Are breakfast cereals getting too expensive? The price of sugar futures may be to blame. Find out, as Sean McGovern, vice president of research at McAlinden Research Partners, Jeff Praissman, IBKR’s senior trading education specialist, and IBKR senior market analyst Steven Levine explore the global economics of the sugar trade, its affects on producer and consumer prices, and its influence on the stocks of certain consumer staples companies. Also, what can traders and investors learn about India’s role as a global exporter? What risks does El Niño pose to the sugar industry? And how much could the next box of your favorite breakfast cereal cost? All this and more as our agricultural commodity series continues….

Note: Any performance figures mentioned in this podcast are as of the date of recording (August 28, 2023).

Summary – IBKR Podcasts Ep. 103

The following is a summary of a live audio recording and may contain errors in spelling or grammar. Although IBKR has edited for clarity no material changes have been made.

Steven Levine

Hello, and welcome to IBKR Podcasts. I’m Steven Levine, senior market analyst at Interactive Brokers. I’m your host for today’s program. We’re very fortunate to have Sean McGovern, vice president of research at McAlinden Research Partners, back with us again for our ongoing series on agricultural commodities. McAlinden Research Partners is an independent investment strategy group. They focus on identifying alpha-generating investment themes, and they’ve got a lot of great commentary on our Traders’ Insight platform. You’ll want to check that out. Great to have you back, Sean!

Sean McGovern

Great to be back.

Steven Levine

Jeff Praissman’s also here with us. He’s our senior trading education specialist here at IBKR. How are you, Jeff?

Jeff Praissman

I’m doing well, Steve. Good to see you and Sean, again. Thanks for having me on the podcast.

Steven Levine

Very happy to have you here. Jeff’s been using our Trader Workstation platform and tools, along with his own research. He’s provided us with some really great insights into the performance of futures prices, as well as related company stocks and other instruments – from coffee to wheat to corn … cocoa and cattle. You can check out our past podcasts for some great information there. And he’ll be helping us out today on the highs and lows of the sugar futures market. Excited to be talking about that today and how it might be affecting breakfast cereals.

So, just wanted to kick things off with some fun facts:

- Around the mid-19th century, a New Orleans-born gentleman named Norbert Rillieux invented a sugar refining process for production that transformed … [it] really revolutionize the industry. It effectively commoditized sugar from what was sort of a luxury item prior to that and made the United States a global leader in sugar production. And he’s really an interesting and inspiring historical figure. I do urge listeners to learn more about him.

- But It was also in the in the 19th century that breakfast cereals were born, notably with John Harvey Kellogg’s granola, and later Corn Flakes, as well as C.W. Post’s Grape Nuts. A lot of fascinating stories behind those products as well.

- And then sugar futures began trading in the U.S. on the Coffee, Sugar and Cocoa Exchange in New York and the New York Board of Trade in 1914.

- And I suppose without the commoditization of sugar, people couldn’t actually pour it over their Corn Flakes or buy Frosted Flakes or have the opportunity to purchase any number of sugar-laden cereal brands like Lucky Charms or Fruity Pebbles.

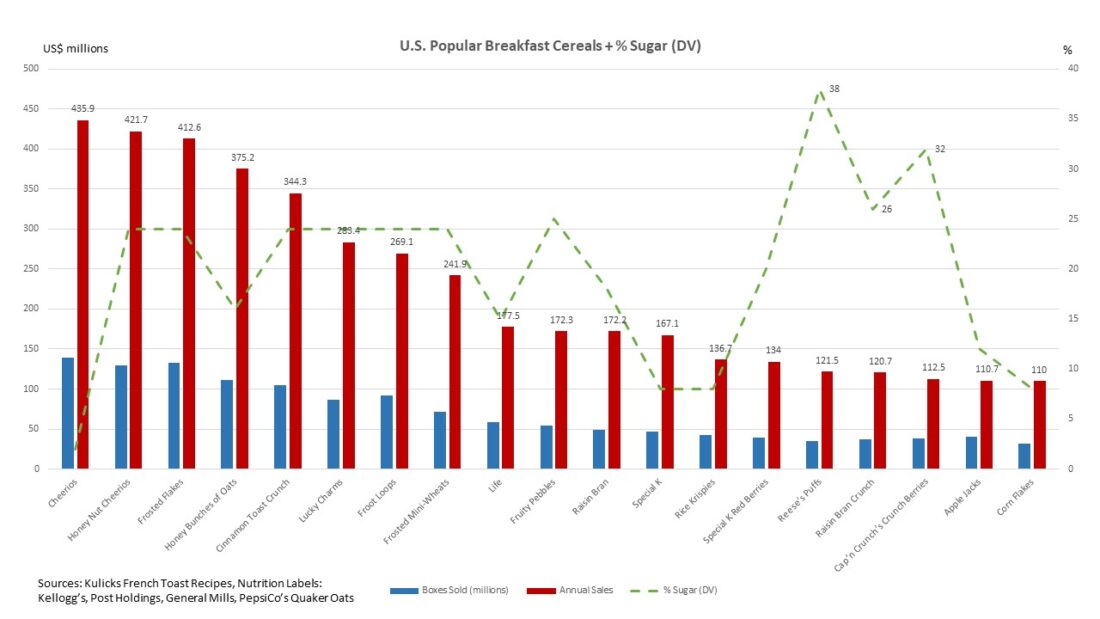

- It’s a market really dominated by only four companies, and we’ll be exploring that. In fact, according to National Cereal Day…. Yes, there’s a National Cereal Day, apparently. It’s on March 7th – so, mark your calendars. According to National Cereal Day, roughly half of the U.S. population starts their day off with a bowl of cereal. This adds up to around 2.7 billion boxes of cereal sold every year. And, according to them, it’s enough to wrap around the entire planet Earth thirteen times over … and that’s a lot of cereal.

