Study Notes:

The IBKR Student Trading Lab offers an extensive toolkit to complement fundamental, technical, and computational college classroom curricula.

Through this lesson, we’ll highlight some of the available resources that college finance courses requiring fundamental analysis can use to help meet their learning objectives, including Fundamentals Explorer, Risk Navigator, the Impact Dashboard, as well as a long list of data fields as part of our Trader Workstation and IBKR Mobile trading platforms.

We also have several courses in Traders’ Academy, along with material across the IBKR Campus, to help bolster your learning experience!

Explore IBKR’s Tools & Tutorials

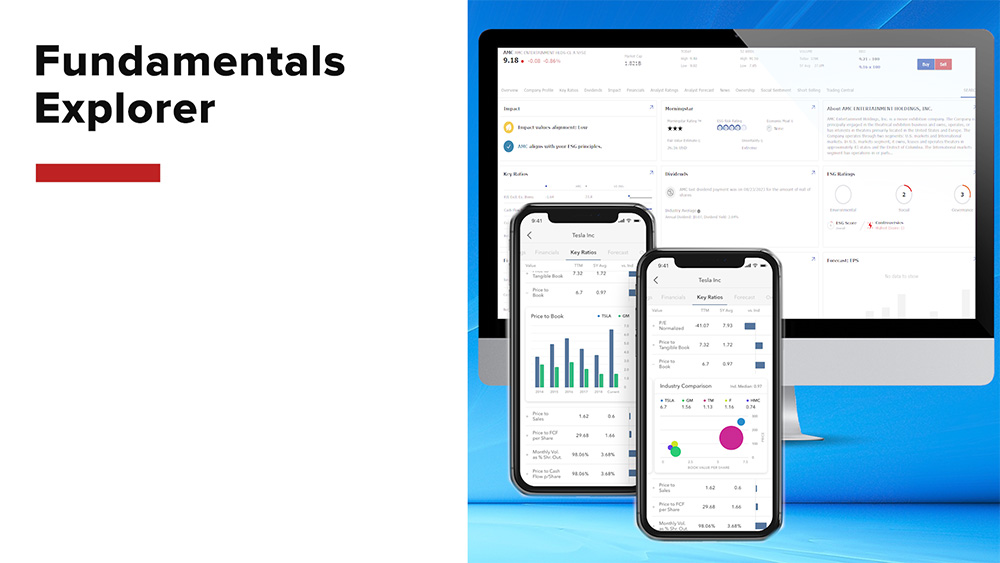

Fundamentals Explorer

Perform better research, and make better investment decisions, with our Fundamentals Explorer tool – available at no cost through our Trader Workstation and Client Portal platforms.

Fundamentals Explorer Includes the most important information about a company and its competitors, such as:

- Company profile,

- Analyst ratings,

- Financials,

- Key ratios,

- Analyst forecasts,

- ESG ratings,

- Ownership,

- Dividends,

- Industry comparisons,

- Historical trends,

- News & reports, and

- Calendar events

For example, see how a company compares with its competitors, and the industry average, across many data points, or view its performance over time with historical trends.

Fundamentals Explorer provides comprehensive, worldwide fundamentals data, covering over 30,000 companies, with more than 300 data points per firm, along with more than 80 sources for newswires and reports, and over 5,500 analyst ratings from TipRanks … so, you can see the whole picture.

Learn more about Fundamentals Explorer at Traders’ Academy! And uncover more details in IBKR Guides.

