Study Notes:

The IBKR Student Trading Lab offers a wide array of options trading and analytical tools, available in the IBKR Trader Workstation (TWS), along with other platforms we’ve mentioned – such as IBKR Mobile. In this lesson, we’ll outline some of our more popular options tools, as well as guide you towards specific Traders’ Academy courses that will help you learn what options are, how to use them in different trading strategies, as well as provide you with stepwise video lessons that will help get you up and running with the tools in our platform.

A Brief History

Interactive Brokers is well-known for its innovative options tools and resources. In fact, the history behind the company’s specialization in this area can be attributed to its current chair and founder Thomas Peterffy, who in 1977, purchased a seat on the American Stock Exchange, became a member, and traded as an individual market maker in equity options – with a vision to independently employ his own algorithms to profit from market pricing inefficiencies.

As Peterffy anticipated the rise of electronic trading, and the demise of floor trading, he aimed to provide technology to professional individual investors wanting to trade on the same terms as market makers.

Indeed, since its inception, and throughout its history, Interactive Brokers Group has held true to its mission – that is:

IBKR Offers Several Tutorials to Help Better Understand Options!

While Interactive Brokers provides a wealth of advanced options tools, students just starting out learning about these often complex trading products can familiarize themselves by taking our Introduction to Options course on Traders’ Academy, as well as learn about different option strategies – from beginner, to increasingly more challenging levels.

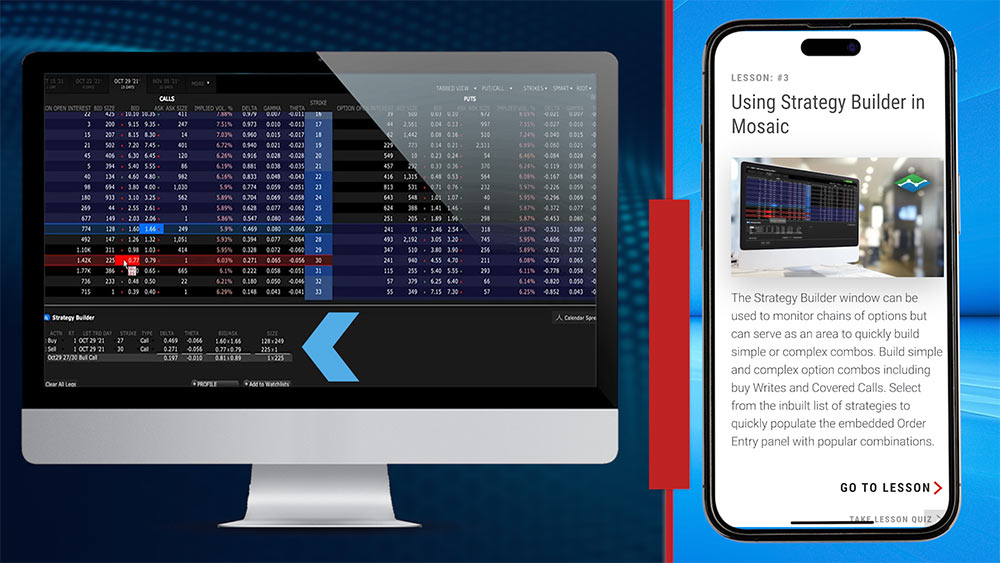

Moreover, with our TWS Option Tools course, participants in our Student Trading Lab can learn to use several of our more popular resources, starting with Accessing Option Chains in Mosaic, which covers how an option chain displays each expiration’s calls and puts and allows users to choose from a list of data columns, such as the Greeks or Implied Volatility Percentage.

The Option Chain also has a strategy builder embedded in it to easily build multiple leg combinations, and there’s a lesson on this, as well.

Moreover, TWS users can launch the Option Chains and save it permanently to a custom page or download the Option Trading page from the TWS Layout Library.