The Sugar Trade

So, okay, it’s been a little over a century, Sean, since sugar futures began trading in the U.S. – 100 years ago, it started. So, what’s it look like today? Let’s start there.

Sean McGovern

Well, just give me one second here, because you’re telling me now for the first time, I’ve missed National Cereal Day this year. And it’s kind of devastating, because I guess I have to wait so many months now. Extremely underrated holiday, but I did miss it this year.

Steven Levine

March 7th. Mark your calendar. March 7th.

Sean McGovern

I will. I’m actually going to be preparing for that starting tomorrow. You know, we’re going to be ready for it next year.

So, sugar futures are a commodity futures contract that can be traded on the Chicago Mercantile Exchange [and the] Intercontinental Exchange. So, you’re looking at the CME or the ICE. There’s a couple of different types of sugar contracts out there, and we can get into that. But if we’re talking about the most widely traded contract, that’s going to be Sugar Number 11, and it’s going to be raw sugar, and one contract is going to be worth 112,000 pounds. The contract series is only four months. So, you’ve got March, May, July, and October, and that puts the current front month in October.

Steven Levine

So, there’s a Sugar Number 11. You’re saying that’s the most liquid contract. There’s other numbers like Sugar Number 16, I saw. Are there other numbers? Is this like red dye number three or something? I mean, how does that work? Do they mean anything?

Sean McGovern

Number 16 is going to relate to the delivery of cane sugar of U.S., or duty-free origin. The U.S. has these long-standing subsidies and tariff programs that supports our domestic country’s sugar farmers. So, at least 85% of annual sugar purchases have to originate from the domestic market, and Number 16 is going to fill that need. It’s also going to trade at a higher price than Number 11. There are also white sugar futures, and that’s Number 5. Still, Number 11, raw sugar, is an unrefined industrial product that is not really for human consumption. Don’t eat that. Sometimes you’ll see things like ‘sugar in the raw’ or products claiming to be raw sugar, but they’re not actually raw, if they’re being sold in the United States. That is totally illegal. So, as I said, Number 5, white sugar, is going to be what you’re putting in your coffee, drinking your soda, so on and so forth. That’s what you would really recognize as table sugar.

Steven Levine

Okay. But Number 11, the raw sugar … that gets put through Rillieux’s refining process? And that comes out in the end as the kind of sugar that gets bought by producers, for example, like the cereal companies?

Sean McGovern

Right. Exactly.

Sugar Highs

Steven Levine

So, Jeff, looking at the Trader Workstation … how are these sugar futures performing? I mean, are you seeing any interesting trends there?

