Study Notes:

Conditional orders allow the user to create multiple stipulations for multiple instruments that must be true to activate an order. For example, you may want to buy 100 shares of symbol AAPL at the market if SPY drops 3%. Conditional orders can be created in both TWS Classic and Mosaic and used outside of regular trading hours. A conditional order can also be used to cancel a prevailing order. For example, if you have a limit order to buy 100 shares in symbol AAPL, you could create a conditional order that would cancel that order in the event that symbol SPY is higher on the day by more than 2%.

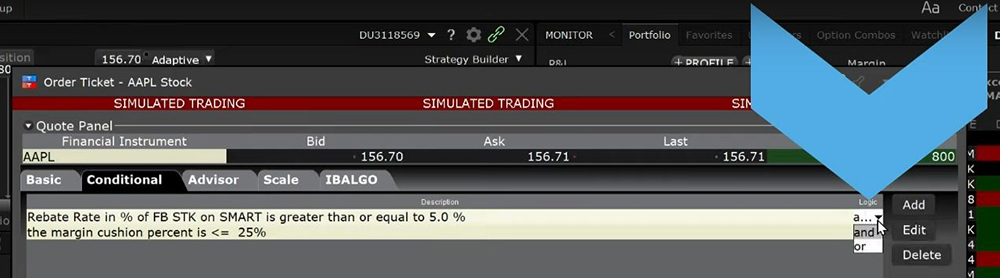

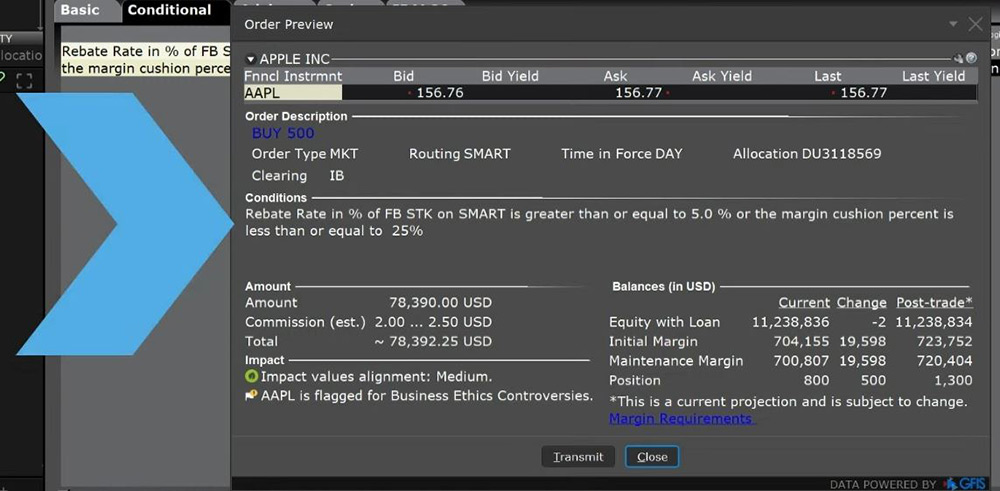

We will now walk through creating a conditional order in Mosaic to buy 500 shares of AAPL at the market if the rebate rate in Meta – symbol FB – becomes greater than or equal to 5%, or the margin cushion is 25% or lower. And choose to allow the conditions to be satisfied outside of regular trading hours. Later, we will then edit the existing order to change the margin cushion from 25% to 20%.

- From the portfolio tab or any Watchlist right click on the symbol AAPL and scroll down to “Trade”.

- From here select either: “Create a Buy Ticket” or “Order Ticket”.

- Once selected an order ticket box will appear displaying the Basic tab .

- Even if you choose “Create a Sell Ticket” accidently, it can be changed in the upper left-hand side under “Action”.

- We’ll create a market order for 500 shares. Once you have input all the order criteria click on the Conditional tab to the right.

- If you don’t see it there click on the grey arrow to the right of the last tab.

- At the bottom of the screen click on the box next to “Allow condition to be satisfied and activate outside of regular trading hours” and choose to submit an order if the stipulations are triggered. Underneath is where you can select to cancel the order instead.

- Now we will create the conditions necessary for the order to be submitted. Click on the Add button in the top right-hand corner and the “Create Condition” box appears.

