If consumer prices of certain pork products are declining, why are they not being piled onto more plates? Find out how higher interest rates, broader inflation, and global demand are impacting the performance of lean hog futures, producer costs, and shoppers’ meat selections, as Sean McGovern, vice president of research at McAlinden Research Partners, Jeff Praissman, IBKR’s senior trading education specialist, and IBKR senior market analyst Steven Levine explore the global economics of the pork industry and its influence on some of the world’s largest meat producers. Also, what can traders and investors learn about the role of foreign exchange on ADRs? And what in the world is ‘scrapple’? All this and more as our agricultural commodity series continues….

Summary – IBKR Podcasts Ep. 117

The following is a summary of a live audio recording and may contain errors in spelling or grammar. Although IBKR has edited for clarity no material changes have been made.

Steven Levine

Hello, and welcome to IBKR Podcasts! I’m Steven Levine, senior market analyst at Interactive Brokers. I’m your host for today’s program. Sean McGovern, vice president of research at McAlinden Research Partners, joins us again for our ongoing series on agricultural commodities. And if you’re not already familiar, McAlinden Research Partners is an independent investment strategy group that focuses on identifying alpha-generating investment themes, and they have a lot of commentary on our Traders’ Insight platform. So, you’ll want to check that out. Great to see you, Sean, welcome back!

Sean McGovern

Good to be back, good to see you both.

Steven Levine

Great to see you! IBKR’s senior trading education specialist, Jeff Praissman, is also here with us, again. How are you, Jeff?

Jeff Praissman

I’m doing great. I’m doing great. And you know, just love the series, and I’m kind of thinking about bacon right now.

Steven Levine

We’re going to get to bacon. Jeff’s been using our Trader Workstation [TWS] platform and tools, along with his own research. He’s provided us with some really terrific insights into the performance of futures prices, as well as related company stocks, and other instruments. Yes, we have covered quite a bit, haven’t we? I mean, the series has been really tremendous … what a broad scope – from coffee, wheat and corn to cocoa, live cattle, and sugar – a really well-rounded list of agricultural commodity futures that I think has shed a lot of great light on the current state of food prices, inflation, and the challenges that producers, consumers and investors have been facing. Sean, Jeff, thank you so much for providing those insights! You can check out our past podcasts for some really great information there, and we’ll be continuing along that road today.

A Brief History of the Future

Steven Levine

We’re discussing lean hogs, and lean hog futures, and how these might be affecting certain giants in the industry like China’s WH Group, which owns Smithfield Foods, along with Brazil’s JBS, and Hormel, which has its headquarters in Austin, Minnesota.

Tiny bit of background about lean hogs: these commodities essentially represent the global pork industry, which seems fairly obvious, and here we’re including items such as ham, pork loins, pork chops, and so on. Not as obvious is they’re used in pharmaceuticals like insulin, cortisone, and heart valve replacements, among many others, as well as industrial applications like certain cosmetics, plastics, floor waxes, insecticides – really long list there as well, which I found rather interesting. And unlike sugar futures, which we discussed in our previous podcast, which have been traded on commodities exchanges since 1914, lean hog futures started out in 1966, and they were introduced as live hog futures. And I believe it was changed to ‘lean hogs’ a few decades later –in the ‘90s.

So, Sean, I suppose we can start there. Why was this the case? I mean, I guess first: why were they introduced as a trading product in the first place? And what’s the reason for trading these commodities?

Sean McGovern

Sure. So, like any futures contract, you know, farmers, pork producers, anyone who’s in the market for pigs is going to use these and try to hedge against price fluctuations down the line. Someone wants to sell a hog at a certain price somewhere down the line, someone wants to buy it at that price, assuming it’s a good value based on expectations about supply and demand trends. And now, obviously traders can use futures contracts to speculate on the price of pork products as well, which is really what the contract is representing, right? It’s the pork prices. That’s the primary reason anyone is buying pigs en masse. I mean, maybe some people want them as pets or whatever, but we’re really talking about buying the pigs for slaughter.

Steven Levine

Like Green Acres … they had a [pig as a pet] I remember. Zsa Zsa Gabor and her little pig – I seem to recall that – not when it first came out, but in syndication. Just to, you know, clarify that.

Sean McGovern

So, you you’ve got lean hogs, but there’s also a second pork-specific contract on the CME that influences the lean hog index significantly. That’s called the ‘Port Cutout’, which was just introduced in 2020. This has its own index separate from the lean hog index and references the value of the pigs using the prices paid for the wholesale cuts of pork. That’s been helpful, as the packers seek to more accurately hedge the prices of their individual cuts.

Steven Levine

That is really, really interesting. I looked at those pork cutouts, as well. They don’t seem entirely liquid, but there are certain cuts obviously that seem to do better than others.