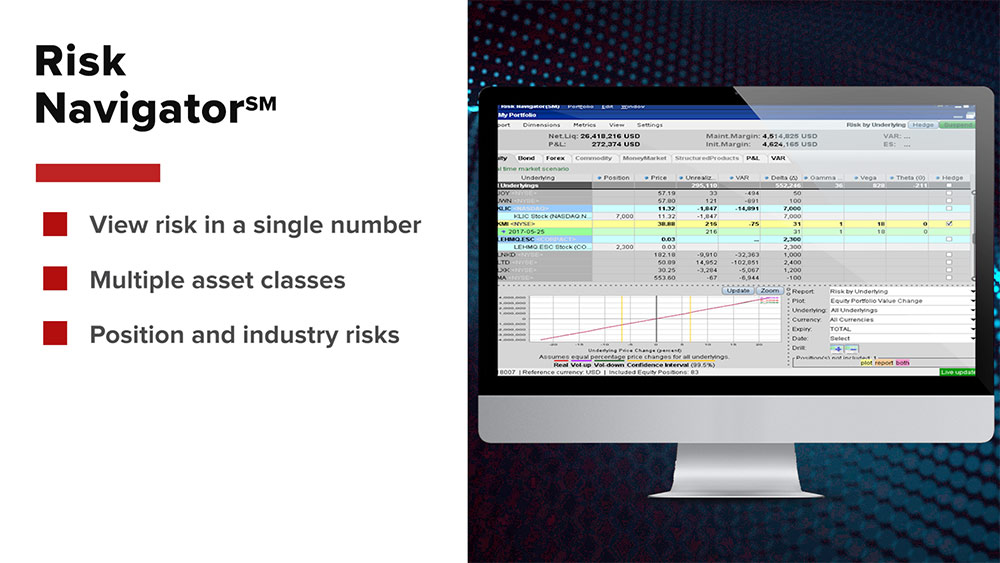

Risk Navigator

Need to better manage your risks? Risk Navigator – our real-time, market risk management platform, available on our desktop Trader Workstation platform – provides a comprehensive measure of risk exposure across multiple asset classes around the globe.

Its easy-to-read, spreadsheet-like interface lets you quickly identify exposure to risk starting at the portfolio level, with drill-down access into successively deeper levels of detail within multiple report views.

Among other benefits, the Risk Navigator offers its participants the ability to view their entire risk in a single number, manage portfolio risk for multiple asset classes, and assess specific risks by position, and by industry.

Participants can also create a hypothetical “What-If” portfolio to see how their risk profile might change based on changes, such as adding, closing, reducing or increasing positions. Meanwhile, equity portfolio managers can use the Risk Navigator’s advanced beta analysis to build their portfolios based on key concepts of the Capital Asset Pricing Model (CAPM). Learn more at Traders’ Academy!

Fundamental Data Fields

Earlier in this course, we illustrated some of the powerful trading tools and resources housed in our desktop Trader Workstation and IBKR Mobile apps. And, indeed, there are several features on those platforms integral to performing fundamental analysis. For example, there are tons of data fields in TWS and IBKR Mobile that contain fundamentals that can be applied directly into market scanners and custom watchlists to help inform trading and investment decisions.

Through IBKR Mobile, for instance, you can view features such as:

- A company’s dividend payment,

- Related industry analysis,

- Competitors,

- Market cap,

- Company profile, including

- A financial summary,

- Key management, and

- Common shares, along with

- Relevant news,

- Earnings outlooks,

- Financials,

- Key ratios,

- Ownership structure,

- A trade log,

- ESG ratings & score, and more

– and all right in the palm of your hand!

