Excerpt

Corporate bonds and equities of the same firm should share the same fundamentals, but does this preposition hold for the ESG scores and their implications? In the equity market, there is convincing literature that states that ESG scores lower risks or even can improve the performance of portfolios. However, it was shown that the ESG implications could not be universally applied to all countries and their markets. Novel research by Slimane et al. (2020) examines the role of the ESG in the fixed market. The paper shows that the fixed income market is probably some years behind the equity market, but the ESG is also emerging in the fixed income. The performance of ESG outperformers compared to underperformers is continually rising. In Europe, the difference is already economically significant; the rest of the world seems to lag a little. Therefore, the ESG might have a bright future also in the corporate bond market. So far, the results are promising…

Authors: Mohamed Ben Slimane, Eric Brard, Théo Le Guenedal, Thierry Roncalli and Takaya Sekine

Title: ESG Investing in Fixed Income: It’s Time to Cross the Rubicon

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3683477

Abstract:

This research is the companion study of three previous research projects conducted at Amundi that address the issue of ESG (Berg et al., 2014; Bennani et al., 2018; Drei et al., 2019). These studies, which were focused on the stock market, showed that 2014 marks a turning point for ESG screening and the performance of active and passive management in developed equities. Indeed, ESG investing tended to penalize both passive and active investors between 2010 and 2013. Contrastingly, ESG investing has been a source of outperformance since 2014 in Europe and North America. Moreover, it appears that ESG investing and factor investing are increasingly connected. In particular, Bennani et al. (2018) and Drei et al. (2019) concluded that ESG is a new risk factor in the Eurozone.

The case of fixed income is particular since it has been little studied by academics and professionals. It is true that implementing an ESG investment policy in the bond market is less obvious than in the stock market. For example, in the case of sovereign bonds using ESG filters may dramatically change the profile of the bond portfolio, particularly in terms of liquidity. In fact, it seems that ESG investors pursue two different goals when they consider equities and bonds. They invest in stocks with good ESG ratings in order to avoid extra-financial longterm risks, whereas they consider that fixed income is the field of impact investing. This explains the high demand for green and social bonds, and this also explains why ESG screening is less widely implemented in fixed income markets than in equity markets.

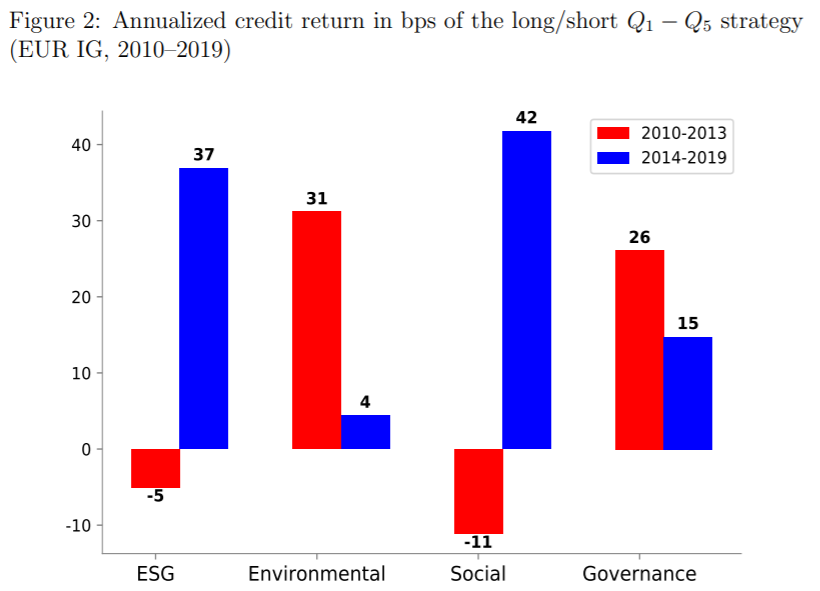

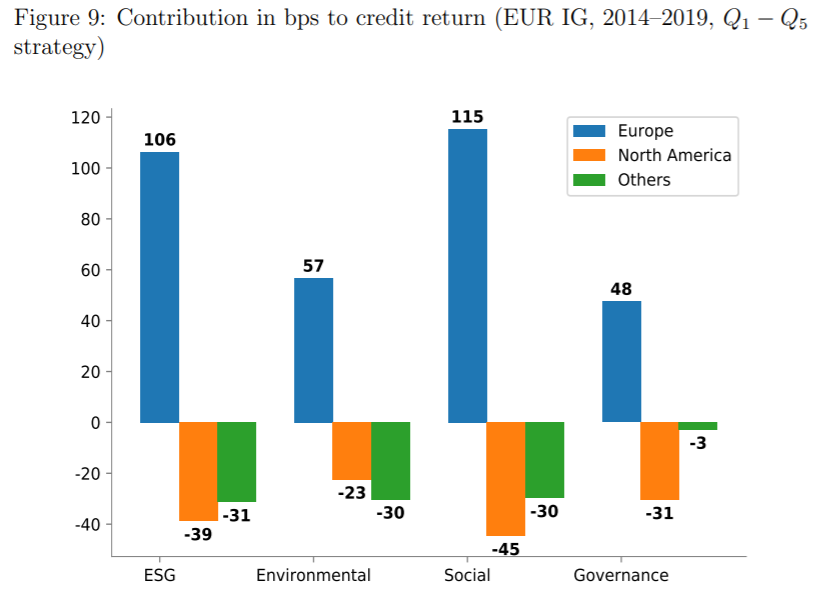

The objective of this new study is to explore the impact of ESG investing on asset pricing in the corporate bond market. For that, we apply the methodologies that have been used by Bennani et al. (2018) for testing ESG screening in active and passive management. In particular, we consider the sorted portfolio approach of Fama and French (1992), and the index optimization method that consists in minimizing the active risk with respect to the benchmark while controlling for the ESG excess score. Three investment universes are analyzed: euro-denominated investment grade bonds, dollar-denominated investment grade bonds, and high-yield bonds. Results differ from one universe to another. In the case of EUR IG bonds, we retrieve some common patterns observed by Bennani et al. (2018) in the case of equities. Indeed, from 2010 to 2013, ESG screening has produced a negative alpha, whereas we observe an outperformance since 2014 when we implement ESG scoring in active and passive management. In the case of USD IG bonds, the results are disappointing since ESG screening produces negative alpha for the entire period. Results on high-yield bonds are difficult to interpret since ESG coverage of this market is not satisfactory.

We also test how ESG has impacted the cost of corporate debt. Our results show that there is a positive correlation between ESG and credit ratings. This is normal since credit rating agencies also incorporate extra-financial risks in their default risk models. Using the approach developed by Crifo et al. (2017), we propose an integrated credit-ESG model in order to understand the marginal effects of ESG on the cost of capital. We find that there is a negative relationship between ESG scores and yield spreads. The better the ESG rating, the lower the yield spread. For instance, we estimate that the cost of capital difference is equal to 31 bps between a worst-in-class corporate and a best-in-class corporate in the case of EUR IG corporate bonds. In the case of USD IG corporate bonds, the difference is lower but remains significant at 15 bps. Moreover, the impact of ESG is more pronounced for some sectors, for instance Banking and Utility & Energy. These results are important because ESG investing and ESG financing are two sides of the same coin. In order to tackle environmental and social issues, ESG must be a winning bet for both investors and issuers.

As always, the results can be presented through interesting charts:

Visit Quantpedia to read the full article: https://quantpedia.com/esg-investing-in-fixed-income/

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quantpedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quantpedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.