Sean McGovern

Yes, the pork cutouts are very new. They’re not as popular as the lean hogs, but believe it or not, the index of the pork cutout actually does have a pretty big influence on the lean hog contracts these days.

Steven Levine

So, in 1966, they came in as live hogs. Are they no longer trading as live hogs like live cattle? Are they the unfortunate aftermath of what they were when they were alive?

Sean McGovern

Yes, the changing of the contract from the live hog to the lean hog represented a couple of adjustments in the settlement mechanism. So, originally, the live hogs were physically delivered, which means exactly what it sounds like. The contract said you were buying 30,000 pounds of live hog, and that’s what you were getting on the settlement date. That kind of physical delivery is still the case with live cattle we talked about several months ago. But in 1997, with the advent of lean hogs replacing live hogs at the CME, the contract unit was changed to 40,000 pounds of hog in carcass weight. So, not the live weight. And the contracts also began being financially settled, which means there’s no actual delivery of the hogs, just payments between the parties engaged in the contract once the settlement date is reached.

Prices Penned-In

Steven Levine

It’s very interesting. It’s a very interesting commodity. Where are they trading, Jeff? If I’m an investor, what am I looking at in terms of performance on the futures contract?

Jeff Praissman

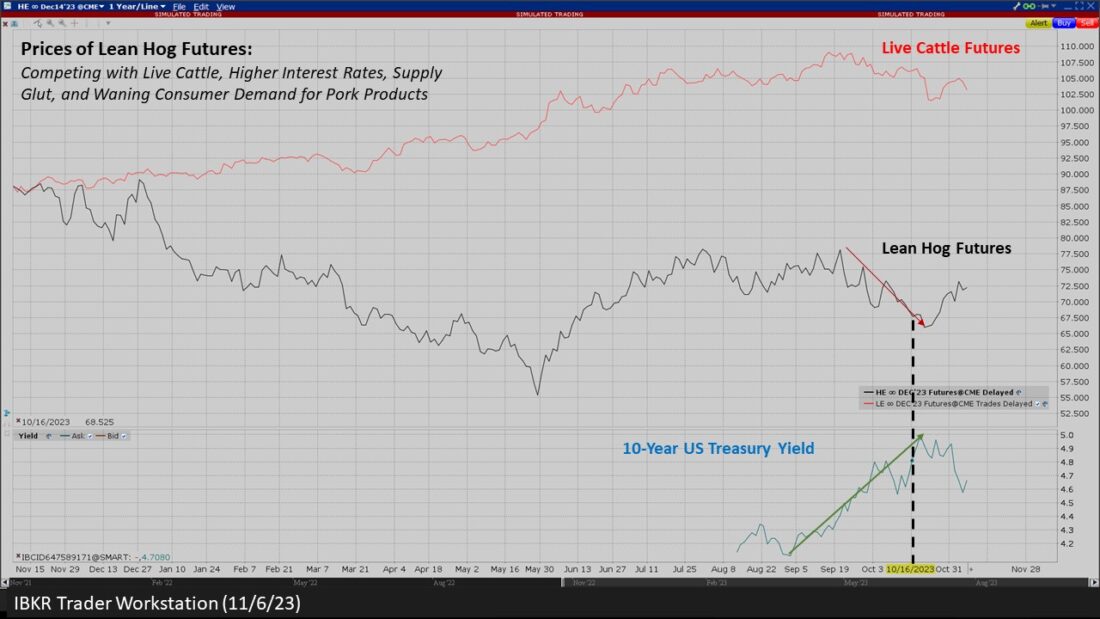

Yes, Steve, it’s interesting. If you take the last 52 weeks, it’s kind of trading about smack in the middle of its low. It’s touched around 55 back in June, and its high of around low 90s – that was essentially a year ago back in late October … early November. So, it’s kind of smack in the middle right now. And it seems to have … after that bottom out … just kind of steadily risen up over, I’d say, the course of the end of the summer and kind of stayed pretty stagnant. It’s a little bit on the decline right now, but still, again, safely in the middle of a 52-week low and high.

Steven Levine

It’s nowhere near what live cattle is doing, which I understand is still really, really on elevated levels, but how do you account for this, Sean? What do you see as affecting prices? Are there economic drivers or other catalysts?

