(Today’s theme song: “You’re a Mean One, Mr. Grinch”, sung by Thurl Ravenscroft[i])

It’s that time again, one of the eight weeks a year that we prepare ourselves for the next scheduled FOMC meeting. To say that expectations are riding high for Wednesday’s outcome would be an understatement. Considering the huge changes in both market expectations and liquidity, it is important to wonder whether Chair Powell will push back against some of the enthusiastic projections for rate cuts that are currently priced into markets. If so, he runs the risk of playing Grinch ahead of the hoped-for “Santa Claus rally.”

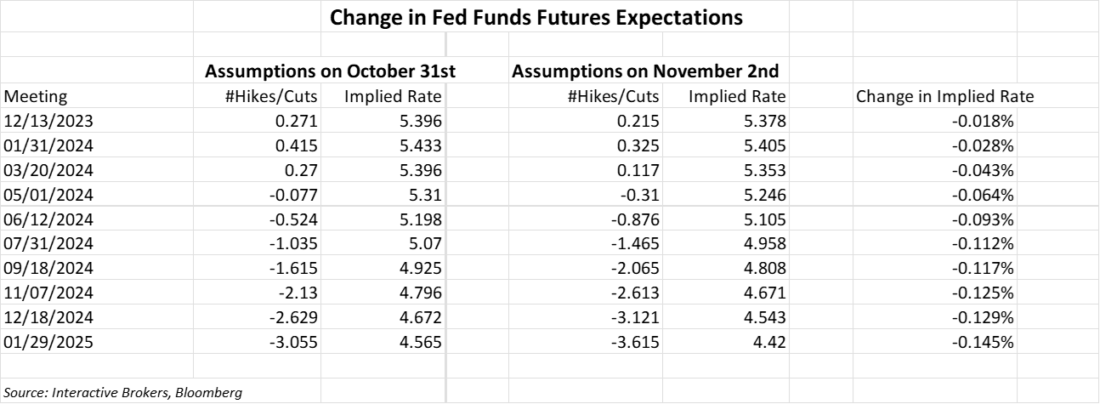

Remember how we approached the last meeting on November 1st. Major US equity indices had just completed their third straight down month, with some ticking into correction territory, and 10-year notes were flirting with 5% yields. Fast forward just six weeks and things have changed dramatically. The S&P 500 (SPX) and NASDAQ 100 (NDX) are closer to all-time highs than correction lows, and while 10-year yields have risen from their recent lows, they are still yielding only 4.27%. More importantly there has been a sea change in expectations for future Fed rate cuts. Prior to the November meeting, Fed Funds Futures were pricing in a 41.5% chance for a January hike, a 50% chance for a June cut, and three cuts for 2024. By the end of that week, just two days later, odds of a further hike had fallen to 32.5% and the likelihood of a cut in June had risen to 87.6%