Jeff Praissman

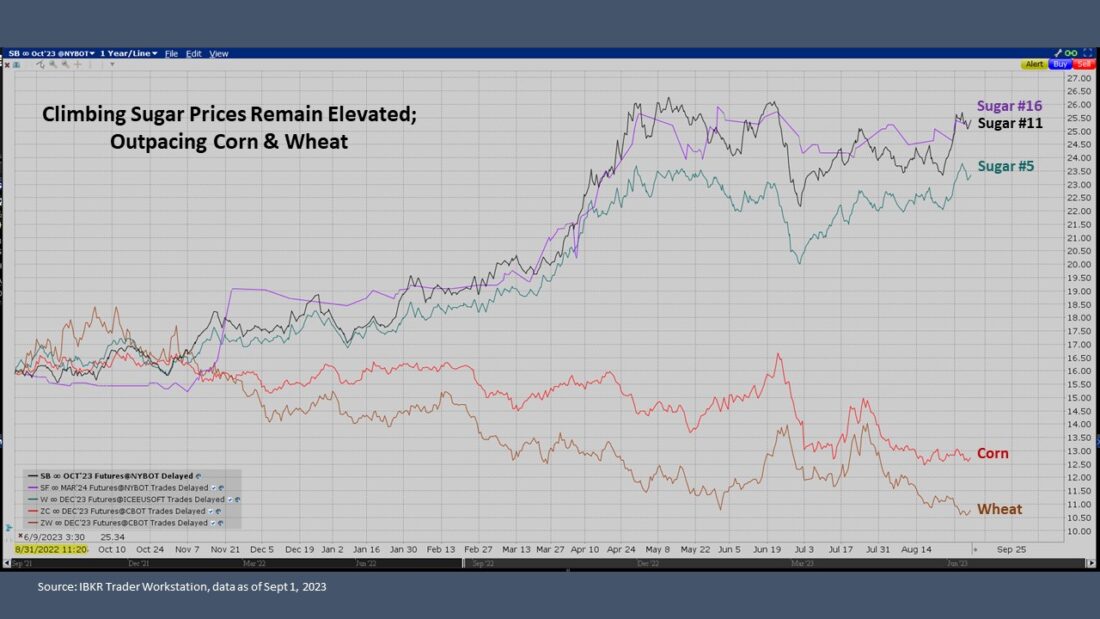

Yeah, so, actually, Sugar 11 is trading near its yearly high. I think April was above 27, but really hasn’t seen this level, in general, since, probably back in October 2017. I’m just looking at the charting feature on the Trader Workstation. And then Sean mentioned Sugar Number 16, which, of course, as you said, is the hedging product for the delivery of cane sugar. That seems like it was relatively flat between 2008 to late 2020. And it’s just kind of climbing up now as well.

The Wide World of Sugar

Steven Levine

So, Sean, these sugar futures are at fairly elevated levels, it seems. Before maybe talking about the performance and some of the drivers, how big is this industry globally?

Sean McGovern

Well, in total, there’s about 180 million tons of sugar produced, annually. Brazil is the biggest exporter by far, with over 28 million tons being exported in the 2022 to 2023 marketing season. You also have Thailand and India as the next largest exporters, but they’re really only putting out a combined 17 or 18 million tons. That just shows how significant Brazil’s domination of this global market is. And this year, India limited their global exports to just 6.1 million tons in this marketing season. That was down from 11 [tons] in the prior year. And they met that all the way back in May. So, Brazil has been leaned on heavily to fill that gap. That reliance should become even greater next year, as India is expected to ban exports of sugar totally in the next marketing year.

Steven Levine

What are they doing that for? Their population … internally, domestically … need the sugar?

Sean McGovern

Yes, but they’ve seen a big drop off in output totally. India has really strict restrictions on a lot of their crops, like wheat and other things. And sugar is one of those products that they’re going to look to protect their domestic market before thinking about the global market. So, yeah, totally. No sugar going out of India next year.

No Halloween Treats? Is This a Trick?

Steven Levine

Wow. So, I suppose this is going to put some pressure on producer and consumer prices. Where are they now, and where do you think they might be going?

Sean McGovern

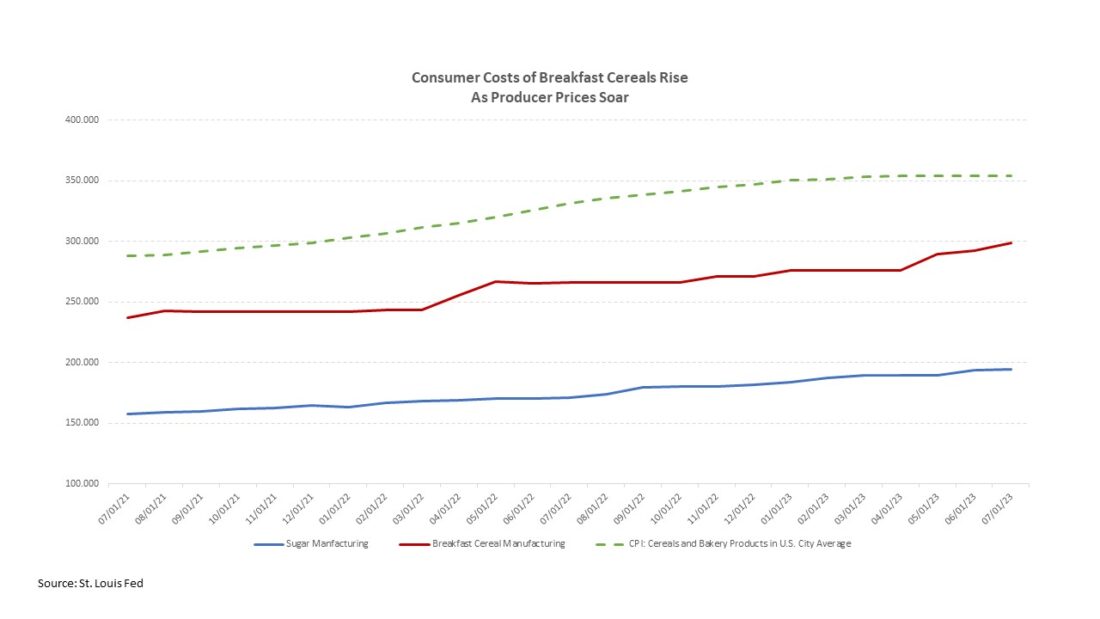

We actually do have a Consumer Price Index category for sugar and sweets. That’s what it’s called … comes right out from the BLS. The problem is that it’s only calculated twice per year for the first and the second half – that’s obviously very infrequent. But what we can see is that the year-over-year gain in sugar and sweets prices jumped out to an all-time high of around 13% in the second half of 2022. But that increase slowed to 10.9% in the first half of this year. If you look back to some of the headline CPI prints throughout the first half of 2023, those were coming in between 3% to 6%. So, illustrating how aggressively this commodity has risen, really, when compared to broader inflationary pressures.