Sean McGovern

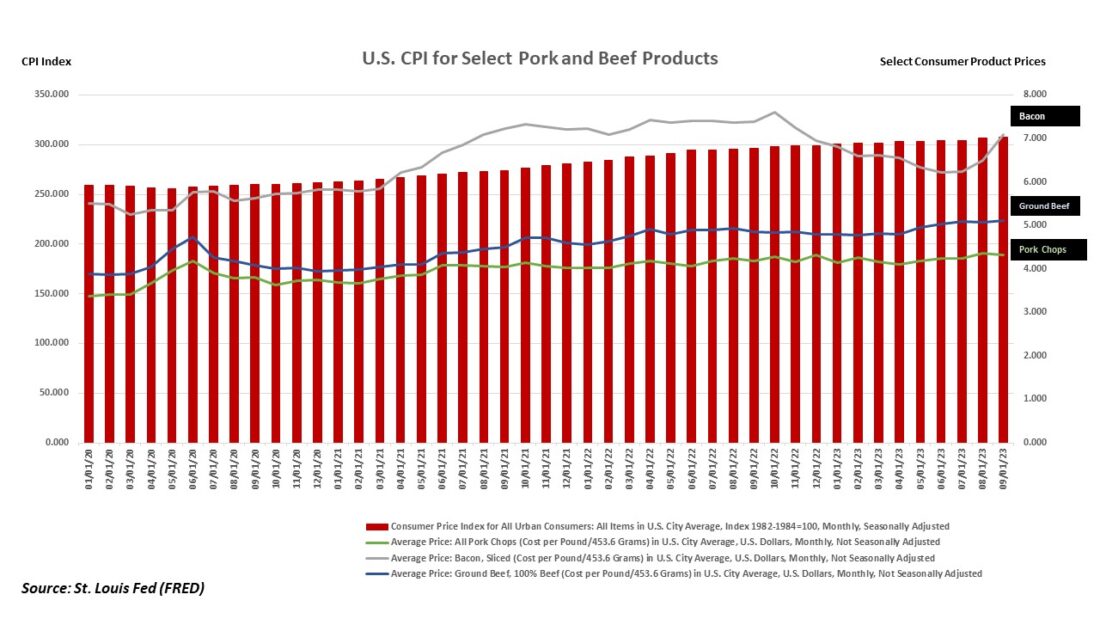

So, with many of the current patterns and commodity markets, we have to trace the hog’s price back to 2020, specifically back to COVID, when all these plant shutdowns in North America created huge backlogs at the processing plants. This led to culling and anticipation of the long … these like really long-lived shutdowns. A lot of these producers really got ahead of themselves and did a little too much hunkering down. When you look at the [U.S. Department of Agriculture] USDA data … that shows that the hog slaughter rates did drop by double-digits on an annual basis in March, April, and May, but then they actually exceeded the 2019 rates of the pre-pandemic rate in five of the following seven months. So, you had a potentially unwarranted pig culling, which narrowed the supply, followed by a massive commodity comeback in the immediate wake of the initial lockdowns, and hogs came along for the ride. You know, that sent hog futures up to like a six-year high, around 120 around June 2021 – actually kind of forming a double top there between then and March 2022. And since then, it’s just been downhill. The timing of that downtrend reflects higher interest rates slamming the brakes on the demand side of the equation for hogs, and obviously high prices were good for producers when rates were near zero. You know, liquidity was flowing. Inflation was bad, but it wasn’t hindering consumers all that much. At the time, it seemed like it was, but we look back now and you’re like, yeah, you know, things really weren’t that bad. But now that the high interest rates have been piled on top of the inflation, consumers have started to cut down, or cut out, consumption of certain products that may be dispensable or particularly overpriced. And that may have been exactly what happened with pork, which is…. Now, we’re seeing the prices fall on an annual basis. As a whole, prices of pork products in September’s CPI, that’s consumer prices, showed a decline of 1.7% year over year. For bacon, that decline was even larger. They fell by 2.7%, and breakfast sausage was down even more steeply than that – at 3% you know, down 3% decline is.

Steven Levine

Now is the time to stock up. Jeff. Now’s the time to stock up on your bacon. You wanted that.

Sean McGovern

This decline, it was just across the board with the pork products, despite… the CPI is still going up. So, you have pork products, consumer prices of those going down, broader inflation kind of rising and that behavior is going to feed through to the revenues of producers and the value of futures contracts.

Steven Levine

So, demand it sounds like … it’s really on the way south, and so prices are following that demand south.

Sean McGovern

It has been, yeah.

Taking Pork off the Table

Steven Levine

So, who’s going to be affected by this, or who are the top global producers, country-wise – if we look geographically? I’m thinking it’s got to be … China’s got to be in there?

Sean McGovern

I sort of hinted at it earlier talking about the North American plants. The U.S. is the largest hog producer on a national level. More than one-tenth of the world’s pork is produced here, which is a big reason that the country is the largest single exporter. The European Union is a huge exporter, but that’s a group of like 27 countries. So, I don’t really put them on the same scale as the U.S. You look at a state like Iowa, the number of hogs in Iowa actually outnumbers people. Yeah, so, you gotta watch out, when you’re out there. Don’t mess with the don’t mess with the pigs. They’ll, you know…. The U.S. hog inventory actually, though, has been shrinking since 2019, but that contraction has not been able to revive the prices. We’re exporting primarily to Mexico, Japan, and like you said, China. All three of those countries are some of the largest pork consumers in the world. China, by far, is the leading consumer … a huge producer as well, but the leading consumer out of the major economies on a per capita basis. The average person in mainland China consumes 37.2 kilograms per year of pork. In Hong Kong, it’s actually significantly higher – the average person consuming 64.2 kilograms, annually. I got those stats from pig333.com – great website for all of your pig statistics. So, obviously, we know China has a lot of issues with economic growth recently and I think that is playing a significant role in weaker pricing for pigs lately.

