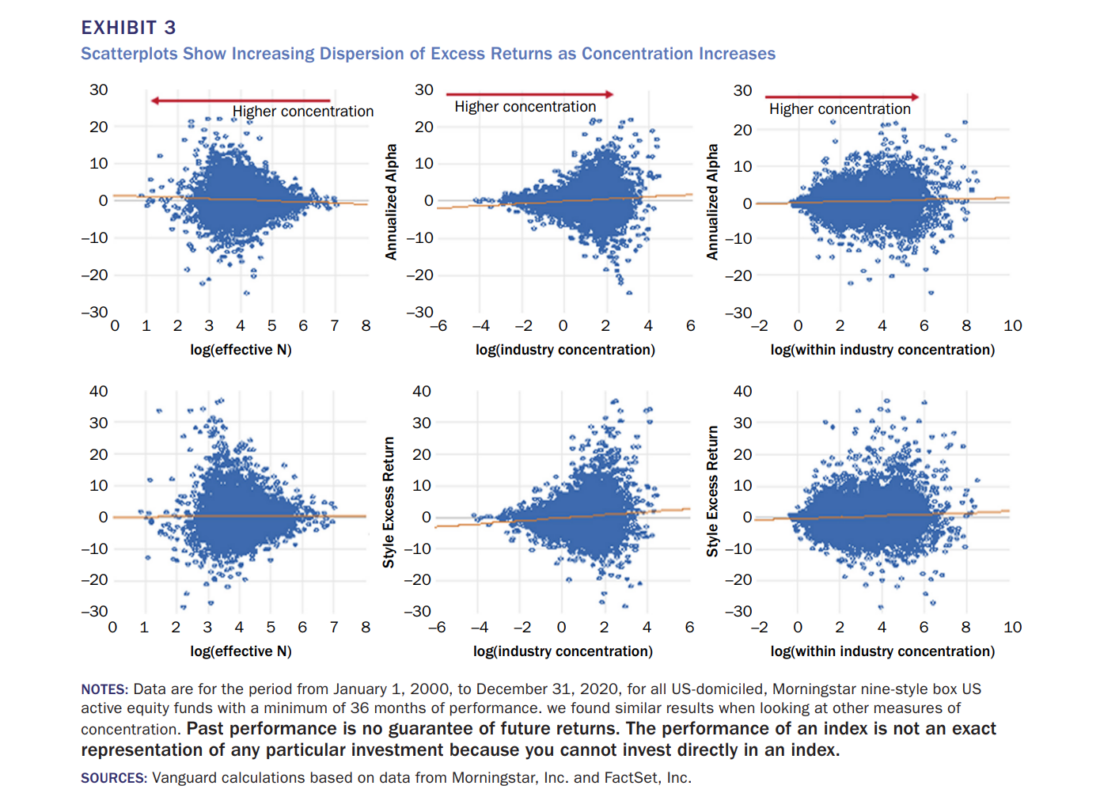

2. YES. As shown in Exhibit 3 below, as concentration increases, the volatility of returns also increases. Note that a lower value of N implies higher concentration and a higher value of industry scores implies more concentration. The volatility of excess returns increased monotonically from 3.2% to 7.7%, across levels of concentration. In addition, systematic risk exposures across deciles of N changed negatively across market, value, market cap and momentum with respect to fund concentration. The more diversified the fund, the larger the exposures to the factors. When controlling for time and size fixed effects as well as turnover, AUM, and fund family AUM, the authors report significant regression coefficients as large as -1.4714. This confirms the hypothesis that as a fund becomes more concentrated, returns increase. Moving from the performance of an average fund to a fund at the 25th decile in terms of concentration would result in an estimated increase in excess returns to as much as 0.46%. However, when industry concentration measures are included, the excess return falls considerably, to 0.22%. It seems that holdings-based and industry-based measures should be used when analyzing the effect of fund concentration.

Why does it matter?

A quote from the authors,

The possible economic intuition for these results is that managers who believe they have special insights into certain investments with the ability to earn higher returns will want to concentrate in these investments. This strategy to increase concentration will lead to a portfolio whose returns are driven by fewer investments, and with insights and information not being perfect, the outcomes will either be positive if the insights are correct or negative if the insights are incorrect.

Although it is difficult to disagree with the above conclusion, the real message in this research is aimed at investors and selectors of funds. While legitimately a prescription for increased risk-taking on the part of investors and fund managers, there is one caveat: Can investors and selectors reliably identify skilled managers? If yes, then targeting strategies with high concentrations makes sense. Unfortunately, the empirical evidence is at odds with the premise that the skill necessary to identify skilled managers is present. More than likely that skill doesn’t exist.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Investors who believe an active manager has insights or forecasts with the potential to earn higher relative returns may look for the manager to concentrate their portfolios. Because foresight is imperfect and correct forecasts will lead to more favorable outcomes and incorrect forecasts to less favorable outcomes, this analysis seeks to explore the impact of decisions to increase concentration on performance. We used portfolio sorts, standard OLS regression methods, and quantile regression methods to test the effect of portfolio concentration in various ways. We found that concentration has a significant convex relationship with the absolute value of relative returns. That is, as the effective number of holdings increases, its association with positive and negative relative performance diminishes. Additionally, we find that increasing concentration has a pronounced positive impact on performance for outperforming funds; the opposite is true for underperforming funds. Most importantly, higher levels of concentration generally hurt the poorly performing funds more than it helps the outperforming funds. For investors and gatekeepers who focus on holdings-based measures of concentration, the findings show that you can’t just look at holdings-based measures of concentration without considering industry exposures.

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.