On the producer side of the equation, there’s a variety of sugar-related sub-indices in the PPI [Producer Price Index], and it appears that the cost pressures mostly rose in line with price hikes that have been passed on to consumers. So, for example, the annual gain in the PPI for Sugar Confectionery Product Manufacturing – that peaked at 11.8% last September but has been falling to below 9% since then. There’s been a few headlines over the past several months about an emergent sugar candy shortage this Halloween in the U.S., which obviously would be terrible, but seems unlikely that’ll be the case. And, overall, the softer gains in the prices of sugar products may be following a broader trend of disinflation in the economy. All of this is highly dependent on commodity prices for sugar, but obviously companies are going to be beholden to what consumers are willing to pay as well. And, you know, based on some of the strong sales numbers we talked about for Mondelez and Hershey on our May podcast with the cocoa futures, right. It doesn’t look like some of the big names are having too many issues selling their sugar-rich products.

Steven Levine

Well, we’ll see. We’ll see. Because these cereals seem to be suffering some pain pretty recently. But we’ll come back to that. You know, I’d love to understand what your outlook on the markets, say, for the rest of the year is. What are you going to be looking for?

Sean McGovern

So, we’re going to be looking at weather for sure. As always, traders are looking at weather, right. And as far as Brazil goes, the center south of the country, that’s the most important place to watch. That’s where most of the sugar growing goes on. The weather in that area has been pretty dry recently, which actually favors the harvest this time of year, since it makes farmers’ jobs a lot easier. Both the sugar cane crush, which is the actual sugar cane they’re taking out … they’re processing … and resulting sugar output were up year-over-year in the back half of July and rose by a third in the first half of August, which has probably helped to keep those futures prices off the 2023 peak that we talked about, which was reached back in April. Part of that could also be tied to uncertainty regarding interest rates as well, and things like that. But when just sticking with the weather for a second, we’re really looking at anomalies, and there’s a very high probability that a strong El Niño, which has been talked about in the media, that is probably going to be a critical factor for production across the world. This is the meteorological phenomenon that causes unusual warming of surface waters in the Pacific Ocean. So, it sounds a little bit mundane at first, but this El Niño has wide flung implications across the globe –

places like Brazil, right. We’re going to get probably soggier, rain-intensive weather. Southeast Asian nations like Thailand can expect dryness and potential drought. And these are two nations we already talked about. Back in July, Bloomberg had reported rainfall across Thailand may be as much as 10% below the average in the monsoon season. And that forecast wasn’t even accounting for the impact of El Niño. Conversely, heavier rains than usual in Brazil, that’s going to make harvesting more difficult. You know, rain is obviously good for crops, but generally mud … flooding, not good for harvesting, makes the farmers’ jobs a lot harder. The NOAA [National Oceanic and Atmospheric Administration] … their latest El Niño update says that there’s more than a 95% chance that the El Niño event will last through February 2024. So, this is a concern that’ll cover the rest of 2023, at least. And the latest instance of a strong El Niño was back in 2015/2016 marketing year, and that was responsible for wiping out seven million tons of sugar output.

Steven Levine

Wow. So, maybe sweet for sugar prices, but it sounds like, overall, a fairly bitter forecast.

Sean McGovern

It really depends. I mean, this is all kind of up in the air. El Niño is very, very unpredictable. That’s why we call it ‘anomalies’. Now, we know what typically happens, and it seems like a very high chance we will get these anomalies, and if demand remains strong for sugar, then it seems like we’re going to get more of the same.