Steven Levine

Wow. If it’s demand that is largely driving prices south, what is the turnaround for that demand? I mean, what is going to make people want to eat pork again?

Sean McGovern

So, I’ll be watching China. So much of the weakness we’ve seen in commodities as a whole has been related to the economic issues over there, since they’re just such a massive importer … so many things. And, as I’ve said, we have seen the hog supply tighten in the U.S. – however, despite slower GDP growth over there … China … their output of pork is absolutely booming. In Q1, it was up 1.9%; Q2, up 4.6% year-over-year. So, that’s two straight quarters of really strong growth in the pork production, and when China is producing a larger amount of its own supply, it’s less reliant on U.S. exports, which then can create a glut of pigs in the U.S. market and push down on the futures prices. China previously removed tariffs on pork in 2020, when they were struggling with an outbreak of African swine flu among their hogs, which happens relatively often in China, but they put those tariffs back on last year – showing they anticipate less need for imports going forward. Ultimately, it seems that prices for pork have been coming down gradually in the U.S., and we’ll need to see when consumers will feel comfortable putting bacon and sausage, and other pork-based breakfast components, back on their plates.

Steven Levine

It’s quite interesting – essentially, I’m seeing that you’re looking at China and supply as you’re forward-looking outlook for this market, primarily?

Sean McGovern

Yes, I mean, demand will start to come back, when we sort of see the end of this monetary tightening, right? That’s really what the demand side is, or at least what the traders are probably looking at most

closely. Higher rates will usually correlate with lower demand for a lot of commodities, and that’s going to flow through even to the agricultural commodities. So, yes, it’s really going to be a supply-side story, and demand will come back. It’s just that’s really a matter of time, and we’re kind of just trying to see what is the supply going to look like, as demand gradually comes back into the market when rates start to maybe kind of hit that terminal level or even start to come down into 2024-2025.

National Pulled Pork Day

Steven Levine

It’s certainly had an effect on some companies, but we’ll get into that, and Jeff will give us some insights into some of the producers and manufacturers that are heavy in the pork industry. But I did a little bit of digging, and when I when I found about national cereal day, which again falls on March 7th. So, please remember that, Sean, March 7th – lest we forget.

Sean McGovern

Got it. It’s on my calendar.

Steven Levine

I also found that there is a National Pulled Pork Day. If you happen to want to celebrate National Pulled Pork Day, it’ll be on October 12th. We just missed it, at the time of this recording, by a few days. But it’s interesting. I understand from a site called National Today that it’s a pretty recent celebration. There’s a story behind it. Sonny’s BBQ – for those of you who aren’t familiar with Sonny’s … Sonny’s is a chain of restaurants across the U.S. It started in Gainesville, Florida in 1968 – just a couple of years after live hogs became a commodity. What do you know? And Sonny’s set a Guinness World Record back in 2016 for the largest serving of pulled pork – weighing in at 2,012 pounds. That seems like a lot of pork. I don’t know. So, Sonny’s got together with some other barbecue players in the industry, and they deemed October 12th as National Pulled Pork Day. So, there you have it. Now, I also told this story, because it’s a sort of a filler for the absence of pork in my diet. I don’t eat pork. But that might not be so good, I understand. Also, from National Today, pork has more B-vitamins, iron, and zinc than chicken, which I do eat. So, maybe I should be eating pork? Maybe all these people who are not eating pork are missing out on some really critical vitamins in their diet, it seems? But did you know that pork is the most consumed meat at the global level? Did you all know that?

Sean McGovern

Well, I knew that just from…. Clearly, I’ve done a little bit of research on pork, but also, it kind of just makes sense, because you think of China with a billion plus people, and this is the number one thing that they have in their diet, as far as meat goes. So, it’s really not that surprising when you think about it in those terms.

Steven Levine

Well, spare ribs. I mean, I have to say the spare ribs are pretty darn amazing at this one Chinese restaurant in New York that I go to. Probably, the only pork that I’ll eat is going to be in Chinese food like pork fried rice …. or bratwurst. I like bratwurst. You can consider that pork, no?

Sean McGovern

Oh, it’s definitely pork. It comes from a pig.

