Learn about hierarchical clustering with the overview, key concepts and types of clustering articles.

Pros of hierarchical clustering in trading

Here are some pros of hierarchical clustering concerning trading.

- Diversification: By grouping similar assets, hierarchical clustering helps traders and investors identify opportunities for diversification within their portfolios. Diversification can mitigate risks associated with individual assets and enhance overall portfolio stability.

- Risk Management: Hierarchical clustering considers the relationships and correlations between assets, allowing for a more nuanced understanding of risk dynamics. This enables traders to allocate capital in a way that balances risk across different clusters, potentially leading to more effective risk management.

- Improved Decision-Making: By organising assets into clusters based on their inherent similarities, hierarchical clustering assists traders in making more informed decisions. It provides a structured framework for identifying opportunities, managing risks, and optimising portfolio allocations.

- Scalability: Hierarchical clustering can be applied to a wide range of assets and is scalable to different market conditions. Whether dealing with a small or large number of assets, the hierarchical approach remains applicable, making it versatile for various trading scenarios.

Cons of hierarchical clustering in trading

Let us now see some cons of hierarchical clustering that a trader can be aware of.

- Computational Complexity: Hierarchical clustering can be computationally intensive, especially as the number of assets increases. The process involves the calculation of distances between all pairs of assets, and the complexity can become a limitation for large datasets.

- Static Structure: The hierarchical structure formed by clustering is static once created. In dynamic markets, where correlations and relationships between assets change over time, the static nature of hierarchical clustering might not capture evolving market conditions.

- Subjectivity in Dendrogram Cutting: Determining the appropriate level to cut the dendrogram to form clusters can be subjective. Different cutting points may result in different cluster structures, leading to potential variations in portfolio outcomes.

- Assumption of Homogeneous Risk within Clusters: Hierarchical clustering assumes that assets within the same cluster share similar risk characteristics. However, this assumption may not always hold true, especially when assets within a cluster have diverse risk profiles.

- Limited to Historical Data: Hierarchical clustering relies on historical data for clustering decisions. If market conditions change significantly or unforeseen events occur, the historical relationships may not accurately reflect the current state of the market.

- Challenges with Noisy Data: In the presence of noisy or irrelevant data, hierarchical clustering may produce less meaningful clusters. Outliers or anomalies in the data can impact the accuracy of the clustering results.

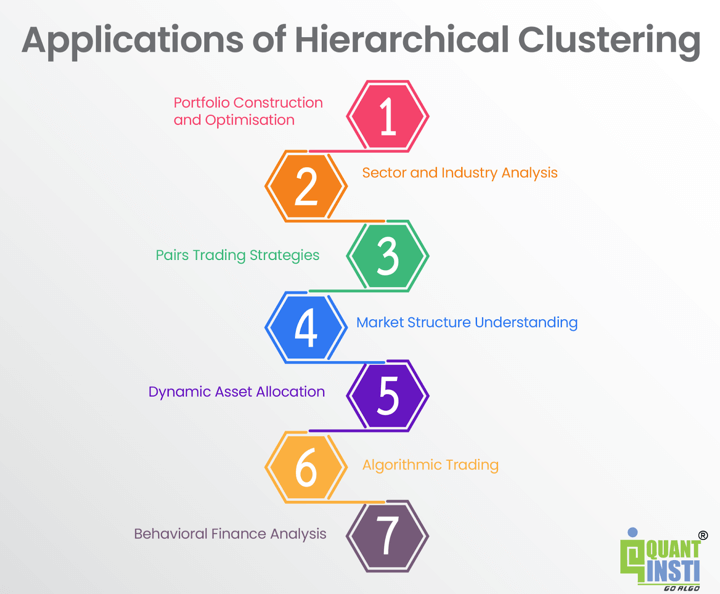

Applications of hierarchical clustering

Hierarchical clustering finds applications in trading and finance, offering valuable insights and decision-making support across various areas:

- Portfolio Construction and Optimisation: Hierarchical clustering aids in grouping assets with similar risk and return profiles, facilitating the construction of diversified portfolios. By optimising asset allocation within clusters, traders can achieve balanced portfolios that align with their risk tolerance and investment objectives.

- Sector and Industry Analysis: Hierarchical clustering can reveal natural groupings of assets related to specific sectors or industries. Traders can leverage this information for in-depth sector analysis, gaining insights into the dynamics and performance of different industry groups.

- Pairs Trading Strategies: Clustering helps identify pairs or groups of assets with strong correlations. Traders can implement pairs trading strategies by taking long and short positions in assets within the same cluster, aiming to profit from relative price movements.

- Market Structure Understanding: Clustering provides a visual representation of market structures through dendrograms. This aids traders in understanding relationships between assets and discerning overarching patterns and trends in the market.

- Dynamic Asset Allocation: The hierarchical structure allows for dynamic asset allocation strategies. As market conditions change, traders can adapt portfolios by updating the clustering structure, ensuring alignment with evolving market dynamics.

- Algorithmic Trading: Hierarchical clustering can be integrated into algorithmic trading strategies. Algorithms can use clustering results to make real-time decisions on portfolio rebalancing, trade execution, and risk management.

- Behavioral Finance Analysis: Clustering can help identify groups of assets exhibiting similar behavioural patterns. This information is valuable for understanding market sentiment, investor behaviour, and potential anomalies that can be exploited for trading opportunities.

Conclusion

This comprehensive guide on Hierarchical Clustering in Python equips readers with a deep understanding of the methodology’s fundamentals and practical implementation. By exploring key concepts, such as agglomerative and divisive clustering, dendrogram interpretation, and Python implementation, readers gain the skills to apply hierarchical clustering to real-world datasets.

The pros and cons discussed highlight its relevance in trading, offering improved diversification, risk management, and decision-making. The outlined learning outcomes ensure readers can define the purpose, differentiate techniques, and proficiently apply hierarchical clustering, making this guide an essential resource for data analysts and traders seeking to enhance their analytical toolkit.

To explore more about hierarchical clustering, you can explore the course on Portfolio management using machine learning. With this course, you can learn to apply the hierarchical risk parity (HRP) approach on a group of 16 stocks and compare the performance with inverse volatility weighted portfolios (IVP), equal-weighted portfolios (EWP), and critical line algorithm (CLA) techniques.

Author: Updated by Chainika Thakar (Originally written by Vibhu Singh)

Originally posted on QuantInsti blog.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.