Living on Sugar Mountain

Steven Levine

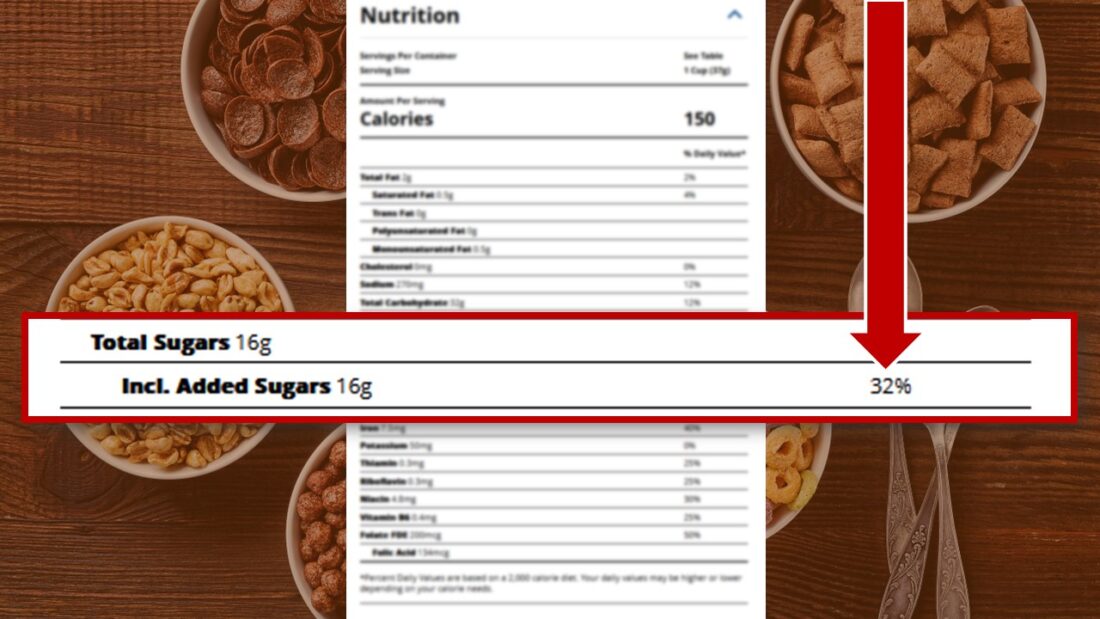

I know we touched on breakfast cereals, and they use a lot of sugar. And from what I understand, the cost share of sugar as a raw material in breakfast cereal manufacturing is among the highest, I think, if not the highest of just about all products containing sugar. I read, according to one study [that] uses data from the Economic Census – it’s nearly 33%, placing it higher than confectionery products … that’s non-chocolate and chocolate, as well as ice cream and frozen dessert manufacturing, and soft drinks … all by fairly wide margins. So, I took a look at some of the more popular ready-to-eat breakfast cereals, and I’m sorry to scare y’all – I don’t know if…. I’m sure you already know it already, but their respective percent daily value, that’s percent ‘DV’ of sugar … and people listening can look at the backs of these boxes and look at ‘percent DV and added sugar’.

Just keep in mind that the CDC [Centers for Disease Control and Prevention] recommends that Americans [aged] two years and older should keep their intake of added sugars to less than 10% of their total daily calories. That’s less than 10%. And the USDA [United States Department of Agriculture] places any amount of sugar over 21% per serving as exceeding their limit in their Child and Adult Care Food Program. That’s a CACFP for short. So, I’m looking at the labels, and I’m seeing brands like Honey Nut Cheerios from General Mills, by some counts, one of the most popular breakfast cereals, more than 129 million boxes sold, annually, 24% total sugar as a percent DV, or nearly 32.5% per serving. It’s exactly the same with Kellogg’s Frosted Flakes, [which] sells around 132 million boxes a year. Cap’n Crunch Crunch Berries, 32% total sugar, that’s 43% by serving.

And on the borderline of the USDA’s program limits: Post’s Honey Roasted, Honey Bunches of Oats, 16% DV or 19.5% per serving; Life Cereal from Quaker Oats … now, Quaker Oats is owned by Pepsi … 15% percent daily value, 19% per serving; and probably among the lowest is Cheerios, with only 4.6% of sugar per serving.

I can’t say I’m too surprised. But these cereals can’t be all that good for you. In fact, I think Lucky Charms [is] one cereal brand that’s been banned in certain countries … like Norway and Austria … given its use of food dyes like yellow 5. We talked about red dye 3. Well, this is yellow 5, yellow 6, red 40. Because of these additives, the product’s also required to wear a warning label in the EU – this was according to Stacker, a site [that] provides data-driven journalism. They also say that Frosted Flakes, Honey Bunches of Oats, Rice Krispies all contain a flavor enhancer called BHT [Butylated Hydroxytoluene], which the site claims is a potential carcinogen. And while the evidence for that is inconclusive, these products are still banned in Japan, as well as the EU. It goes on and on.

I mean, I remember last year the FDA [United States Food and Drug Administration] looked into mass complaints … I think over 8,500 self-reports were made last year … people were basically claiming that Lucky Charms made them violently ill – like they’d been poisoned. Cheerios, I think, to some extent as well. The FDA didn’t find anything in its investigation that gave the claims any merit, but still … kind of alarming. And to a lesser degree, Kellogg’s recalled Honey Smacks – they used to be called Sugar Smacks – in 2018, after 135 people across multiple states said they felt sick after eating it. About 34, 35, I understand, were hospitalized. So, this is all just very alarming, and they have these cartoon characters on them as mascots, and they seem very friendly, and positioned towards children. So, I also recently passed by a box called Cocoa Munchies … [it] had this hippopotamus with like four teeth … 47% sugar per serving. It’s like over twice the amount the USDA’s program has stated as a limit.

Growing up, we had Sugar Smacks … what’s now Honey Smacks … Honeycombs, Trix, Froot Loops…. Later, it was Kix and Rice Krispies, Frosted Mini-Wheats … I had to put sugar on the Kix, but… Did you all have breakfast cereals growing up? I’m really curious. How do you position that now … just psychologically … knowing that they have this kind of possible effect on your health or well-being?

Sean McGovern

I sort of buried the lead at the top, you know. I mean, I’m talking about National Cereal Day. Yeah, of course, I love cereal. And as a kid, funny enough, I think my favorite was Cookie Crisp, which is actually one of the banned American cereals in Canada.

Steven Levine

There you go….

Sean McGovern

I was eating a banned cereal, but it was those. Reese’s Puffs. And I mean, if we’re talking sugar content, those have really got to be at the top of the list. And that’s a little too much for me now.