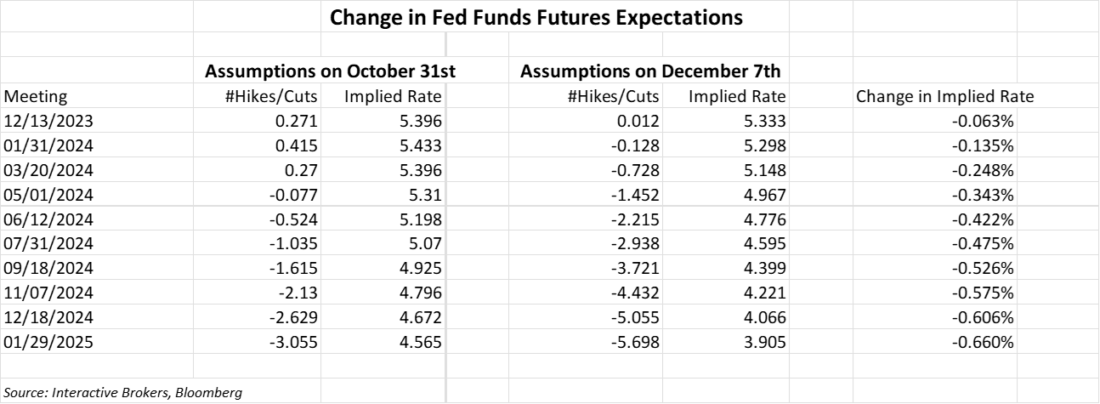

Considering the rhetoric of the November statement and press conference, a loosening of expectations seemed appropriate. But we then set about further loosening expectations for Fed policy, culminating with aggressive expectations last week ahead of Friday’s Payrolls report:

We wondered last week whether the markets had “outkicked the coverage” regarding rate cut expectations. We’ll find out if that was the case on Wednesday.

The November meeting did not feature a “dot plot,” the colloquial name for the FOMC’s Summary of Economic Projections (SEP). In September, the median Fed Funds rate projection for the end of 2024 was 5.125%. That hardly squares with the 4.26% that is currently estimated by futures markets. (Though it is indeed up from last week’s 4.07%) A dot plot that falls well short of current projections could certainly spook markets, and unless Powell is willing to disavow his colleagues’ projections, he will need to spend a fair amount of the press conference explaining why the FOMC’s views are so far off the market’s.

Ask yourself, which has the greater likelihood? That the FOMC and Powell will reaffirm the market’s rosy assumptions about rate cuts, or whether they will reassert that while we have made great progress against inflation, we have not yet achieved the 2% objective, and thus it is premature to consider rate cuts until that occurs. If the former, then by all means remain sanguine about risk assets. If the latter, perhaps some risk aversion seems prudent.