- You can choose from the following conditions: Price, Margin Cushion, Volume, Percentage Change, Rebate Rate in Percent, Time, Daily P&L, Trade, and Shortable Shares.

- We will start with setting a condition for the rebate rate in percent. Click Next.

- Now select another underlying, it does not need to be the same underlying the order is for. I’ll choose FB for Meta, and set the rate to greater or equal to 5%. Click Finish.

I will add a second condition by clicking on the Add button, choosing Margin Cushion, and next. I’ll choose less than or equal to 25%. On the far right of each condition is the word “and”. You can choose whether multiple conditions need to be met, some conditions need to be met, or just one of the conditions needs to be met by switching between “and” and “or”. For this order set the conditions so either one will trigger the order by changing and to or.

When everything is set click Preview on the bottom left-hand corner and the Order Preview box will appear. In the middle the Conditions section displays a summary of the condition or conditions needed for the order to be submitted. When ready click Transmit in the lower left-hand side. The order will populate the Activity panel with a green background for the row indicating it is a Conditional Order.

Once the order is sent and has not been activated you can go in and change the conditions and/or order details by right clicking on the row and selecting Modify, then either Order ticket or Condition. Selecting Condition will take you directly to the Conditional tab while if you select Order Ticket you will have to click on the tab when the Order ticket appears on the screen. Once you are in the Conditional tab click on one of the Conditions. Let us choose margin cushion. Click on Edit on the right-hand side. We will change the Condition parameters to 20%. Click Finish. Click Transmit.

Conditional Orders allow the user to create an order dependent on a single or multiple defined stipulations to trigger it. They can be extremely useful in preventing an order from being sent unless certain circumstances become true.

Can you place conditional orders for options combos?

Hi Danie, thank you for reaching out. Yes, you can place conditional orders for options combos. If you have any other questions, please let us know.

Can a conditional order be placed to become activated at a specific date?

Ex. on monday, enter sell on market close order that activates Friday on open

Hello Richard, we appreciate your question. For conditional orders, you can choose from and combine logical conditions from Price, Time and Volume variables using operators of equal to, greater or less than. You can review this page for more details: https://www.interactivebrokers.com/en/index.php?f=584. We hope that helps!

HI

Is there any presets or hotkeys available for conditional orders?

Hello Raj, thank you for asking. We have a user’s guide page that covers HotKeys, including creating them for a specific order type. Check it out here and let us know if you have any more questions: https://www.ibkrguides.com/tws/usersguidebook/configuretws/hotkeys.htm?Highlight=hotkeys#XREF_39191_To_create_a_Buy

Could you please clarify what the “Percentage Change” condition means? Is this %change from previous closing price, opening price, high/low price during the day (what about outside RTH?), or how is it defined?

Thank you for asking, Anonymous. The Change % is the difference between the last price and the close on the previous trading day (regular trading session). In the future, you can however over a column in TWS to get the tooltip description. We hope this helps!

Can I place conditional order to buy option once stock reaches specific price ?

Hello Kastytis, thank you for asking. Conditional orders allow the user to attach one or more stipulations that must be true before the order can be submitted. This might allow an investor to only buy/sell an option if its underlying is trading above or below a specified level. For more information and an example, please visit https://www.interactivebrokers.com/en/index.php?f=584.

can I include a “open price of a stock less than $10” as a condition? Thanks

Hello Jeff, thank you for asking. This should be possible based on our user guide page on the conditional order type (https://www.ibkrguides.com/tws/usersguidebook/specializedorderentry/conditional.htm) which states, “Select whether the price of the contingent asset should be less than or equal to (<=) or greater than or equal to (>=) the trigger price.” Please let us know if you have any other general questions.

Hi, in what order do the “and” and “or” operators work? What if I want to create condition= condition_1 AND (condition_2 OR condition_3)? Thanks

Hello Yuri, we appreciate your question. To confirm the logic for your conditional order, you can create a web ticket. There is a “How to Use” category in the Secure Message Center.

What happens if I set up the condition = (condition_1 OR condition_2 AND condition_3)? According to the rules of Boolean logic, the AND operation must be performed before the OR operation. Is that how it works?

