Those toasting with mimosas on New Year’s might want to consider the recent spike in prices – not so much from the Champagne – but from the orange juice! Join us in this lively discussion about frozen concentrated orange juice (FCOJ) futures with Sean McGovern, Vice President of Research at McAlinden Research Partners, as well as Jeff Praissman, IBKR’s Senior Trading Education Specialist, Cassidy Clement, IBKR’s Senior Manager of SEO and Content, and Steven Levine, IBKR’s Senior Market Analyst.

Learn about what’s been driving costs higher for producers and consumers, alike, and how China has been helping to grow Coca-Cola’s Minute Maid Pulpy sales! All this and more, as our agricultural commodity series continues..

Summary – IBKR Podcasts Ep. 124

The following is a summary of a live audio recording and may contain errors in spelling or grammar. Although IBKR has edited for clarity no material changes have been made.

Steven Levine

Hello, and welcome to IBKR Podcasts. I’m Steven Levine, Senior Market Analyst at Interactive Brokers. I’m your host for today’s program. We’re capping off 2023 with a nice, refreshing discussion about orange juice. Later, I suppose we’ll have Champagne and maybe a couple of mimosas. What do you think? But as you might have guessed, we’ll be talking about frozen concentrated orange juiced futures – with Sean McGovern, Vice President of Research at McAlinden Research Partners, Jeff Praissman, IBKR’s Senior Trading Education Specialist, and also back with us is Cassidy Clement, IBKR’s Senior Manager of SEO and Content. You might remember Cassidy. She gave us some insights into her personal consumption of what became very expensive bagels, I remember, in our ‘War on Wheat’ podcast earlier this year. I urge listeners to check that out. She’s also been hosting a ton of podcasts in our newly released series on financial literacy, personal finance, and career development called ‘Cents of Security’. Those are very well done. You just did one on ‘Lessons from a Hedge Fund Manager’, I remember, with Databento’s Christina Qi. We’ll give you some links in our show notes for that, so you can listen there as well.

So, welcome back, everyone. Welcome! How y’all doing?

Sean McGovern

It’s kind of hard to believe we’re coming up on the end of the year. No one’s really said that to me until just now. So, the realization’s hitting me.

Steven Levine

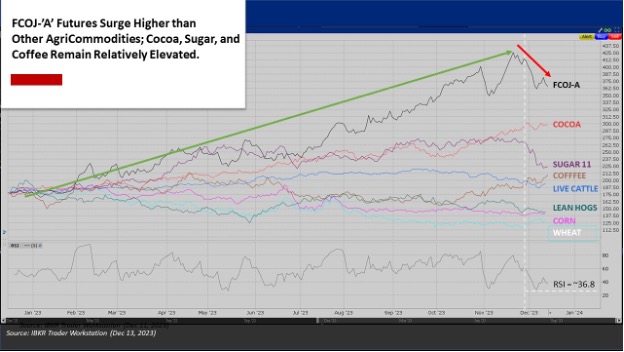

For those of you just tuning into this series on agricultural commodity futures, both Sean and Jeff have given us some really great insights. As mentioned, Sean’s with McAlinden Research Partners. It’s an independent investment strategy group that focuses on identifying alpha-generating investment themes. They’ve got a lot of great commentary on our Traders’ Insight platform. You’ll want to read their analyses there. Jeff’s been using our Trader Workstation platform, and tools … his own research … and he’s provided us with details on how futures prices have been performing, as well as related company stocks and other instruments, and we have covered pretty much the gamut … I mean, it’s been a wide spectrum of commodities through this series: coffee, wheat, corn, cocoa, sugar, live cattle ,and lean hogs, and today – orange juice.

This is it – 2023 is going to be in the ‘bucket of 2023,’ and we’ll start filling up 2024 pretty soon … pretty amazing, I know.

But before we get into just how much the cost of orange juice has spiked, and it has spiked. And although it seems some of the agricultural commodity futures we’ve discussed this year are still on elevated levels – sugar, for example. By comparison, frozen concentrated orange juice … this is referred to in the markets as ‘FCOJ’ … far and away has seen the most dramatic increase in prices, and we’ll be talking about that.

