The title of today’s piece is taken from an order reportedly issued by Colonel William Prescott at the Battle of Bunker Hill. The American revolutionaries had much less ammunition than the British forces, so the order was issued to ensure that the precious gunpowder would only be utilized when there was a higher likelihood of aiming successfully. Markets seem to be taking the same approach when it comes to the looming debt ceiling crisis, with one notable exception.

For investors, the key questions are, why should we worry about this now, and if we do need to worry, when should we start? But in the meantime, most have decided that they’ve seen this movie before, and remember that it always had a satisfying ending regardless of the suspense. They are holding their concern until it seems apparent that the outcome will be different this time. Many realize that, “it’s different this time” can be the four most dangerous words in investing.

The debt ceiling is a legislative cap on borrowing. Raising that cap creates a weird political ritual, somewhat unique to the US, that often leads to fiscal brinksmanship. Both parties need to agree to raise the limit, and both are loath to cede leverage over the government’s purse strings. Once again, we find ourselves amidst an array of unproductive finger pointing and scare mongering, wondering whether good governance can outweigh political infighting.

Concerns about the debt ceiling have been percolating for months. We wrote about the situation in January. In that piece we wrote a one-act play, a lighthearted marital drama, to illustrate the terms of the debate. In short, the debt ceiling addresses money that has already been spent or is committed to be spent in the near future. The crux of the current debate revolves around legitimate concerns about future deficit spending and whether those should be addressed now, while a potential crisis looms, or as part of the budgeting process in the coming months.

Although we have seen the crisis looming, it has taken on greater urgency in recent weeks. Treasury Secretary Yellen has been warning that the US government could run out of money as early as June 1st. She acknowledges that the date is only an estimate, so markets understand that if there is indeed a crisis, it may be somewhat afterwards.

The Cboe Volatility Index (VIX) is “designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market” The debt ceiling can certainly come to a head during that 30-day window, yet VIX is currently at about 17.5. That is above the most complacent levels seen a week ago, but hardly demonstrates a strong demand for volatility protection.

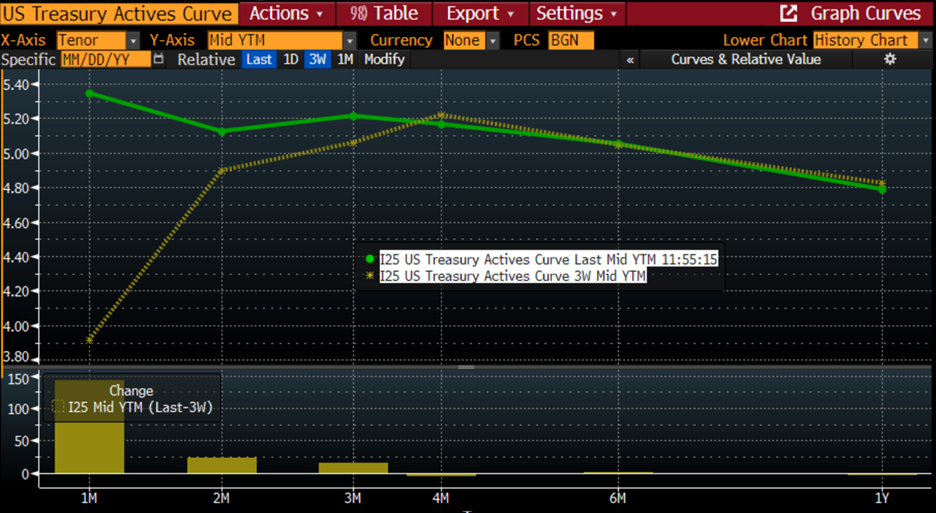

That said, Treasury Bills are not taking the negotiations lightly. Three weeks ago, we noted that T-bill rates were pricing in some incremental concern around the time that a potential default could occur. Since then, the concerns seem to have grown:

US Treasury Yield Curve, 1-Month to 1-Year, Today (green line), 3-Weeks Ago (yellow dots and asterisks)

Source: Bloomberg

Even allowing for the fact that the prior 2-month bills are now 1-month to maturity, and the fact that the FOMC raised rates by 25-basis points last week, we see the rates on bills maturing in June rise from about 4.88% to 5.33% in the course of three weeks. The inversion in the curve shows that T-bill holders – many of which are money market funds – are concerned that a government shutdown could delay the timing of expected payments. But this is a temporary concern, since rates fall back to within the expected Fed Funds target range shortly thereafter.

The longer-term concern is what penalty could be placed by foreign investors upon US Treasury debt. We have never failed to pay our debts – and in theory the 14th Amendment prevents us from doing otherwise – and there are legitimate fears that even a temporary default could cost the Treasury more to borrow over time. But that is a longer-term concern. In the meantime, even large investors are outgunned by Congress and the Treasury, and thus keeping their powder dry until circumstances clearly dictate.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/smush-webp/2024/04/tir-featured-8-700x394.jpg.webp)

![[Gamma] Scalping Please [Gamma] Scalping Please](https://ibkrcampus.com/wp-content/uploads/2024/04/tir-featured-8-700x394.jpg)

I really don’t believe repaying debt with debt is the way to go. Each time the debt ceiling comes up, financial catastrophe is threaten. Yet we never really try to balance spending with revenues. It is that far out of hand!. We simply kick the can don’t the road another year spending mor & more,. It’s a Hugh growing snowball, now so big, no one dare try & balance, much less repay. So, let’s default!

Thank you for sharing your opinion, N Bisges.