Steven Levine

Is it contraband If you if you smuggle in a box of Cookie Crisp into Canada? Is that considered contraband?

Sean McGovern

Next time I’m going up there, maybe I’ll bring it with me. I’ll see what happens.

Steven Levine

I don’t know if you’ll want to cross the border….

Sean McGovern

….I get dragged off the plane … like one of those crazy people with my box of Cookie Crisps. And so, it’s a little too much for me now. But as you said, like Frosted Mini-Wheats – those are great. I love Frosted Mini-Wheats, Raisin Bran, maybe a little bit more of a controversial choice, but I’ve been a huge fan of those, too.

Jeff Praissman

Well, you know, I’m just thinking back, you know, being a kid, Saturday morning cartoons, you open that box of cereal, and my ‘go-to’s were either Fruity Pebbles, Cap’n Crunch, Cookie Crisp. So, apparently, I couldn’t go to Canada either. And of course, I don’t know if people remember, but the triple threat of Count Chocula, Franken Berry, and Boo Berry – they all had their made up, you know, monsters on the on the cover. But I love cereal as well. I think it’s a great food. I love it either with milk or even, honestly, just kind of eating it dry sometimes. I’ll just kind of, you know, don’t tell my wife and kids this, but I’ll stick my hand in the box and just start eating. My kids, they’re all a little bit younger, so their ‘go-to’s are … Cinnamon Toast Crunch is super popular in my house, Lucky Charms, Froot Loops, and also like, I guess, it’s Chocolate Chex mix.

Steven Levine

Chocolate Chex mix?

Jeff Praissman

Yeah, I think that’s the cereal. And maybe Cinnamon Chex. But definitely Cinnamon Toast Crunch is probably their favorite.

Still Dig ‘Em?

Steven Levine

Have you all noticed if they’re any more expensive, say, recently than they were maybe this time last year?

Jeff Praissman

I can definitely speak to the fact that they’re definitely more expensive. I’d say probably 10% to 15% more. And I know Sean’s talked about shrinkflation before on our coffee podcast, and it definitely seems that the boxes have gotten smaller as well. They might be thinner width. They seem to make them look like … if you’re looking straight on, they look the same, but then when you turn them sideways, they seem a lot more shallow than they used to be.

Sean McGovern

Yeah, sometimes what they’ll do is … they’ll keep the box the same size, but they’ll decrease the net weight of what’s inside of it. That’s what you have to actually look at is the net weight, not necessarily the packaging. And, yeah, the name brands for sure are more expensive. I buy generic store brands, and you know from our prior company conversations, I’m really not one to hammer home some of the cliché, ultra-frugal financial advice, but, you know, I’ll tell you the prices on the name brand cereal – sometimes, I’m just like, wow, that is really crazy.

Steven Levine

Yeah. I’ve seen something like Cap’n Crunch Crunch Berries up 114%. I mean, this is one of the more sugar-laden cereals, but that’s a significant hike over last year. That’s from one statistic that I saw from a company that was looking at the statistics from purchases off of Amazon. But 114%, you know, that’s pretty hefty.

Sean McGovern

Grain prices have continued to soften almost perpetually since May of last year. This is going to be another big factor in the cost of the cereal that’s helped to offset some of the cost pressure that cereal producers would have felt if prices of both commodities were rising. So, you’ve got sugar up, grain down, a little bit of canceling each other out there. We talked on the podcast a few months back about risks facing the global supply of the wheat crop, specifically, those futures have remained subdued, and if that pattern were to reverse and grain prices began rising, that would compound the pressure from sugar. Probably make the cereal companies feel the sting of surging sugar prices a little bit more acutely. Until then, however, I feel that cereal won’t be one of the product categories seeing severely above average inflation.

Steven Levine

And I can just imagine that Cap’n Crunch Crunch Berries going for like $30, if sugar prices go higher, and grain prices aren’t enough to offset. That’s mostly sugar, I think.