FCOJ’s Origin Story

Steven Levine

A bit of background: FCOJ futures have traded in New York since 1966, first on the New York Cotton Exchange and then on the successor New York Board of Trade. It’s now on ICE Futures – that’s the Intercontinental Exchange. By the way, same year, 1966 – that’s when live hog features were introduced. We covered that on our last podcast on lean hog futures. Okay, so I read an article in Time Magazine online – it appears that unlike apple and tomato juice, orange juice didn’t fare so well with the early freezing and transporting process of the 1930s. So, people generally had tomato juice with their eggs and bacon. It wasn’t until 1945 that some Florida-based scientists at the USDA managed to find a way to keep OJ’s flavor somewhat intact – it came out as ‘gloop’, I understand, from the early transport process. And then with World War II underway, and with an effort to provide soldiers with vitamin C, a businessman and scientist named Richard Stetson Morse was called upon to apply certain of his techniques … some scientific magic he concocted … that ultimately led to the creation of concentrated frozen orange juice, which was then introduced to the general consumer for the first time in 1946, and this product … can anyone guess?

Sean McGovern

Was it Minute Maid?

Steven Levine

It was Minute Maid. Yes, it was! It was Minute Maid!

Sean McGovern

Whoa, how about that?!

Steven Levine

And that Minute Maid was bought by Coca-Cola in 1960 … and this was only six years before FCOJ futures started trading, which I find really kind of interesting because, you know, there’s a lot of coincidentals between when the commoditization of these products came to consumers and when they first started trading as futures on the exchanges. But Minute Maid is still with Coca-Cola, and I guess we can thank Mr. Morse for that … otherwise we’d still be drinking tomato juice and apple juice, but we wouldn’t have orange juice on our tables.

Now, we’re going talk about the reasons for this, as well as our own experiences with buying orange juice, but as I understand it, these FCOJ futures recently – they hit a record high, didn’t they? And if you look at some items on Amazon’s price tracker, this is through this Camel, Camel, Camel site, I’ll just say that at this point – they’re up, and they’re up substantially.

So, Sean, first, what can you tell us about these futures contracts? How are they traded? What should investors know about them in terms of delivery, et cetera? And what oranges are we talking about –what is the ‘O’ in FCOJ? Are they Valencias? Are they naval? What kind of oranges are we talking about here?

Trading FCOJ Futures – What to Know

Sean McGovern

Well, you actually got it right there. The juice included in the FCOJ contract comes from the Valencia orange, which is a sweet orange. You also have sour and Mandarin oranges as the other two varieties, but sweet oranges are the most commonly grown variety for commercial distribution in the U.S. That’s likely because they produce so much juice as compared to other sweet oranges. As an example, it takes about three Valencia oranges to produce a cup of juice, but you only get a third of that juice with the same amount of navel oranges. Also, you mentioned how difficult it was in the past to keep the orange juice fresh in transit. Well, Valencia orange juice maintains freshness and sweetness longer than the other comparable oranges. Basically, it’s just the best balance of all the factors needed for mass production and distribution of orange juice. As for the FCOJ-A contract, which is traded on the Intercontinental Exchange … so, that’s ICE … the majority of this juice is going to be coming from the U.S. and Brazil – specifically, the Florida and São Paulo regions. But it can also originate from Costa Rica or Mexico. These contracts are tied to 15,000 pounds of orange juice in solid weight and are physically delivered in January, March, May, July, September, November. You’ve got six months there. FCOJ is going to be one of the more thinly traded futures contracts in terms of volume, but those have really been some of the best performers this year. I mean, we talked about cocoa not long ago, and that’s one of these, you know, not really one of the big ones you think of right off the bat but big performer.

Steven Levine

It’s amazing. I mean, the last I looked, they were they were really, really high. Jeff, what are you seeing there for frozen concentrated orange juice futures?

Jeff Praissman

They definitely have increased steadily all year. They’re actually off their peak. It looks like they hit a high of around 429-ish or so, and they’re actually trading a little bit down at 363, but so far ahead of …

it was about 175 or so back in December of 2022 … a huge increase, obviously, up to the current value of 360-something for those futures.

Steven Levine

It went from 175 to 360? 175 at the start of the year?