Steven Levine

Okay, good. So, there you go. I’m a very die-hard bratwurst fan. But I can’t find the bratwurst that I like in my grocery store. I did look at the prices that are about $7.50 now for a package of four bratwurst, which I think is a lot more expensive than I used to buy them for. Do you guys eat pork? Are you a pork fan, Jeff?

Jeff Praissman

I am. I am. You know, bacon is a staple in my household. Definitely either Saturday morning breakfasts … or Sunday morning breakfasts, as well as sausage. Pulled pork is absolutely delicious. We’ll do a pork roast. As Homer Simpson once said … it’s that strange, magical animal that all these great foods come.

Steven Levine

It’s very true. I have to probably recant my ‘I don’t eat pork in my diet.’ It’s not a staple, but, yes, there’s a lot of products that I really like that come from…. Bacon. It’s just so hard to make. It’s like you got to take all those paper towels and sop up the grease and everything. It takes longer to make than it takes to eat it. It’s like gone in two bites, basically.

What is Scrapple???

Sean McGovern

if I could ask a question … have either of you ever heard of scrapple?

Jeff Praissman

I’m from Philadelphia, so I know scrapple well….

Sean McGovern

Wait, wait, wait. Steven, do you know scrapple?

Steven Levine

I’m out of this one. My first hearing was ‘Scrabble’, which I didn’t quite understand.

Sean McGovern

No, no scrapple with two ‘p’s. So, Jeff, just yes or no, do you eat scrapple?

Jeff Praissman

I have in the past. I have to be honest with you. I’m more of a sausage and bacon guy at this point. Definitely, my younger years, I ate scrapple, but…. For anyone out there listening, and for Steve—

Sean McGovern

Hang on, hang on. I got this. Let me. Yeah, it is delicious. Stop there, though, because I want to … because this is our Philadelphia roots showing through, right. My family’s all from Philly. I didn’t know you’re from Philly, Jeff, but let me just tell you – it’s one of these things I always ask … I love talking about it, because people outside of like Pennsylvania, New Jersey, Maryland, they probably have no idea what it is, and you probably won’t find it out there. So, it’s the best tasting food that is made from the absolute worst ingredients that you do not want to hear about. And if I’m not mistaken, you can correct me if I’m getting anything wrong here, but it’s like a Pennsylvania Dutch breakfast food – essentially like a block of all the parts of the slaughtered pigs that can’t be used for anything else. I mean, like, the head, the heart, liver, eyeballs, whatever is trimmed or just like falls off, gets on the floor, it gets swept up, they throw it into a bone broth, cook it up in there and mix it with some kind of wheat flour to hold it all together when it’s done. And, so, it basically looks like a breakfast meatloaf kind of thing. And I swear it might sound crazy to some people, but I promise you, or anyone listening, if you’re in the Philly area … you haven’t had it … order it at a diner. You’ll be shocked — in a good way.

Jeff Praissman

I would agree, it is the stuff … if you take the lowest grade hot dog, it’s the stuff that didn’t make the cut for that hot dog. But it is delicious, and it’s definitely…. I think you’re right. I think it’s strictly a Philadelphia thing, and I don’t even think you can get it anywhere else.

Sean McGovern

I’ve seen it in North Jersey a few times … South Jersey … definitely Maryland. I think so. But outside of that region, you’re not finding it. And people…. I’m watching Steven, he’s taking his glasses off just like a little blown away. So, we’re kind of getting into it here. But I recommend it. And I guarantee you, anyone listening from out that area who knows this, they’re probably like…. Yeah, I mean, listen, it’s just good.

Steven Levine

Everything gets used, right? It sounds like everything gets used. ‘Want not, waste not,’ I don’t know – it’s a conformed pork product of all the things that you would not eat by themselves, unless, I guess, you were like Indiana Jones in that Temple of Doom movie, right? You just sit there eating out of a monkey head. But this is this is…. You’ve had this??

Jeff Praissman

All my life growing up, absolutely.

Steven Levine

Really. Would you call it spam? Is it spam?

Sean McGovern

No, not at all. Not even close. You have to look it up. You have to see. It’s like a loaf. I ate it all growing up, too. My mom is probably the biggest scrapple fan in the world. So, yeah, it brings me back to my childhood.