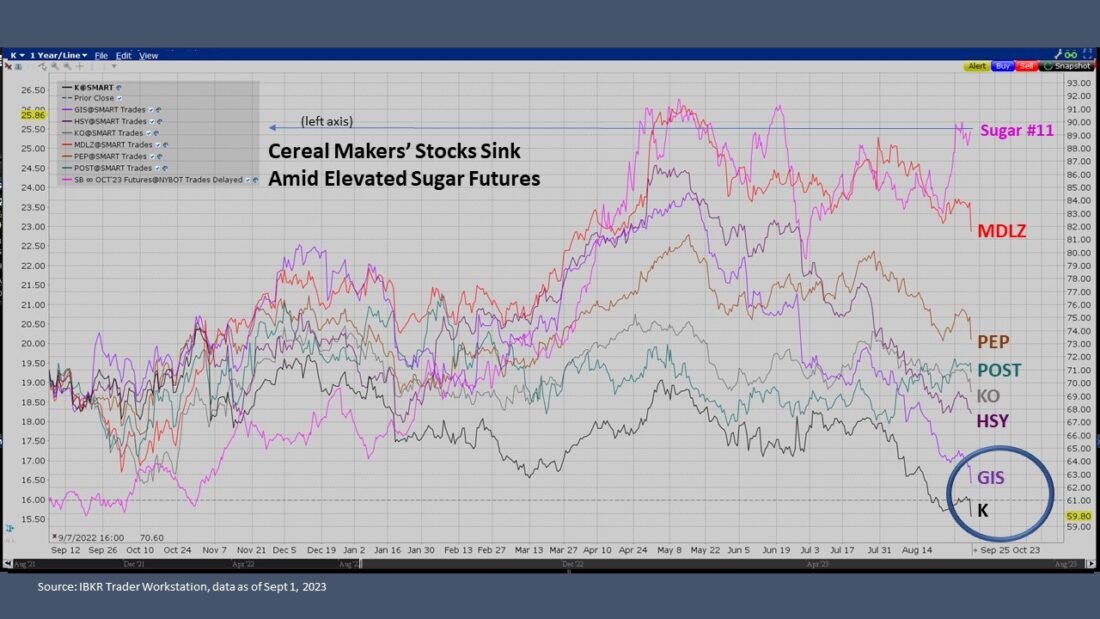

And it’s really hard to separate out the marketing of these from what you’re actually getting in your bowl. You know, when you think about the health benefits that are touted from certain cereals like Chex, perhaps, or Cinnamon Toast Crunch or Honey Nut Cheerios … or Life. I mean, boy, Life cereal … there’s really no better benefit than Life, I would say. Why those other kids didn’t like Life. I don’t know … why they had to pass it off to Mikey, I have no idea. And what you look at in your bowl … when you just take a hard look at it and divorce yourself from the marketing that takes place, you have to ask: ‘Is this really food fit for consumption?’ Lucky Charms is just a bowl of dried up, puffed sugar, basically, it seems. I don’t know. It makes the milk taste, you know, pretty good for a little while, but then, you know, you start to wonder whether this is really going to help you out in the future in terms of health impacts. And so, marketing it towards kids, it’s a whole other story…. But yes, it looks like the elevated prices of sugar, and the and the amount of sugar that goes into these cereals, is really having an impact. So, I’d love to ask Jeff where he sees company stocks like Kellogg’s and General Mills going. I remember, Sean, you were talking about, you know, demand at any cost. But I don’t know, these both hit like 52-week lows recently, didn’t they?

Sugar Lows

Jeff Praissman

They did, yeah. Kellogg’s and General Mills, they’re both trading near or at their 52-week lows. I think it was last Wednesday, in fact, that they both hit their 52-week low. Then the other two major players, Post Holdings, which yeah, they own a couple other items such as Peter Pan peanut butter – they seem to kind of be cruising along. And then Pepsi, which is really hard to decipher, because obviously they own Frito-Lay; they own, you know, soft drinks, which is such a big part of it as well, besides the cereal business. So, those other two ones are a little bit harder to kind of do a direct correlation. But certainly with Kellogg’s and General Mills, the stock price is hurting somewhat in the last year or so.

Sean McGovern

The impact of high sugar costs may not be impacting the companies making cereal as it had in the back half of 2022 and the first half of this year. Sugar prices are rising more gradually now than they were in those periods. So, it’s going up, but not as sharp.

Sugar Substitutes

Steven Levine

I know Kellogg’s is undergoing a restructuring, and, I don’t know … I mean, there are sugar substitutes…. There’s beet sugar and cane sugar, I think we mentioned, and for those people who are more health conscious, is there a sugar substitute market that rivals the raw sugar market … the refined sugar market?

Sean McGovern

Probably not in the near term. Personally, I don’t use sugar in my coffee. I actually use Stevia. I like the idea of zero calorie, right. That’s one of those things that appeals to me about alternatives to sugar. So, any kind of sweetener like that, you’re going to have that kind of appeal. But what we’re actually seeing with the demand trend of sugar is that it’s rising globally. That’s why we’re seeing the prices go up so aggressively, as it’s really a demand side, even in light of higher interest rates and slowing growth in many parts of the global economy, or at least some parts of the global economy. We’ve not seen demand drop off for sugar all that much. There definitely is some amount of its market share being bitten off by alternatives, but nothing that would eat its lunch in the near-term, I don’t think.

Steven Levine

Yeah. It’s been sold on the market as a commodity since 1914. I think it’s very well-entrenched as a staple in our diets or our habits … very hard to replace that. What do you think, Jeff?

Jeff Praissman

Yeah, I’m not too keen on, like, the chemical substitutions. I would imagine if manufacturers were able to put, say, beet sugar in … or some other natural substitute … I wouldn’t have any issue with it at all. I mean, It’s more, I guess, a taste preference. I would imagine they’d be able to do it seamlessly and not alter the taste of the product.

Starting the Day Off Right?

Steven Levine

Well, I can tell you, I loved Honeycombs, and I loved Trix, and, you know, I miss the prizes in the boxes. And I miss these…. I guess I could have them again, but I have a feeling they’re just not the same that they used to be. I have a feeling that they just produce these very differently from the way they did when I was growing up. And, so, I just won’t touch anything anymore.