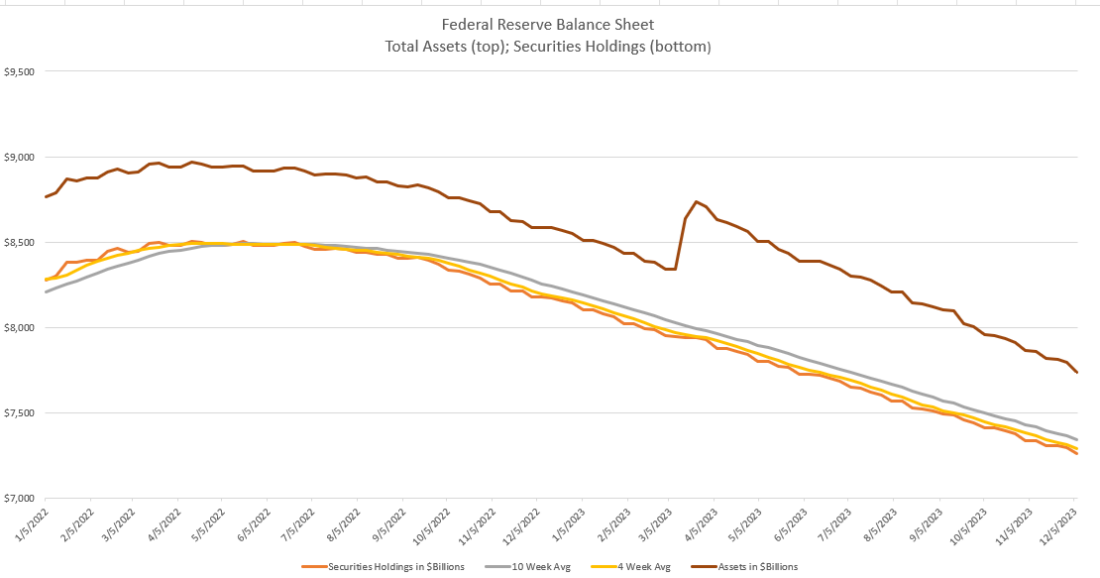

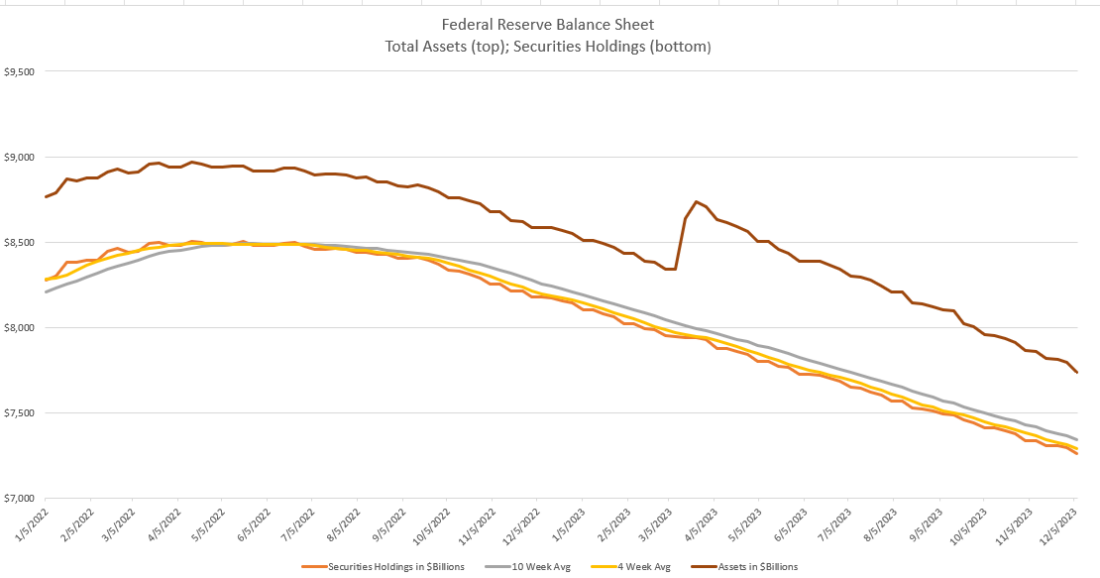

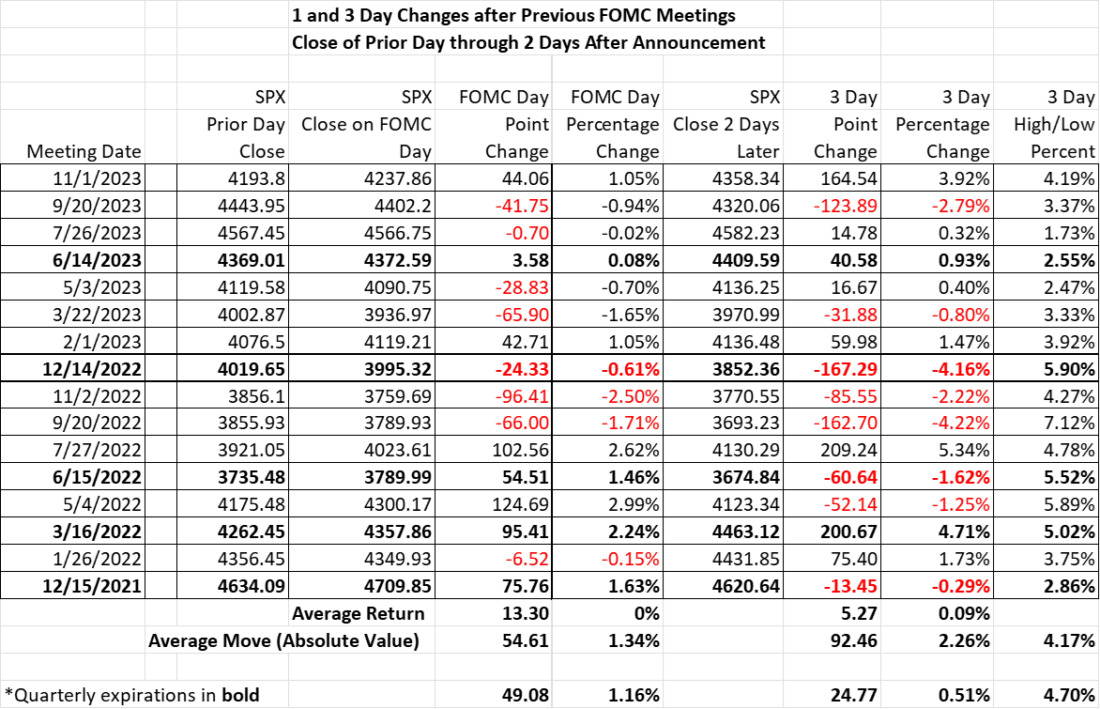

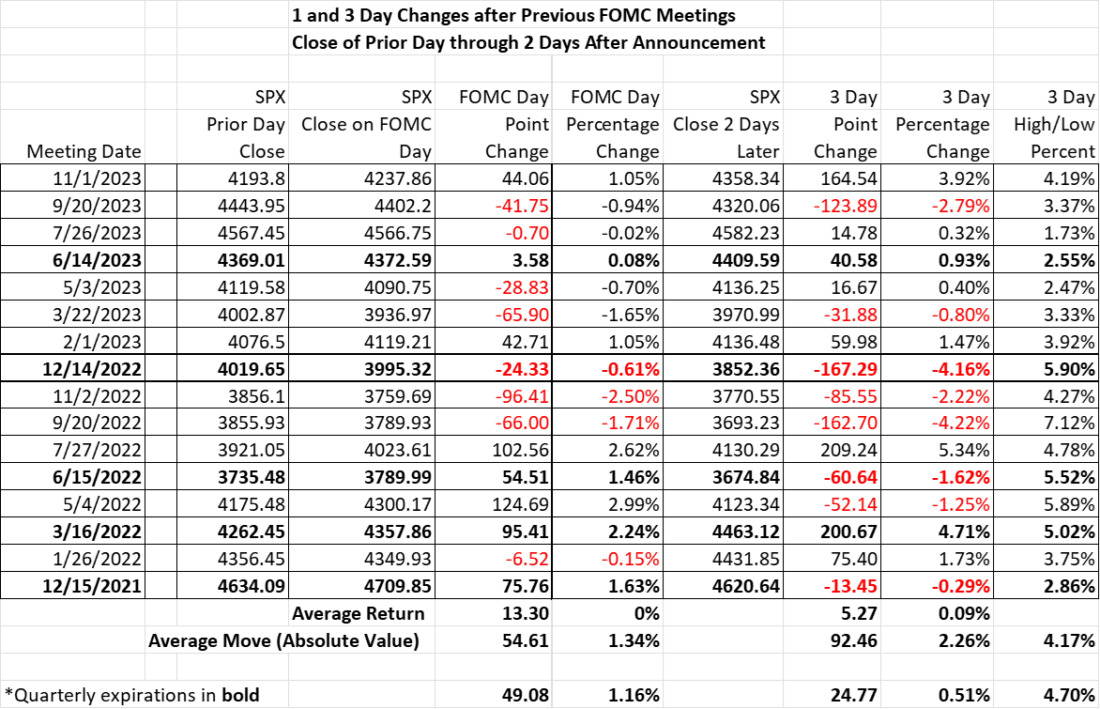

By the way, here are some useful reminders. The chart below shows the current pace of quantitative tightening (QT) on the Fed’s balance sheet. The latter table shows the reaction of SPX to recent FOMC meetings. Bear in mind that this week is a quarterly expiration, so the dates in bold may hold more sway.

Source: Interactive Brokers, Federal Reserve

Source: Interactive Brokers

—

[i] The Seuss-ically named vocalist, uncredited in the original cartoon, was also the voice of Tony the Tiger. “They’re Greeeaaaattt”

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.