Pork Processors & the FX Effect on ADRs

Steven Levine

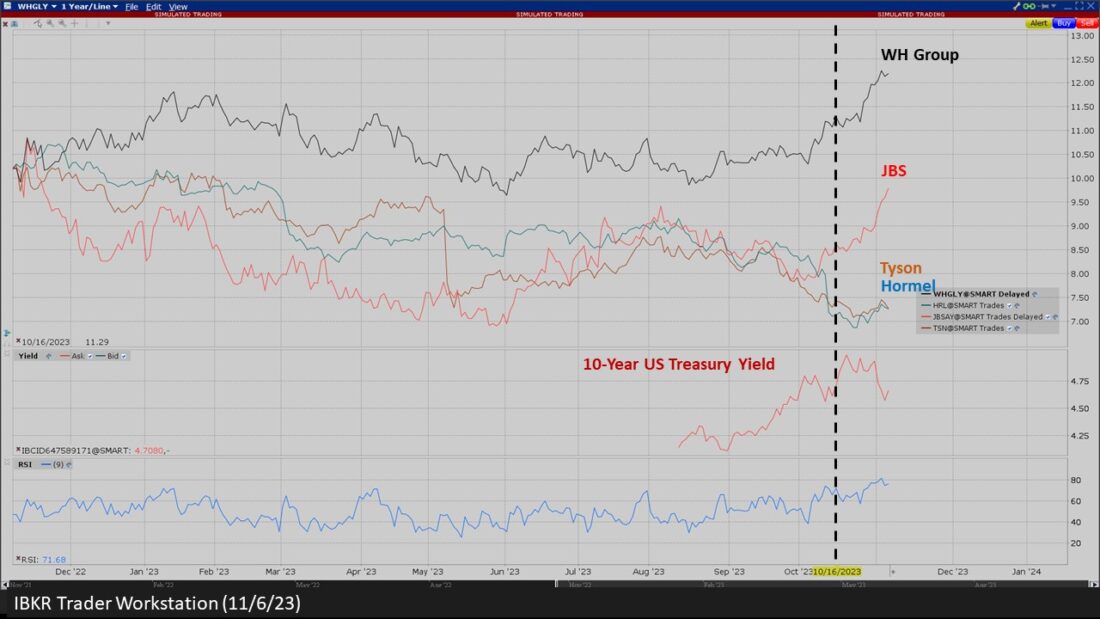

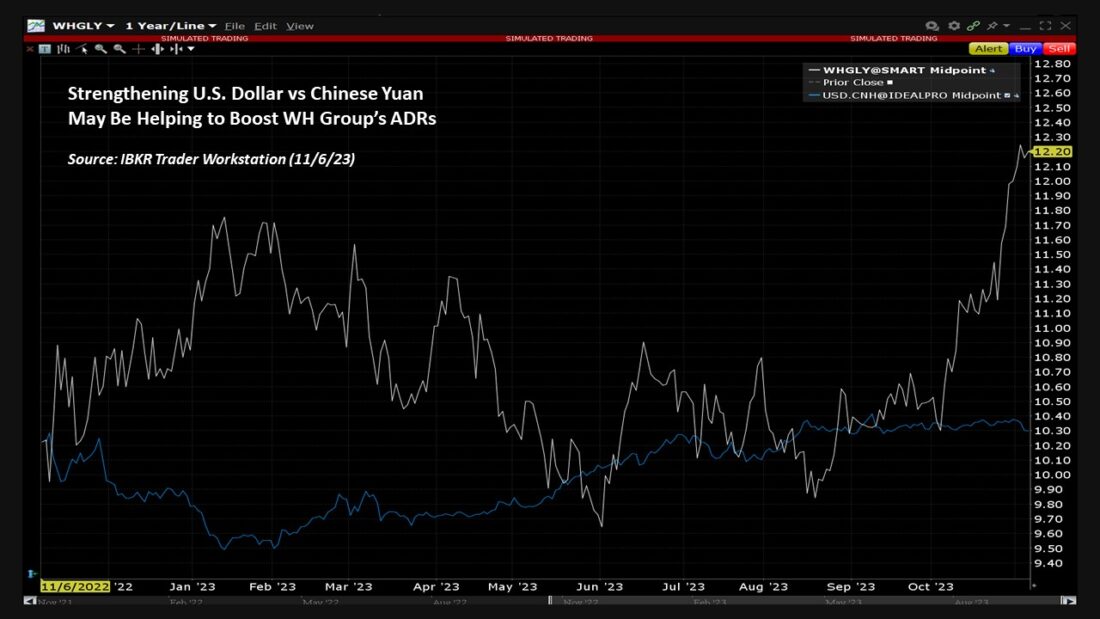

Very, very interesting. I mean, I guess I would go for Honeycombs, if I were going to do that, but I understand. So, okay, we talked a bit about some of the bigger players in the pork industry. We talked about China’s WH Group – they own Smithfield Foods … Brazil’s JBS … Hormel – U.S. company. I think with pork prices going where they’re going, I can’t imagine these companies are doing all that well in terms of their stock. Jeff, what are you seeing in these companies?

Jeff Praissman

Actually, all three companies that you mentioned are trading closer to their 52-week lows, if not quite on there. [JBS ticker] JBSAY is around the $7.00 range. It touched down around $6.25 at one point and peaked at $10.75. So, they’ve all had a steady decline over the last 12 months or so. And, another thing with two of them being ADRs, there’s certainly – for anyone listening to … they’re American Depositary Receipts, and they’re basically shares of non-us companies listed in the U.S. and priced in U.S. dollars. There is also a currency risk, and, just in the simplest terms, to explain it for listeners that aren’t familiar, let’s just say:

US$1.00 is worth €1.00, and the foreign stock is €10. So, it costs you US$10 to buy that.