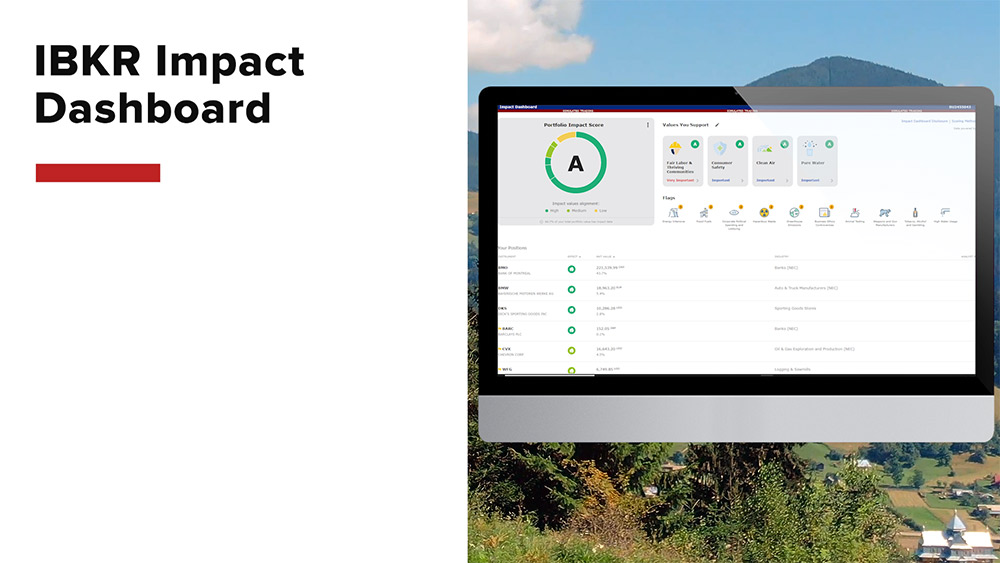

Impact Dashboard

Speaking of ESG, use our Impact Dashboard – available in TWS, IBKR Mobile, Client Portal, and via APIs — to help ensure that your current and future investments reflect your values. For example, you can identify those values that are important to you like clean air and racial equality, and tag the practices that you find objectionable, like animal testing and greenhouse gas emissions.

Based on your preferences, we calculate an overall environmental, social, and governance (ESG) score that shows you how well your investments align with your standards. Drill down and see whether a company’s practices align with, conflict, or are neutral with your own principles.

The Impact Dashboard makes it easy for you to invest responsibly.

Learn more about the dashboard, and ESG Investing, at Traders’ Academy. Also, dive into our scoring methodology and ESG Guide for more details!

Your ‘Go-To’ Source for Tutorials

You may have noticed that we have pointed to Traders’ Academy as a ‘go-to’ resource for additional information and details in the tools and features we’ve been addressing. In fact, there is a generous number of courses in that Campus pillar dedicated to helping you perform better fundamental analysis on a host of different topics.

Among the free, on-line courses available to participants, Traders’ Academy has tutorials such as Fundamental Analysis, which walks you through basic fundamental accounting concepts, including Income Statement, Balance Sheet and Statement of Cash Flows. This is followed by a practical demo of additional tools in Fundamentals Explorer. Also, through Building a Trade Plan, we’ll explain the steps of building a plan, such as setting an objective, establishing a methodology, ensuring strategies for trading, and risk management, and more.

Stocks, Bonds, and Futures

We also offer insights into those fundamentals associated with trading products, such as stocks and bonds.

If you are new to investing and want to begin to understand stock market fundamentals, our introduction to the stock market course will help familiarize you with some common terms and concepts. Also, our introduction to corporate and municipal bonds courses provide essential details into those fixed-income markets, including the types of securities investors typically encounter, as well as some tools to help you get a better understanding of the risks involved with these instruments, ways in which they may be mitigated, as well as recent developments that have helped shape market dynamics. Lastly, we’ll walk you through the IBKR Trader Workstation’s Global Bond Scanner, where you can locate certain bonds in the secondary market, create charts, and conduct due diligence to help inform your investment decisions.

The CME also offers a course on Futures Fundamental Analysis, which explains how to determine the model price of a futures contract, now and in the future, by using factors such as micro- and macroeconomic data, as well as industry financial conditions.

Economics

Need a primer on economic indicators? Through our global economics courses, participants can equip themselves with a better understanding of the U.S. and global economic landscape, including our starter guide to basic economics, which will help you grasp the theory and principles behind the workings of an economy.

Other courses include a deep look at U.S. monetary measures, economic output, and corporate profits, as well as a detailed breakdown of indicators in several countries and regions, such as Canada, the European Union, the United Kingdom, and Australia.

Values-based

And for those seeking more clarity about ESG Investing, our Traders’ Academy course on that topic illustrates some basic concepts to help better define the meaning and financial relevance of ESG-related issues, including the rationale behind the inception of ESG investing, as well as how this discipline has evolved.

Learn More

Analysis in Practice

When exploring the IBKR Campus, you are also bound to discover fundamental analysis in practice.

Our podcasts and webinars, for example, will frequently address fundamental concerns in their discussion points. And you can keep abreast of fundamental analyses daily with commentary on our Traders’ Insight platform.

Now that we’ve provided insights into resources for performing fundamental analysis, we’ll next share with you some critical tools and services that can complement college finance courses requiring technical analysis.

Come back and join us!

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.