Hello Juri, we appreciate your question. To confirm the logic for your conditional order, you can create a web ticket. There is a “How to Use” category in the Secure Message Center.

What is the default method in create condition dialog using Price as a factor? How can I change this “default”?

Thank you for asking, Da. When you add a price condition in TWS, a window pops up that allows you to configure the condition. It will have several blank fields that you will have to fill out (underlying symbol, trigger method, operator, and trigger price). Please review this webpage for an example: https://www.interactivebrokers.com/en/index.php?f=584

Is it possible to set the limit price at the time of the condition automatically? e.g. when conditions are true, set limit to (ask + $0.05) –> $0.05 above ask

e.g. when conditions are true, set limit to (mid*1.01) –> 1% above mid

Thank you for reaching out, Anonymous. This is a good question, and we encourage you to create a web ticket to get the best answer for it. There is a category for “How to Use.”

I have already create an option combo and buy it, and I wanna close it when the underlying stock hit a specific price level. If I place a sell order of that option combo with price condition , will the order sell the existing option combo I bought previously or just to sell a new option combo to get the option premium

Hello Samuel, thank you for reaching out. Please view this FAQ for more information on Conditional Orders. We hope this helps!

Conditional Orders | Interactive Brokers LLC

Conditional orders let you attach one or more conditions that must be true before the order can be submitted

http://www.interactivebrokers.com

In TWS can I place a conditional order which is dependednt on another order being filled e.g I have a diagonal spread that is only filled if my Call spread is filled

Hello Femi, thank you for reaching out. Conditional orders allow the user to attach one or more stipulations that must be true before the order can be submitted. Please view the link below for more guidance on how to place a Conditional Order in TWS:

https://www.interactivebrokers.com/en/index.php?f=584

We hope this helps!

How does the logical operator precedent work ?

The UI Has (for example)

Price XYZZY > 100 AND

Time > 12:00 AND

PRICE ABCD 100 AND TIME > 12:00) OR (PRICE ABCD 100) AND (TIME > 12:00 OR PRICE ABCD < 200)

Maybe Soe other way?

Hello David, thank you for reaching out. Conditional orders allow the user to attach one or more stipulations that must be true before the order can be submitted. Please view this webpage for additional information about conditional orders: https://www.interactivebrokers.com/en/trading/orders/conditional.php

We hope this helps!

Hi, how can I save the conditional order? It is troublesome to enter it everyday.

Hello, thank you for reaching out. In TWS, you can save a conditional order by clicking the “Save” icon in the Conditional Order box. This will save the order for later use. Please view this webpage for more information: https://www.interactivebrokers.com/en/trading/orders/conditional.php

We hope this helps!

How to buy an option contract at the ask price if the underlying reaches a certain price level?

Hello Sampad, thank you for reaching out. This FAQ addresses your question: https://www.ibkr.com/faq?id=94320701

in my account i set up a conditional order to sell X share of QQQ Nasdaq stock if the close is >= a certain price, i used the trade type of LOC so it would only execute if close was > my limit price, but when i tried to transmit the order it said only trade type LMT can be used but i am concerned that would execute anytime during the day if the condition is met, i only want it executed if close satasfines the >= price i set??? how to do this or will LMT work????

Hello, thank you for reaching out. Please view this FAQ for instructions to create a Conditional Order:

https://www.ibkr.com/faq?id=28224878

We hope this helps!

I like the conditional order features. Is there also a way to cancel based on time or price?

For example: Cancel if AAPL is less than or equal to $170 or Cancel if past a certain date/time?

Hello, we appreciate your question. There is no way to specify a time or price at which a conditional order will automatically be cancelled. You need to manually cancel the order if you no longer want it to be eligible to become active.

We hope this helps!

Are conditions based on % change in the price of a instrument sensitive to positive and negative percentage changes? That is to say, do I need to specifically write -0.5% or 0.5% as a condition, or will both be triggered up and down movements be triggered if I write 0.5%?

Why are you not able to place trail buy and trail sell orders as part of conditional orders? An error appears when you try to transmit the order saying that trail orders are not available as part of conditional orders? What solutions are available for this?

Hello Daniel, thank you for reaching out. Please review our available order types on our website: https://spr.ly/IBKR_OrdersCampus