Jeff Praissman

Yes, yes. 175 to 180 or so.

Steven Levine

Okay, 360 or so from 175 to 180. So, that’s almost…

Jeff Praissman

Huge.

Steven Levine

Yeah.

Jeff Praissman

They increasingly increased in price throughout the year.

Steven Levine

I mean, that’s just incredible. So, what’s driving this, Sean? What’s happening here? What’s happening with Valencias? I suppose, that’s the question.

Production Squeeze

Sean McGovern

The USDA’S data puts global orange production at 47.8 million tons for the 2022-2023 marketing year. It’s actually down 5% from the prior year … contraction in supply, which explains some of the really bullish price action we’ve seen in the FCOJ prices. In fact, orange juice production fell even more steeply than the output of oranges themselves – estimated at a 9% decline year-over-year, down to 1.5 million tons. There were a few years, where OJ output actually exceeded 2 million tons back in the late 2010s, but we’ve since we’ve entered the 2020s, we’ve yet to see anything approaching that level.

Steven Levine

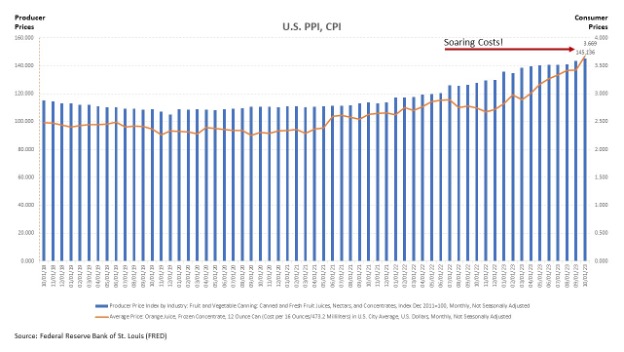

So, what are the input costs for producers, and what’s happening there? What are you seeing with CPI [Consumer Price Index], PPI [Producer Price Index]?

Sean McGovern

So, orange juice, and fruit juices more generally, fall under the non-alcoholic beverages and beverage materials category of the CPI. You’ve got frozen and non-frozen carbonated juice and drinks within that category, and those two, sort of sub-indexes, they jumped by 4.1% and 22.1% year-over-year in October, respectively. Both of those sub-indices rose faster than the broader category, and the CPI as a whole. The gain in the frozen non-carbonated sub-index was actually the largest ever. You can look at some of the average price data that shows canned orange juice – that’s kind of what we’re talking about more when we’re talking about concentrated orange juice – it’s going to be in cans as opposed to like freshly squeezed orange juice, which you’ll see in bottles, right.

Steven Levine

Right.

Sean McGovern

So, the 16 ounces of canned orange juice is now up to almost $3.70 per 16 ounces. That’s 57% higher than it was at the start of 2021. The story is kind of the same in regard to producer prices, the PPI series for frozen fruit drinks, ades drinks, cocktails – that was up almost 20% in October, and a 10% rise was clocked in the canned fruits and juices.

Steven Levine

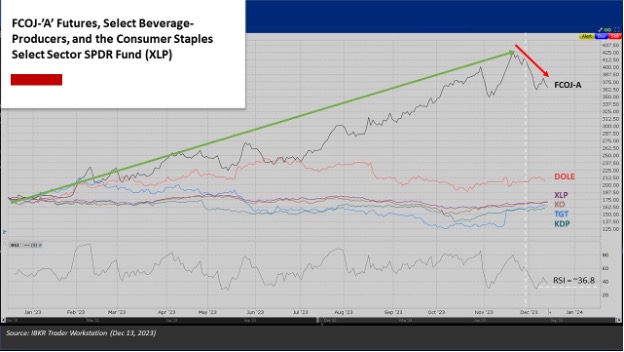

Wow, it would make sense that the prices for these for consumers are being passed along by those companies that are producing these. It’s interesting, because there aren’t a lot of publicly traded orange juice companies. You can’t really look up a bunch of stocks for companies that offer orange juice. Tropicana used to be part of Pepsi. Now, I understand, they’re part of a private equity company – PAI Partners, I believe. Minute Maid is part of Coca-Cola. So, it’s really hard to parse these out.