Now let’s just say:

The dollar is now worth €0.50 – now, that same US$10 share that you bought … and let’s just say all things remain the same … now, if you tried to sell it, you would get US$5.00 for it.

And conversely:

If US$1.00 is worth €2.00, and that foreign stock remains at US$10.00, and you sell it, you would get US$20.00, essentially.

And, obviously, the stock isn’t staying the same price. So, there’s a relationship between the exchange rate – not only for the ADR’s – but, also, like anything else, these are global companies. And when they’re buying and selling, if they’re not hedging their currency risk, they’re going to be exposed either in a positive or negative way, and I think that’s important to say that a weaker U.S. dollar is generally going to be a positive for an ADR if you’re investing in it, and a stronger U.S. dollar is going to be sort of a negative if there’s no hedging involved.

Steven Levine

I think the dollar is really strong against the China yuan, recently. I think it’s hit some highs pretty recently – the dollar against the yuan. So, basically if…. Again, if the U.S. dollar is strengthening against the yuan, how does that affect the [Chinese] ADR? It’s a negative impact?

Jeff Praissman

Well, so, it depends. If you want to buy it, and the dollar is stronger, it’s going to cost you more U.S. dollars to make that purchase. Conversely, if you already own it, and you’re going to sell it, then you’re going to get more U.S. dollars back, I guess, but there will be an effect depending on what position you have or don’t have.

Steven Levine

Right. Right. It’s a sort of global equity derivative, in a sense.

Jeff Praissman

Right, correct.

Steven Levine

It’s going to fluctuate in part with the underlying currency, which is what they are valued in on their local markets. We’re just denominating it in dollars here, and so you have to peg that currency exchange when you’re considering them. And, so, WH Group is obviously a Chinese company listed on the U.S. exchange [OTCMKTS: WHGLY], and so is JBS [OTCMKTS: JBSAY], and its underlying currency would be, obviously, Brazilian real.

Beef Offsets in Earnings?

Sean McGovern

Since we’re talking about JBS, it’s very interesting that Jeff mentioned it’s trading closer to its 52-week low, but if you look at the pork segment, you’d kind of be surprised that it’s not doing a whole lot worse in the first quarter – I believe JBS saw their pork revenue fall by 81% — and, then, in the second quarter, it fell again by 21%, right? So, these are like wholesale pork, right, wholesale pork revenues down in second quarter like 15.8%…. And, then, as I said, wholesale pork prices down by 21% year-over-year in the second quarter. So, it’s kind of interesting that we’ve seen these prices go down, but JBS, if you look at it on a year-to-date basis, is not that far off from where it was trading at the start of the year … whereas, if you look at Tyson, which does make a certain amount of revenue from pork, but they’re also very involved with chicken and beef – and that’s also a big thing for JBS … is beef. I think that for JBS, maybe that beef is really — because we’ve talked about the live cattle, which since we’ve talked about it has just continued to climb – may be benefiting from that … from higher beef prices, and maybe there’s kind of less taking beef off of the plate and more taking pork off of the plate. Like American consumers, and other consumers around the world, are saying, ‘Hey, we like beef. We like beef. We don’t want to get rid of it. And where they’re like, well, you know, pork products … maybe we can do without that.’ And it comes down to a consumer taste kind of thing.

Steven Levine

All these companies, though…. I mean, all these companies are involved in these agricultural commodity inputs – really at depressed levels. I mean, Tyson, that you just mentioned, I’m looking at it now….

Sean McGovern

It’s had a much worse year….

Steven Levine

Yes, it’s. It’s also near its 52-week low … somewhere around $47 …. It’s 52-week [low] was at $46.16. So, this is unfortunate for those who are trading, I suppose, these companies that are involved. I don’t know what the turnaround really is? It’s lower interest rates you’re thinking?

