Invest Responsibly with IBKR

ESG Environment, Social and Governance trend has become a major theme shaping economies and contributing to preserving Earth. We are excited that IBKR has been playing a vital role in providing traders with the latest ESG tools and news, and helping them look for responsibly investing insight.

In this article we look at 3 key features IBKR offers:

- Environmental, social and governance (ESG) scores from Thomson Reuters

- Traders’ Insight ESG category

- Quants contributing to ESG

ESG Scores from Thomson Reuters

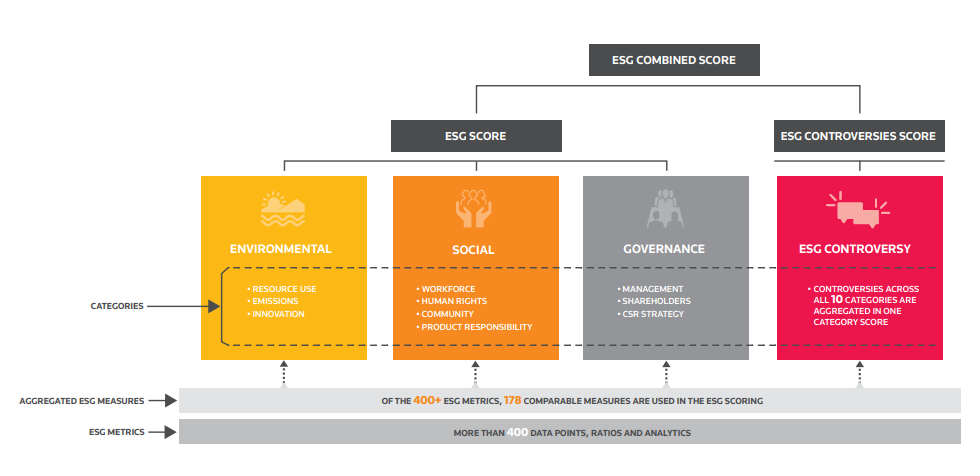

Quants and finance professionals will find ESG scores from Thomson Reuters available on Trader Workstation. This feature helps traders look for insights on more than financial factors and helps lay out a path in making Earth-friendly investment decisions. Visit our website to learn more about this tool and explore the accompanying ESG Guide for intuitive educational resources. In addition, be sure to test these features on our award-winning platforms.

Image source: Thomson Reuters ESG Scores Guide

Traders’ Insight Blog

The second major IBKR news source for ESG is our sister blog Traders’ Insight. We are thrilled that they just launched a new category ESG.

In particular, Steven Levine, Senior Market Analyst at Interactive Brokers, has been closely monitoring how ESG is shaping economies and market trends. Be sure to check out his features including the latest Rise of ESG Threatens Dairy Market Survival and Not Milk? The U.S. Dairy Industry in Crisis. Steven’s articles provide in-depth analysis of how investors’ attitudes change and seek a responsibly way to meet their revenue expectations.

In addition, Traders’ Insight contributors ranging from Gabelli’s ESG Issue Series: Antibiotics, FTSE Russell and Black Rock further keep traders ahead of the curve on investing responsibly.

IBKR Quant Blog

We are also excited that quants have regularly contributed to the topic. Read Quantpedia’s Quant’s Look on ESG Investing Strategies to learn more on the latest ESG quant trends.

Furthermore, Kavout recently explored the role of artificial intelligence and machine learning in this field. See ESG Investing with AI for practical programming tips.

We wrap this article with a general message – as we all look for ways to limit our carbon footprint and protect Earth, it is important to collaborate on this topic and share ideas on how to make this even more effective. Let’s finish this feature with a good look at this article from The Motley Fool. The authors Alyce Lomax And John Rotonti present how people align their investment decisions with their values: What Is ESG Investing?

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.