But is there a certain report or something that investors can look at? I know you mentioned the USDA, but is there like a citrus report or something that… I remember Trading Places. I don’t know if anyone’s ever seen Trading Places. It’s been talked about a lot on our podcasts early on, but it is a central part, or component to that narrative, isn’t it? That climax of that story was based on obtaining the agricultural forecast for frozen concentrated orange juice. So, is there a report like that that people can go to to do their research? Maybe not game it in the same way that they did in Trading Places, but … and that movie was in the ‘80s, I believe it was ’83. Anyway, Sean, is there a report out there?

Sean McGovern

Well, I’m really glad you brought up Trading Places, because I mentioned that we’d be recording this podcast to my dad. I think he thought I was making a joke. He loves that movie, but I’m pretty sure he thought orange juice futures were like something they made up in the movie. ‘Cause out of context, it sounds kind of like a weird kind of futures contract to trade. It’s so specific. So, I guess I can’t blame him, but and I won’t go any further to avoid spoiling anything from the film. There’s some homework like you said – homework assignment for the listeners that haven’t seen the movie. Take your newfound knowledge of these futures contracts, and go watch Trading Places. I think the report actually that they cited in the movie is real, but it’s not going to move markets maybe as much as that did. I’m looking more at weather patterns and things like that, right … things that kind of develop more over time.

Steven Levine

OK.

Sean McGovern

Hurricanes, and hurricane season, generally is what you really need to watch out for when it comes to oranges, and the orange juice supply. As a really good example, Hurricane Ian, back in 2022, that cost Florida as much as up to a third of its crop for the year. There are a lot of suggestions out there that these kinds of disruptions could be worsened by the potential for climate change to create more destructive storm seasons in years to come. Another big thing is the Citrus Greening disease. That’s a major driver of the thinner supply that we’ve seen recently in the U.S. That’s really slammed Florida for decades now, impacting millions of acres of citrus crops. But it seems to have gotten even worse recently. The greening is exactly what it sounds like, by the way, the oranges from those infected trees, they don’t grow properly, they turn greenish, they end up tasting very bitter, upsetting that ideal balance I mentioned earlier with the Valencia oranges.

Steven Levine

So, that’s a primary driver these FOJ futures are as high as they are?

Contracting Supply & Disease

Sean McGovern

Yeah. Yeah. Well, here’s the other thing, too, is that if you break it down to all the different countries that produce orange juice, right – I’ve mentioned Brazil; I’ve mentioned the United States, already. The next biggest producer behind Brazil is actually Mexico. And the U.S. comes in at third place. But the difference between Brazil and Mexico: so, Brazil’s making over 1.1 million tons of orange juice; Mexico’s making 176,000 tons. So, we’re talking about a six-times difference between the number one and number two producers. The U.S., at number three, as I said, they only made 85,000 tons, but that was actually an all-time low for U.S. output, and that was cut in half over the course of just one year in the 2022-2023 period. Really, we saw reductions in supply among all major producers outside of Brazil, with Mexico and the European Union also reporting double-digit percentage drops in 2022-2023. With this in mind, I think we’re already getting a clearer idea of why we’re getting to the all-time highs here in the FCOJ market. And the big thing we’ll be watching for with Brazil is because they have not yet seen a huge drop-off in production like many of the other orange growing regions, they’re still very much at risk for seeing a mass spread of that greening disease. There’s a study I read that showed more than 50% growth of greening in Brazil’s main orange producing region around São Paulo, and If you look at the country as a whole, the incidents increased to 38% from about 25% last year, and that’s the biggest percentage jump since 2008. So, that’s a region – key region – to watch that has not really been affected as badly as other regions by the greening, but could be at risk going into the next year and that could potentially lead to maybe another leg up for these FCOJ futures, depending on what global demand looks like.

