Sometimes a single statistic acts like a blast of cold water in traders’ faces. After some early, bond-induced selling in pre-market futures, the “buy-the-dip” crowd began its reflexive hunt for bargains shortly after the US opened. Just as it seemed as though the major indices might claw back to yesterday’s closing levels (which themselves were puffed up by furious end of day buy programs), markets got a major jolt from economic news.

We are referring, of course, the August JOLTS Job Opening report that was released at 10 AM EDT. It showed a significant, unexpected leap to 9.61 million, well above the 8.815 median estimate. We also saw July revised higher by 93,000 to 8.92 million. This pushes back against the notion that the labor market is easing. It is hard to imagine wage pressures decreasing if there are increasing numbers of unfilled jobs.

To put it mildly, stocks plunged. The S&P 500 (SPX) and NASDAQ 100 (NDX) plunged from roughly -0.2% and -0.1% lower to over -1% down in just 15 minutes. Yesterday’s love for the Magnificent Seven stocks, which was sufficient to keep indices afloat, has evaporated. They are either leading the declines or falling commensurate with the rest of the market.

Against the backdrop of continually rising interest rates – the 10-year US Treasury yield is up another 8 basis points to 4.76% (btw, the Canadian 10-year is up 22 bp after yesterday’s bank holiday) – and ahead of Friday’s employment report, it is clear that equity traders have gotten more skittish. We see a renewed demand for volatility protection reflecting that nervousness. The Cboe Volatility Index is flirting with, a level not seen since May:

VIX 6-Month Daily Bars

Source: Interactive Brokers

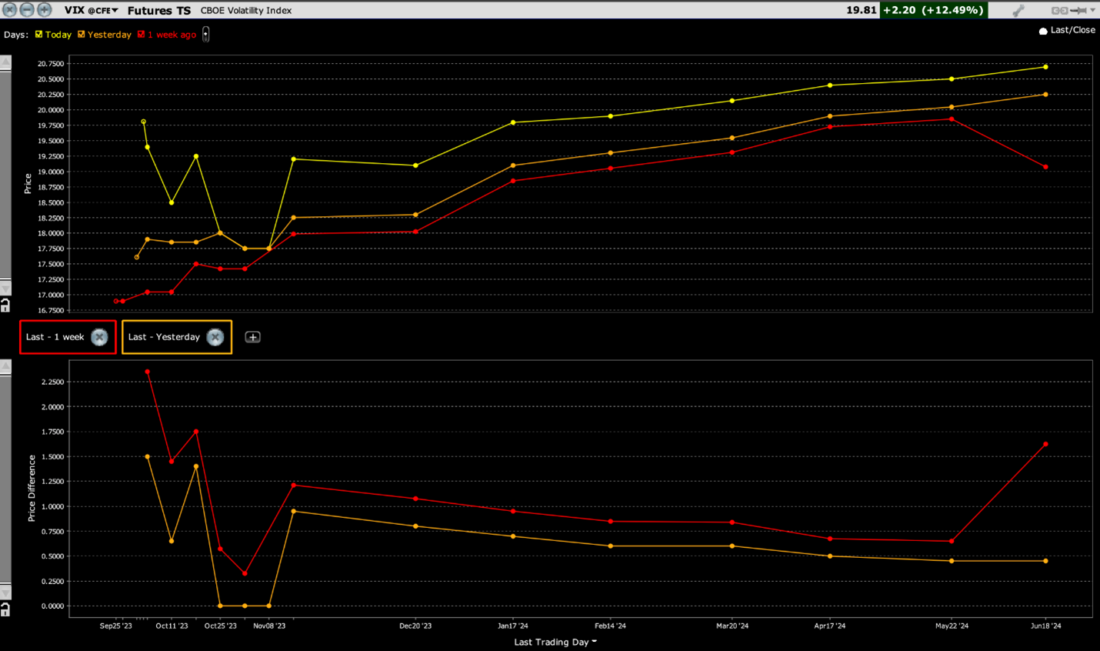

Perhaps more interestingly, we have started to see a small amount of backwardation in the VIX futures curve. It is important to remember that backwardation implies a short-term scarcity in the commodity that is being traded. In the case of VIX, that means that there is relative scarcity of volatility protection, at least between now and the end of the year:

VIX Futures Term Structure, Today (yellow, top), Yesterday (orange, top), 1-Week Ago (red, top); with Changes, Yesterday-Today (orange, bottom), 1-Week Ago (red, bottom)

Source: Interactive Brokers

Not only has the curve moved higher overall from November on, but we have a sharp rise in futures that expire from tomorrow morning through the monthly expiration on the 18th of this month. It is notable because we have greatly diminished the levels of complacency that had caused us some angst over the past few weeks – as recently as six days ago. That said, this hardly indicates the sort of levels that proceed major capitulation, which is why still stick with our comments from Friday:

Considering that the modest bounces in equities that occurred over the past couple of days hardly seem like a major bottom, I’m concerned that the rockiness can persist over the coming weeks.

Before events overtook us, I intended to write about another potential jolt to the economy: the resumption of student loan repayments. Remember, loan repayments are unproductive spending. Money that could have been used for goods, services or savings and investment – all of which have economic benefits – will now be redirected toward paying down loans. This will be a harder topic to quantify, and I received some helpful guidance from my colleague Jose Torres, our senior economist, on the topic. In his view, the resumption of student loan repayments “the pressure on spending will shave off at least 0.6% and up to 0.9% from real GDP through direct and indirect channels.” That is unhelpful for those expecting a soft landing. My concern for markets is that borrowers who have defrayed loan repayments might now need to sell investments to free up cash, adding a headwind to equities in general, and tech stocks and cryptocurrencies in particular. I expect Jose and I to discuss this more in the near future.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Thanks as always

Peter, there is nothing we love more than satisfied customers.

Hi – Does it get any better in terms of even an e-mail to reach anyone at IB? I am in NYC, would be great to hear there are plans to open a basic brick and mortar. But if that is still off in the future, a tel # or e-mail or some sort of response would make me move a few hundred thousand into an account. Thank you

Steven, we would appreciate the opportunity to turn around your experience. We have various support options available (chat, email, phone) and we would be happy to answer general questions here. http://spr.ly/IBKR_ClientServices

Thank You Steve, I love your posts and was concerned for your health when I didn’t see your posts. I read them daily and thank you for sharing your thoughts on the market. I certainly appreciate it and wish you good health.

Hello Vinay, thank you so much for sharing this. We thank you for your business and kind words!