Last quarter was a phenomenal one by almost any standards for a wide range of risk assets in a large part of the globe. But markets are forward looking, by definition. Great quarter, guys – what will you do for us next quarter?

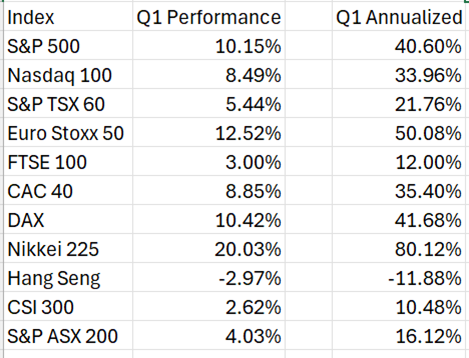

Last week, I put the phenomenal performances of global markets into perspective by annualizing the Q1 results for several key indices.

When displayed that way, it is difficult to imagine that major markets will be up 30-40% or so for the year (Imagine If We Could Annualize This Quarter…). So the question becomes, “can this remarkable momentum continue unabated?”

To answer the basic question: sure, the momentum can indeed continue? Paraphrasing Newton’s First Law, “markets in motion tend to stay in motion until acted upon by an external force.”

But we can’t assume that markets will remain essentially impervious to external forces indefinitely. What might those external forces be?

- Earnings season begins in a couple of weeks. Expectations are generally high after last quarter’s performance, but are those reasonable?

- Another factor is seasonality. Will “sell in May and go away” apply this year? Seasonality is a fluky thing, but it might behoove investors to consider how to apply more defensive strategies while they still have a month to prepare.

- To that end – dividend paying stocks – specifically those whose cash flows support steady payouts — offer downside protection while still allowing participation in a broadening market. Think of dividends as providing ballast to one’s portfolio. While the sexiest investments this quarter have tended to be those with low payouts – like tech stocks – or no payouts — like bitcoin and gold – if we’re considering strategies for a sideways or rocky market, dividends become much more appealing.

- Think about insurance using options. Even though it’s never been more expensive to insure your home, it’s rarely been cheaper to insure your portfolio. With any insurance, you don’t actually want it to pay off! But you do want to sleep better at night. I don’t love writing my semi-annual homeowners’ insurance checks, but I’d much rather not put in a claim.

- Another theme to watch in the coming weeks: Does the Fed really need to cut rates? Fed Funds futures are questioning that theme after today’s surprise ISM Prices Paid reading of 55.8 (vs. 53 expected and 52.5 last month). The likelihood for a June rate cut slipped below 50% briefly today, though it is now around 56%. But I continue to ponder why we need rate cuts if all manner of risk assets are rallying, including foreign stocks and cryptocurrencies. Credit spreads and credit default swaps show no signs of overt stress, and the FOMC’s Summary of Economic Projections now anticipates 2.1% real GDP growth for 2024. Do those seem like the conditions that are calling for immediate cuts?

We’ve all heard countless times that past performance is no guarantee of future results. After nearly six consecutive quarters with terrific performance, it’s tempting to extrapolate those results into the next. As we said above, the trends can indeed continue. They’re quite robust, to say the least, and very hard to bet against. But blindly expecting them to continue is more about hope than strategy. There are certainly strategic reasons to avoid “fighting the tape”, but it is always a prudent move to consider what might alter the market’s mood and mindset. You don’t get warnings when that wile occur, so you need to consider why and how it might.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Sell in May did not work last year but the buy October/November did.. The market will go back down 5% or 10% again, or more, who knows when. Selling call options, or selling the stock, putting it in 5% bills, and selling put options a few strikes down is another way to take profits and have a position. You might buy it back later at a lower price on a big dip, but most likely you pocket the option money.