Steven Levine

Yeah, these diseases seem to be affecting agricultural crops. I know, in past podcasts … we’ve talked about coffee as well … that was also something. Interesting stuff. So, just like we found National Cereal Day, which I I’m sure you will never forget, and National Pulled Pork Day, which is another one, there is also a National Orange Juice Day. So, there’s a holiday for everything. This one falls on May 4th, so ‘May the Fourth’ be with you and your orange juice. About prices – I mentioned the Amazon price tracker earlier, and this is just one example I found. It’s a third-party price on Amazon. So, some vendor on Amazon – this is as of November 7th this year, a 24-pack of 10-ounce Minute Maid orange juice drinks – and I know you mentioned the frozen cans of orange juice, but these juice drinks are made from concentrate, and so I made sure I noticed that on the label – made from concentrate – but this 24-pack of 10-ounce Minute made orange juice drinks cost $39.44, which is an increase over that lowest-ever price for the same purchase of $11.96 – that was three-an-half years earlier – that was that was in March 2020. That was at the start of the COVID-lockdowns, for the most part. But they were at that low of $11.96. Now they’re $39.44. Same product. That’s a 230-percent increase. So, the question here is what is demand like for you consumers? I know you all drink orange juice in some way, shape or form. I’m thinking you do … from concentrate. I’m sure you do. I don’t. I don’t.

Sweetness

Sean McGovern

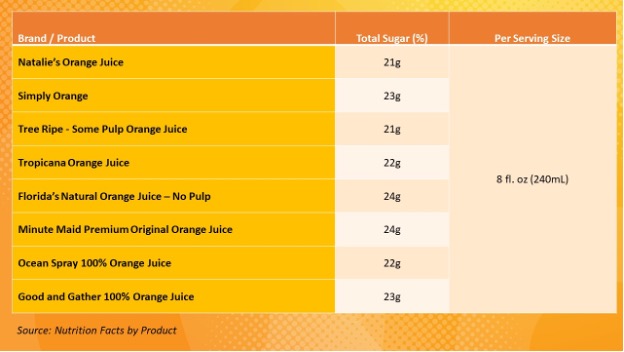

I, honestly, I like the taste of orange juice, but the problem is that it leaves this weird feeling in my mouth. It’s got too much sugar to really, truly be refreshing to me, because then I’m like, ‘I need to wash this down with water or something.’ And I tend to get heartburn from it, too. I don’t know. That’s probably just me. What does everyone else think? Maybe all you guys are better than me for this.

Jeff Praissman

We don’t drink a ton of juice at our house. I would say the kids more drink milk, and I’ll have a glass of orange juice probably over the weekend. But we’re not huge consumers of it. I will say on the holidays, we do like to have our mimosas in the morning, you know, whether it’s Christmas time or even New Year’s Day. So, I guess now I’ll just have to pour more Champagne into the orange juice, since it’s so expensive.

Steven Levine

To have more Champagne, boy that’s got to be torture….

Jeff Praissman

So, there’s actually so much sugar in juice … there’s almost as much sugar as there is in soda. So, as much as they like sweets and stuff, we sort of kept them with milk and water. And they don’t like juice to begin with anyway. So, you know, we’ve sort of kept them away from it, sort of one of those hidden things, where people think it’s super healthy, and it’s not necessarily as healthy as parents think it is, so….

Steven Levine

Yeah, it’s true. And you have these nuances, right? There’s frozen concentrated orange juice. There’s juice from concentrate … juice not from concentrate that’s organic. That still contains a lot of sugar. And there are those that don’t contain that much sugar, I suppose … just comparably, it’s still a lot. But yeah, there’s private markets for things like … a brand called Natalie’s and Tree Ripe. I’m sure there are others. I think there’s a Florida orange juice, I think by name. So, there are selections out there. But yeah, I would also caution about dietary habits and the amount of sugar in these things. It’s pretty crazy. Cassidy drinks orange juice. She wouldn’t have all those podcasts without all that energy.

Cassidy Clement

I know, I do. So, I, myself, kind of like Sean, I actually do water it down, because I don’t really like super, super sweet stuff, but I grew up in a household that always had orange juice. The one thing my Italian family really embraced was the American breakfast. So, my grandmothers – on both sides – would always have the, you know, the big jug of orange juice or the containers, the cylinders. I remember those from growing up. But recently, I haven’t consistently purchased orange juice, probably in like a year, and a lot of it is because of price.

Steven Levine

Yeah. How much is it? Yeah. What are you talking about in terms of price?