Stocked-up Toolbox

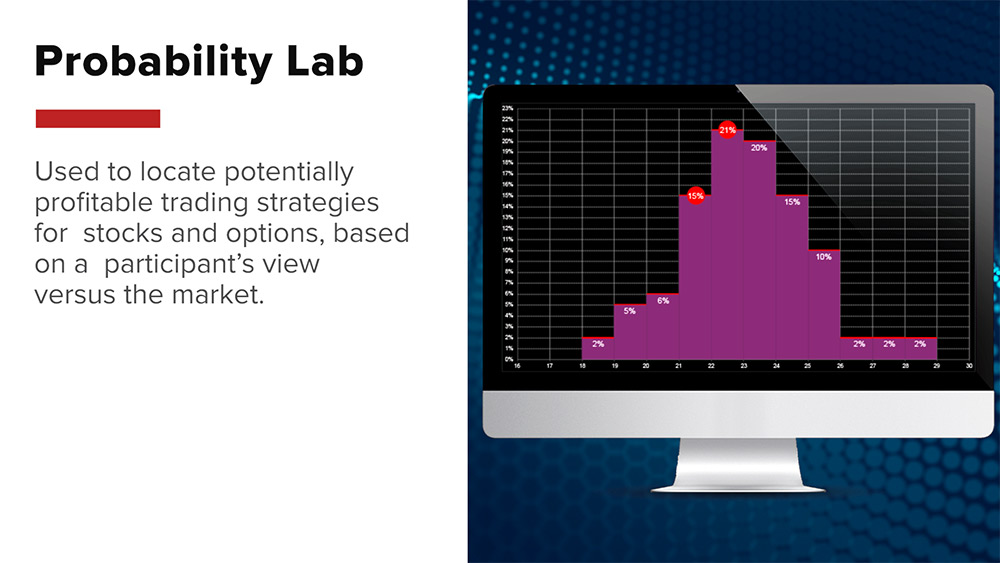

Probability Lab

Interactive Brokers offers several options-related analytical tools in TWS – with the IBKR Probability Lab among the most popular. The Probability Lab analyzes how the market believes certain outcomes will occur and illustrates it as a probability distribution. This tool can be used to locate potentially profitable trading strategies for stocks and options, based on a participant’s view versus the market.

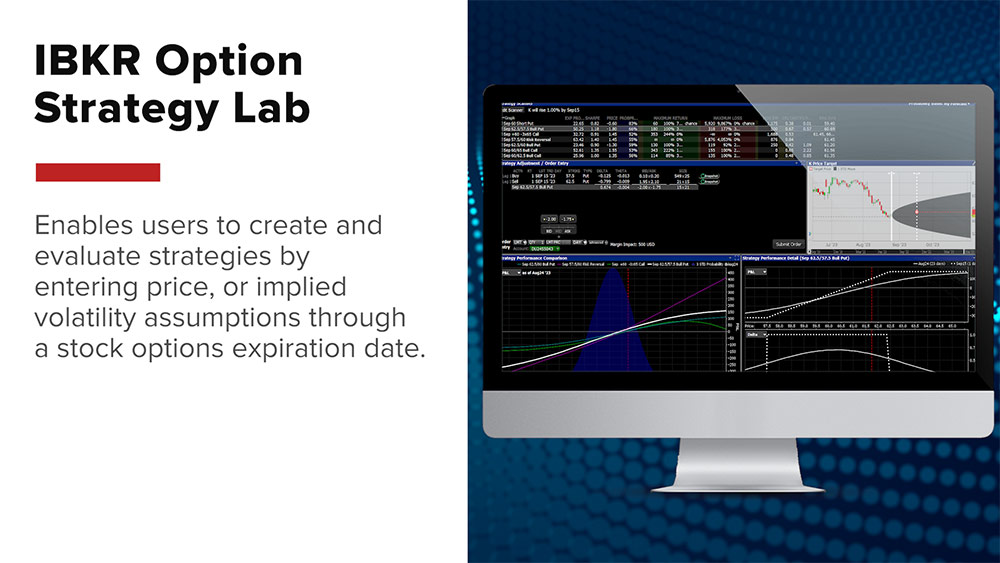

Option Strategy Lab

Another useful tool to find and evaluate option strategies, based on either price or implied volatility, is the IBKR Option Strategy Lab, which enables its users to create and evaluate strategies by entering price, or implied volatility, assumptions through a stock options expiration date.

