The article “Game On: Social Networks and Markets” first appeared on Alpha Architect blog.

This article studies how investment ideas can propagate through a social network and affect market behavior and prices.

Game On: Social Networks and Markets

- Pedersen, Lasse Heje

- Journal of Financial Economics, 2022

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Communication in social networks is not new. In fact, it goes back to coffee houses in the 17th century. According to Standage (2006), “the drama of the South Sea Bubble, a fraudulent investment scheme that collapsed in September 1720, ruining thousands of investors, was played out in coffeehouses.”

The author ask the following questions:

- How do social networks affect asset markets?

What are the Academic Insights?

The author answers the above research question by proposing a theoretical model that shows how investment ideas can propagate through a social network and affect market behavior and prices. It uses GameStop as a case study for this model.

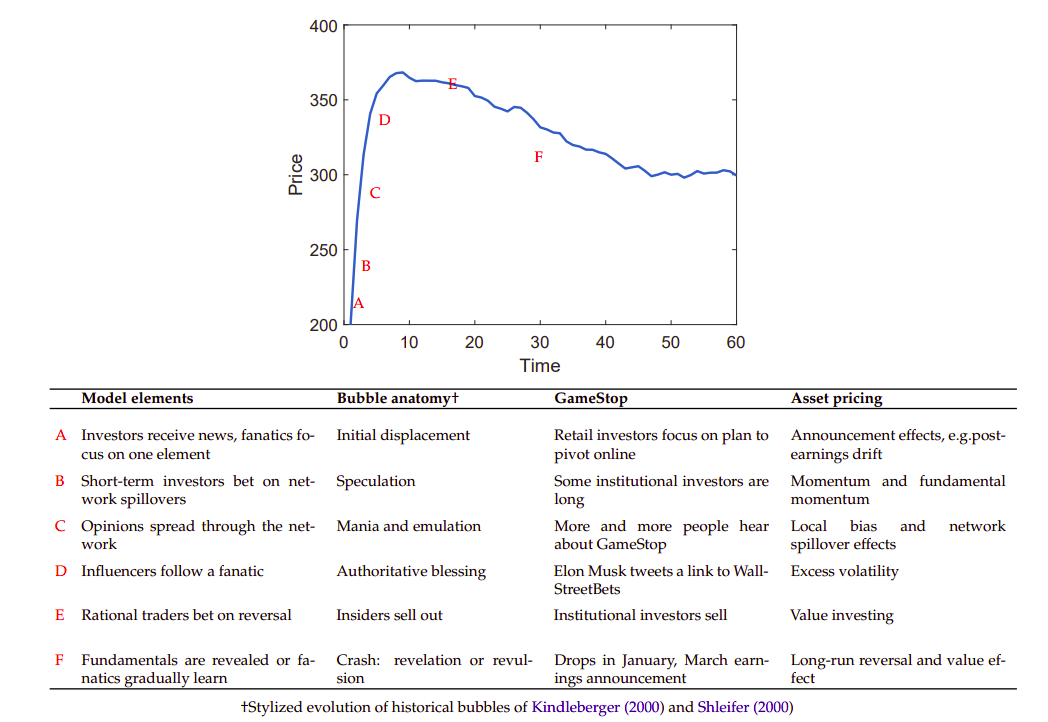

The model is an augmented De Groot (1974), where the author introduces rational learners to capture the effects of sophisticated professional investors (or arbitrageurs). In fact, in this model, there are three types of agents: naive, fanatics, and rationals. Rational agents initially listen to all available information. However, once they process all the information, they become completely “stubborn” in the sense that seeing a different view presented again and again does not sway the rational agent if the different view does not contain any new information. Similarly, fanatics agents can be stubborn and influence other (naive) agents. Investors differ in their reliance on rational or fanatic views. The aggregate importance (or “thought leadership”) of each stubborn view is the sum-product of the attention it gets from its followers and the “influencer values” of its followers. Another difference with the standard De Groot model is that here a consensus is never reached, and the focus is on the average opinion.