Cassidy Clement

Well, so, I will usually look for … now, I’m speaking in terms of what it’s like in Connecticut at some of the stores up here. I’ll look for something like a two-for-five [2 for $5] sale, or two-for-six sale, but they can really climb, especially if you have a brand that you like. There’s also a lot of juice mixes out there. Because I don’t have a sweet tooth, I’m not the person who goes for like the strawberry-orange or mango-orange mix, but they’re out there, and they can really get very high. I like Dole … pineapples, and they make a Dole Whip ice cream that also sometimes they incorporate orange with. And it is so expensive that I just see it in the freezer aisle, and I, you know, walk past with one tier streaming down my face, because I can’t justify buying it. It’s like the cost of three or four gallons of gas some weeks. So, I don’t do it. But yeah, I’ve noticed they’ve gone up.

Steven Levine

I think it’s a double whammy, because sugar futures are still really high, so input costs for producers that are producing anything with sugar – that includes those drinks, I mean, those drinks include a lot of sugar if you look at the backs of them. So, with frozen concentrated orange juice a component to that, plus the sugar, that’s got to be affecting prices pretty dramatically for anything that contains sugar and somewhat orange juice. But those are liter-bottles that you’re talking about that are like two-for-five or two-for-six?

Cassidy Clement

I think so, yeah. I never drank enough to justify getting the giant jug … the gallon … in my adult life, but growing up, that was definitely something we had in the house. But, yeah, depending on if I was at home with my parents or being babysat, it would depend upon my grandparents. It would depend on if we were going to have the gallon or the concentrate of like what they used at Orange Julius, if that’s still around….

Steven Levine

That’s right. Well, when I was growing up, we used those cans to make popsicles, right. We’d put the frozen concentrate with water in the ice cube trays with popsicle sticks of some kind, and we’d make popsicles. But I think you really – talk about the American breakfast…. Since orange juice was really introduced as a consumer product in the mid-‘40s, or about time of World War II, it was still something novel, I would have to say in the ‘50s and ‘60s. It was still a fairly new product in the market. So, to promote it, I can well imagine that a lot of the promotional material would create orange juice as a staple product on breakfast tables for the nuclear family during those times. That’s just my nostalgia talking … but I’m thinking that pretty much has to be the case, and why we consider orange juice as being a staple with breakfast items.

OJ Grows in China

But anyway, it will be challenging to parse out any kind of stocks to talk about the instruments that might be affected by higher frozen concentrated orange juice prices outside of the futures themselves. But we can just reiterate that Minute Maid is owned by Coca-Cola [Coca-Cola also owns the Simply brand]. Target – Target has its own brand of orange juice. I don’t if anybody knows that, but Good and Gather … that’s their brand. Keurig Dr. Pepper makes Nantucket Nectars, and as we mentioned, Tropicana is wrapped-up in a private equity company … PAI Partners that Pepsi sold [it to] in 2021. I do understand though that – and if anyone wants to chime in here — Coca-Cola’s latest earnings … their juice, value-added dairy and plant-based beverages … that segment grew 2%, mainly from their growth in Minute Maid Pulpy in China. So, you think that they’re drinking more orange juice in China? Is there a demand there? Sean, what do you think?

Sean McGovern

Yes. I saw that I was doing a little research, obviously, before we got on here, and I think China is one of the faster growing markets for orange juice. I was not able to parse out why, but anything where you see that the demand is growing in China, that’s usually going to have a pretty bullish impact on the supply-demand balance there, because anything that gets popular in China, the nation of over a billion people, is probably going to be positive for the prices of that commodity or asset.

Steven Levine

Like coffee … coffee ended up being that way in China as well. It was a predominantly tea-drinking country for the longest time, right, for centuries. And then they had all sorts of coffee products introduced, and all of a sudden it became like a massively popular thing. Interesting stuff. What do you think, Sean? Do you think that there would be more interest among traders for [options] calls on these?

Still Some Juice Left?