Commodity Input Costs

Sean McGovern

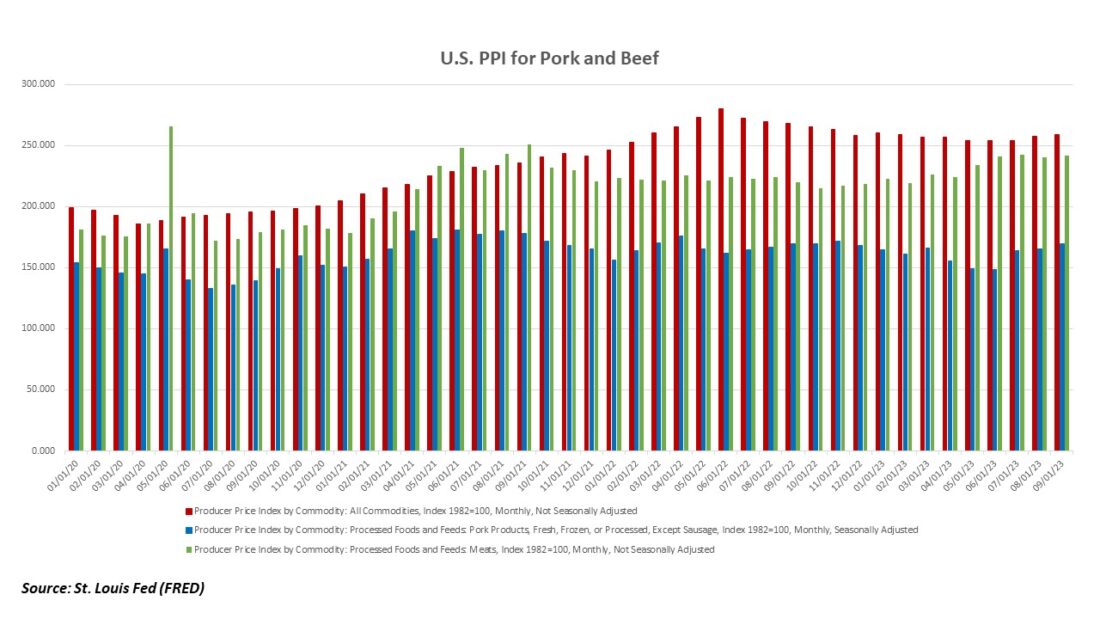

The answer for that is partially going to be, ‘Yes.’ I mean, if you look at the producer prices that these companies are having to pay, particularly in the U.S., we have the producer price index [PPI] here. Some of these producer prices for processed foods and feeds, which is like – there’s a subcategory, pork products fresh frozen processed, except sausage … for some reason they take sausage out of that. Those producer prices were falling, but now have ticked back up in September into positive territory. And remember, we talked earlier, the consumer prices for pork products are going down, but now the producer prices for these products are starting to rise, again. So, as far as high interest rates, yes, that’s going to impact them, especially now that they’re dealing with sort of like falling sticker prices, but rising producer prices.

Steven Levine

Wow, yes, they’re getting crushed then, if that’s the case … it sounds like. If the producer prices are going in the opposite direction as the consumer prices, that’s killing them on both sides of the equation … it sounds like. Wow, unfortunate. But – great, thanks guys so much for taking the time to do this! Any anything else you’d like to add?

Jeff Praissman

No, I think just … Sean and I are going to get together for breakfast and have some scrapple.

Sean McGovern

Yeah, right. Right, right.

Steven Levine

You can leave me out of it. You know, I don’t know what leftovers of scrapple would be like, but it sounds like it would be a sort of…

Sean McGovern

They’re already leftovers.

Steven Levine

Yes, it’s a second derivative of a leftover. Alright, this is great. For our listeners, you can read more commentary and market analysis at IBKR Traders’ Insight at our IBKR Campus – at ibkrcampus.com. You can keep abreast there about topics we’ve discussed here today,

as well as a wide range of other news critical to your investment decisions. McAlinden Research Partners has a host of articles on several themes – from central banks and gold buying to issues involving cybersecurity. Please contact Rob Davis for more details. He’s at rob@mcalindenresearch.com. And for a full list of financial education offerings, visit the IBKR Campus, where, as always, all of our educational material is provided to the public at no cost and until next time, I’m Steven Levine with Interactive Brokers.

LEARN MORE

Currency Commentary & Analysis

WHAT’S FOR BREAKFAST – PODCAST SERIES

- Sugar Futures: Talk About a Cereal Killer

- Live Cattle Futures – Herd Around the World

- ‘Cuckoo’ for Cocoa Futures

- Eyepopping Corn Prices – Fueling Food Inflation

- The War on Wheat – How Much Bread Is on the Table?

- Time for a Coffee Break?

IBKR TRADERS’ ACADEMY

- Courses On Futures

- Introduction to Futures

- Futures Fundamental Analysis

- CME Micro WTI Crude Oil Futures

- Understanding South American Soybean Futures

- Introduction to Grains and Oilseeds

- Hedging with Grain and Oilseed Futures and Options

- Introduction to American Depositary Receipts (ADRs)

MORE FROM McALINDEN RESEARCH PARTNERS

- Foreign Investment Flows to China Continue to be Chopped Down by Sputtering Sentiment (11/1/23)

- Starbucks Looks to Save Coffee From Climate Change, Rolls out New Coffee Breeds to Counter Rust Fungus (10/5/23)

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from McAlinden Research Partners and is being posted with its permission. The views expressed in this material are solely those of the author and/or McAlinden Research Partners and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.