Sean McGovern

You know, It’s interesting, Steven, too, that you mentioned … kind of your declining demand for cereal, right … is a little bit of an anecdotal example … but we’re seeing that across the American populace. It’s one of the fading items in the American breakfast. You know, you mentioned Kellogg’s, who’s a real cereal giant, and just reported second quarter earnings earlier this month. They’re in an interesting spot when it comes to the cereal business. For the company as a whole, their net income expanded year-over-year … sales were up by about 4.6%, largely due to price hikes. But if you look at the cereal business by itself, its North American sales were only up by 1.8% from last year. That’s seriously trailing snacks and frozen foods growth … that’s creating a drag on the company. And that’s probably why, as you mentioned, Kellogg’s is trying to spin out the cereal business into its own standalone company, perhaps to the dismay of its existing shareholders.

Cereal is suffering from a transformation of the carbohydrate-heavy American breakfast, which is really probably going to affect other perceived breakfast foods as well. Two major forces driving that – one being just growing emphasis on protein over carbohydrates. It’s probably going to protect things like eggs and meats in the breakfast and degrade the consumption of cereal, pancakes, waffles…. But the other factor is a general, sort of abstinence from breakfast altogether, with the popularity of intermittent fasting. And I did that myself. And I haven’t regularly eaten breakfast in a long time. But it’s maybe a little bit more of an unsettling development – but Americans are skipping breakfast more frequently due to its simply being more expensive. The Wall Street Journal had an article out in March, I believe it was titled, ‘To Save Money, Maybe You Should Skip Breakfast’. And the text of the article was more focused on the degree to which breakfast food prices were rising, not necessarily suggesting, you know, you should not eat breakfast to deal with that. But the headline was very ominous. And that’s just another one of these factors for cereals – that’s sugar-heavy foods, in general, in the American breakfast, I think, that’s negative.

Steven Levine

I’ve heard people increasingly going without breakfast. And I remember this cartoon. It was sort of like a stop-motion animation, when I was growing up, and there were these tops … there was, like, five tops, right? And four of the tops would spin, and then they’d just fall. But one top kept going, and it would stop mid-turn, and it would say, ‘I had my breakfast, and they didn’t,’ right. And, so, it was kind of a promotion to like, you know, say that you have to start your day off right. You have to eat breakfast. But now I’m finding that maybe it’s not even healthy for you to digest so much protein so early in the morning. I mean, there’s all of these kinds of questions as well. I don’t know the answers to them. It seems to keep changing every year. And so, we’ll just go with what we’ve got, right, which are higher, elevated sugar prices, a great deal of sugar being consumed by producers of breakfast cereals … and very expensive breakfast cereals … and lower stocks in Kellogg’s and General Mills. And, basically, that’s where we’re going. And let’s just hope El Niño doesn’t destroy the outlook so much so that it gets even more and more expensive on the consumer side. I suppose, for those who are holding sugar futures, that would be a plus.

Sean McGovern

Yes, that’s what it would seem.

Jeff Praissman

Yeah, I think I’m just going to go have a bowl of cereal after this podcast. I’m going to go hit the Cinnamon Toast Crunch out of my pantry.

Steven Levine

This has been really great! Sean, Jeff, thanks so much, again, for taking the time to do this. This has been really another fascinating commodities, futures-related podcast!

For our listeners, you can read more commentary and market analysis at IBKR Traders’ Insight at our IBKR Campus – that’s at ibkrcampus.com. You can keep abreast there about topics we’ve discussed here today, as well as a wide range of other news critical to your investment decisions. McAlinden Research Partners has got a host of articles on several themes – from central banks and gold buying to issues involving cybersecurity. Contact Rob Davis for more details. He’s at rob@mcalindenresearch.com. And for a full list of financial offerings, visit the IBKR Campus, where, as always, all of our educational material is presented to the public at no cost.

And wherever you listen to your podcasts, please rate and review us. We’d love to hear from you.

And until next time, I’m Steven Levine with Interactive Brokers.

—

LEARN MORE

RESEARCH & STATS

WHAT’S FOR BREAKFAST – PODCAST SERIES

- Live Cattle Futures – Herd Around the World

- ‘Cuckoo’ for Cocoa Futures

- Eyepopping Corn Prices – Fueling Food Inflation

- The War on Wheat – How Much Bread Is on the Table?

- Time for a Coffee Break?

IBKR TRADERS’ INSIGHT

IBKR TRADERS’ ACADEMY

- Courses On Futures

- Introduction to Futures

- Futures Fundamental Analysis

- CME Micro WTI Crude Oil Futures

- Understanding South American Soybean Futures

- Introduction to Grains and Oilseeds

- Hedging with Grain and Oilseed Futures and Options

MORE FROM McALINDEN RESEARCH PARTNERS

- Indian Trade Restrictions Create 10 Million Tonne Hole In Global Rice Market, More Exporters May Follow (8/16/23)

- Russia Shifts Missile Strikes Toward Ukraine’s River Ports, Cutting Off Back Door for Black Sea Grain Ships (8/2/23)

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.