Performance Profile

Also – prior to trading an individual option or a combination – consider using the TWS Performance Profile if you want to see an estimate of your potential profit and loss leading up to expiration. This tool lets participants see the effects on their P&L, as well as Greek values.

Volatility Lab

Traders will understand that options pricing is affected by several factors, including the price of the underlying, interest rates, and volatility – which is a metric for the speed and movement of the underlying asset and, with all things being equal, such as strike price & underlying price, the higher the volatility – the higher the price of the option. Participants using IBKR’s Volatility Lab, can see historical and implied volatility readings for a stock and its options, and visualize them over time. They may also compare them to other stocks and ETFs, and, here, they can also view volatility skew.

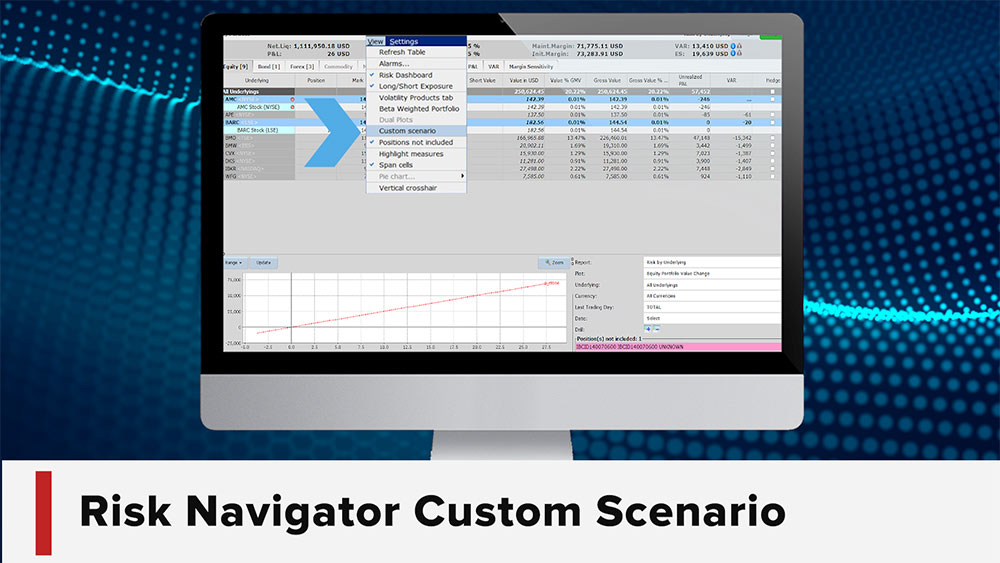

Risk Navigator – Using Custom Scenarios

And, as mentioned in our previous lesson on Resources for Fundamental Analysis, IBKR’s Risk Navigator is a powerful tool that has many features to help manage risk – options included. To further explore details on calculating forward prices for single options and combinations, participants can use the Risk Navigator Custom Scenario function.

Learn more in the Performance Profile for Options lesson of the TWS Option Tools course, and for more on how to use the Risk Navigator for options, watch Using Risk Navigator – Calculate Forward Prices for a Single Option and Option Combinations.

TWS Options Write / Rollover

IBKR also offers the TWS Options Write / Rollover Tool, which may be used to sell calls against long stock positions and sell puts against short stock positions. This tool, which can also roll expiring option positions to a further expiration date, is further detailed in our Traders’ Academy course.

So, if you’re looking for an extensive toolkit to help you trade and study options, with all of IBKR’s options-related resources, we’ve got you covered!

More to Come

Meanwhile, IBKR also offers other critical resources that can help educators and students analyze and manage their portfolios, perform custom reporting, as well as access specialized tools and services — and these we’ll explore in our next lesson.

We’ll look forward to seeing you then.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.