GameStop

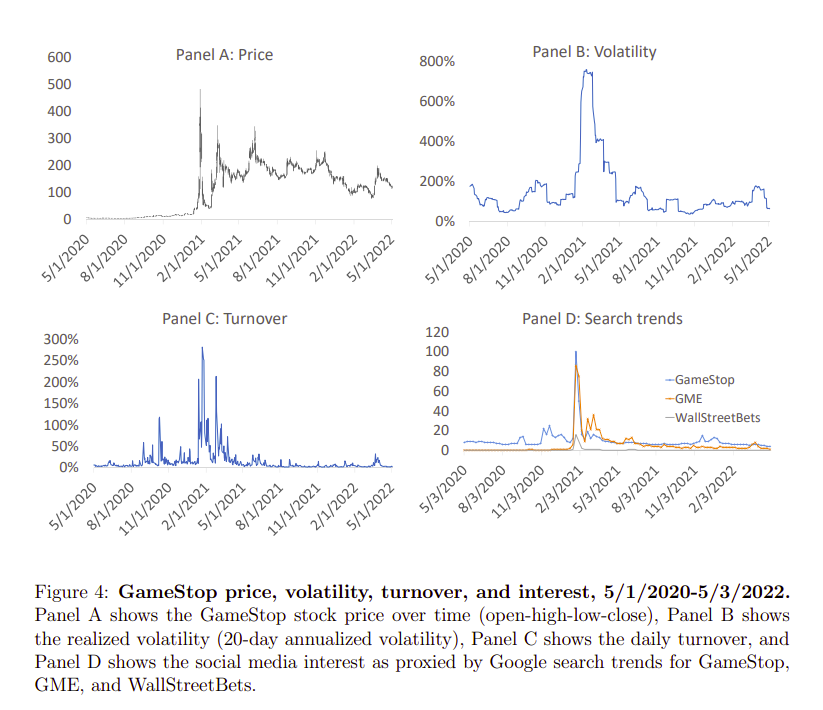

In early 2021, Game Stop (the world’s largest video game retailer) struggled as games were increasingly sold online and the Covid-19 crisis hit the retail industry. Nonetheless, a group of investors (including Keith Gill, one the most followed ) captured a trend reinforced through social networks, especially on Reddit (sub-community: WallStreetBets). Fanatics signaled their bullishness using a “rocket”* meme**. On top of this, Elon Mask (the influencer who follows the fanatics) tweeted a link to WallStreetBets that increased interest in the stock. The stock price increased by orders of magnitude with enormous trading volume (incentivized by the zero commission online broker Robinhood, which uses a business model based on payment for order flow from market makers such as Citadel) and volatility, coinciding with an increase in social media attention.

The stock started 2021 at $19 per share and hit an intra-day high of $483 on January 28, a 25-fold increase with little news. The price dropped to $40 in February but increased significantly again in late February, and stayed above $100 for the rest of 2021. Realized volatility for the year was exceptionally high at over 700%. As the stock price of GameStop rose in late January, some shortsellers were simultaneously forced to close their positions, buying shares they borrowed earlier. This reduction in short positions further pushed the price upward (a “short squeeze”). This short squeeze likely played a role in the price spike in January. Still, it was not a significant driver of the subsequent price rise that started in late February 2021, suggesting the importance of social network effects.

The GameStop saga presented many of the elements included in the model: an investment thesis that spreads via a social network while fanatic views escalate, the contagious investment idea leads to network effects on prices, which starts a bubble, and prices rise further as influencers link to the fanatics. In the meantime, sophisticated momentum investors ride the bubble. In contrast, value investors bet against it, causing high trading volume and volatility, but it all dies down faster than the price bubble.

Why does this study matter?

This paper presents an innovative model that helps explain social network effects in portfolio holdings, excess volatility, momentum, and reversal effects, meme trading, the effects of repeated news, and spillover of expectations and transaction prices across people with social links. GameStop is the perfect example to explain the model empirically.

The Most Important Chart from the Paper:

Abstract

I present closed-form solutions for prices, portfolios, and beliefs in a model where four types of investors trade assets over time: naive investors who learn via a social network, “fanatics” possibly spreading fake news, and rational short- and long-term investors. I show that fanatic and rational views dominate over time, and their relative importance depends on their following by influencers. Securities markets exhibit social network spillovers, large effects of influencers and thought leaders, bubbles, bursts of high volume, price momentum, fundamental momentum, and reversal. The model sheds new light on the GameStop event, historical bubbles, and asset markets more generally.

*Social-media investors sometimes signal a strong potential rise in price of a stock by using a rocket emoji

**A “meme” is an idea that becomes a fad and spreads by means of imitation in a social network

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.