Sean McGovern

Oh, yeah. Well, anytime a price is going up on a commodity, especially something where it seems new, right, a lot of people are just encountering orange juice futures for the first time, maybe even on this podcast, someone’s hearing about it for the first time. So, yeah, I mean, price action … that’s always going to draw in new speculators, right. And that’s probably already happened throughout the year. As we’ve said, FC0J has come off of its highs a little bit now, so maybe we’ve already had that kind of mania phase … that FOMO phase … where everyone starts coming in and they’re interested in this. But as far as the supply-side looks, which is my biggest focus here, I’m going to have to say that there’s still definitely room for more catalysts for this to move higher, and more speculators to continue coming in. It’s like a frenzy right now, and that’s already happened. Especially now think about interest rates coming down, which could be positive for commodities more broadly … we get a broader commodities rally. Orange juice could probably partake in that. So, there’s definitely going to be interest going forward. Hard to say which way everything’s going, but interest will be there on both sides, especially when you talk about options.

Steven Levine

It’s interesting. Anything else you’d like to add? Cassidy, going to go buy some orange juice?

Mimosas, Pannetone … and Happy Holidays!

Cassidy Clement

Yeah, going into the holiday season … listeners who are Italian-American, it’s ‘panettone season’, which is the Italian cake, where it is orange peel, or oranges with some chocolate. So, that’s usually where I start to see them … at this time of the year.

Steven Levine

What’s it called? What’s the cake called?

Cassidy Clement

Pannetone cake. If you have an Italian market, or a deli, you’ll normally see them. They come in an interesting … kind of an octagon box … and some of them actually you can hang on the tree. But they’re kind of like the ‘Italian fruit cake’, and if you don’t eat them quick enough, they do become a brick. You have to eat them pretty quick. But yeah, they normally have orange in them. So that’s usually where I start to see orange around a lot this time of year … other than the orange juice that I look for a sale for in my fridge….

Steven Levine

Right, right. If there’s no real necessity for it, I think the same way. So, this pannetone cake sounds like it’s a necessity. It sounds very good. I want some. So, bring it in … next time.

Cassidy Clement

Oh, it is. Yes.

Steven Levine

Okay, great. Jeff, Sean, Cassidy, thanks so much for doing this … really, really great. Another fun podcast! Mimosas all ‘round … that’s coming next.

And, so, for our listeners out there, you can read more commentary and market analysis at IBKR Traders’ Insight. It’s at our IBKR Campus – at ibkrcampus.com. You can keep abreast there about topics we’ve discussed here today, as well as a wide range of other news critical to your investment decisions. McAlinden Research Partners has a host of articles there on several themes – from central banks and gold buying to issues involving cybersecurity. You can contact Rob Davis and get more details from him. Rob Davis at rob@mcalindenresearch.com. And for a full list of financial education offerings, visit the IBKR Campus, where, as always, all our educational material is provided to the public at no cost. And wherever you listen to your podcasts, please rate, and review us, we’d love to hear from you.

And until next time, I’m Steven Levine with Interactive Brokers.

LEARN MORE

- USDA Orange Juice Grades and Standards

- CDC – Be Sugar Smart: Limiting Added Sugars Can Improve Health

- USDA – Calculating Sugar Limits for Breakfast Cereals in the Child and Adult Care Food Program

WHAT’S FOR BREAKFAST – PODCAST SERIES

- Lean Hog Futures – Is Anyone Bringing Home the Bacon?

- Sugar Futures: Talk About a Cereal Killer

- Live Cattle Futures – Herd Around the World

- ‘Cuckoo’ for Cocoa Futures

- Eyepopping Corn Prices – Fueling Food Inflation

- The War on Wheat – How Much Bread Is on the Table?

- Time for a Coffee Break?

IBKR TRADERS’ ACADEMY

- Courses On Futures

- Introduction to Futures

- Futures Fundamental Analysis

- CME Micro WTI Crude Oil Futures

- Understanding South American Soybean Futures

- Introduction to Grains and Oilseeds

- Hedging with Grain and Oilseed Futures and Options

MORE FROM McALINDEN RESEARCH PARTNERS

- Margin Pressure on Meat Processors’ Beef Business Could Finally Begin to Break (Nov 14, 2023) (11/1/23)

- Starbucks Looks to Save Coffee From Climate Change, Rolls out New Coffee Breeds to Counter Rust Fungus (10/5/23)

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from McAlinden Research Partners and is being posted with its permission. The views expressed in this material are solely those of the author and/or McAlinden Research Partners and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.